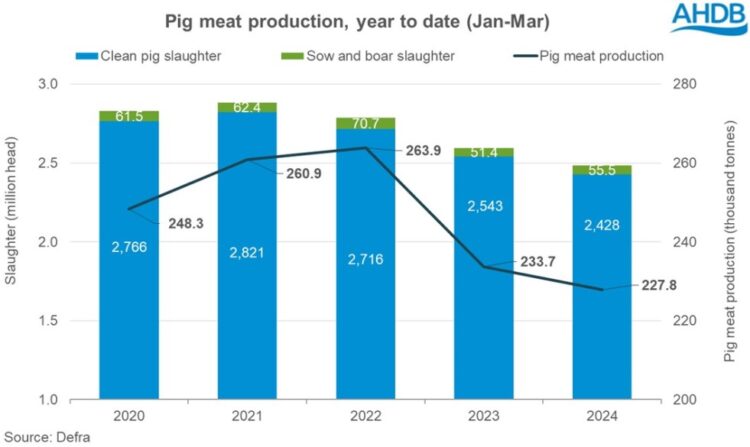

UK pig slaughterings plummeted to a 13-year low all over the primary quarter of this 12 months, riding down pigmeat manufacturing volumes, in keeping with legit Defra slaughter figures.

UK pig meat manufacturing within the first quarter of 2024 totalled 227,800 tonnes, a decline of two.5% at the similar duration final 12 months and the bottom Q1 quantity recorded since 2017. This decline rather exceeded AHDB’s Agri-market outlook forecast of a 2% Q1 decline, made initially of February. The forecast predicted a restoration over the remainder of 2024, with the overall 12 months finishing 0.6% up.

Overall slaughter numbers – blank pigs plus cull sows and boars – for the duration stood at 2.48 million head, the bottom Q1 kill recorded since 2011. Blank pig slaughter totalled 2.43 million head, a 4.6% 12 months on 12 months lack of nearly 116,000 pigs. In the meantime, cull sows and boars totalled 55,500 head, an build up of simply over 4,000 head in comparison to Q1 2023.

The lowered slaughter numbers considerably outweighed the have an effect on of a 1.6kg upward push in reasonable carcase to 90.5kg in Q1, when put next with Q1 2023.

“Persevered rainy climate has been reported to be negatively impacting on farm productiveness, which might additional prohibit pig provides later within the 12 months,” AHDB analyst Freya Shuttleworth stated. “The elements has additionally led to lowered plantings of arable plants over the fall and is but to ease off sufficient to permit for spring drilling. That is elevating some considerations round feed component availability and price for the again finish of the 12 months.

“Persevered rainy climate has been reported to be negatively impacting on farm productiveness, which might additional prohibit pig provides later within the 12 months,” AHDB analyst Freya Shuttleworth stated. “The elements has additionally led to lowered plantings of arable plants over the fall and is but to ease off sufficient to permit for spring drilling. That is elevating some considerations round feed component availability and price for the again finish of the 12 months.

“Along this, straw costs were rocketing upwards, with reasonable costs now £40/t upper than final 12 months. The 2023 straw harvest used to be deficient because of a rainy summer season compounded by way of the truth that call for for straw has higher, with many livestock being housed for longer because of deficient flooring stipulations proscribing prove. A deficient harvest in 2024 is most likely so as to add additional flames to the hearth.

“In spite of stepped forward farm margins, those components recommend that various hesitancy stays amongst manufacturers and processors. That is more likely to lead to a persisted restoration targeted mentality following the demanding situations of the previous couple of years, outweighing any important funding.”