U.S. beef manufacturers are going through an more and more difficult financial setting this is more likely to persist via the rest of 2023. The combo of increased working prices and depressed hog values are evaporating manufacturer returns and proscribing total trade enlargement. Whilst hog costs have risen this summer season, they have got no longer stored tempo with skyrocketing prices for feed, exertions, development and different bills, in line with a new record from CoBank’s Wisdom Change.

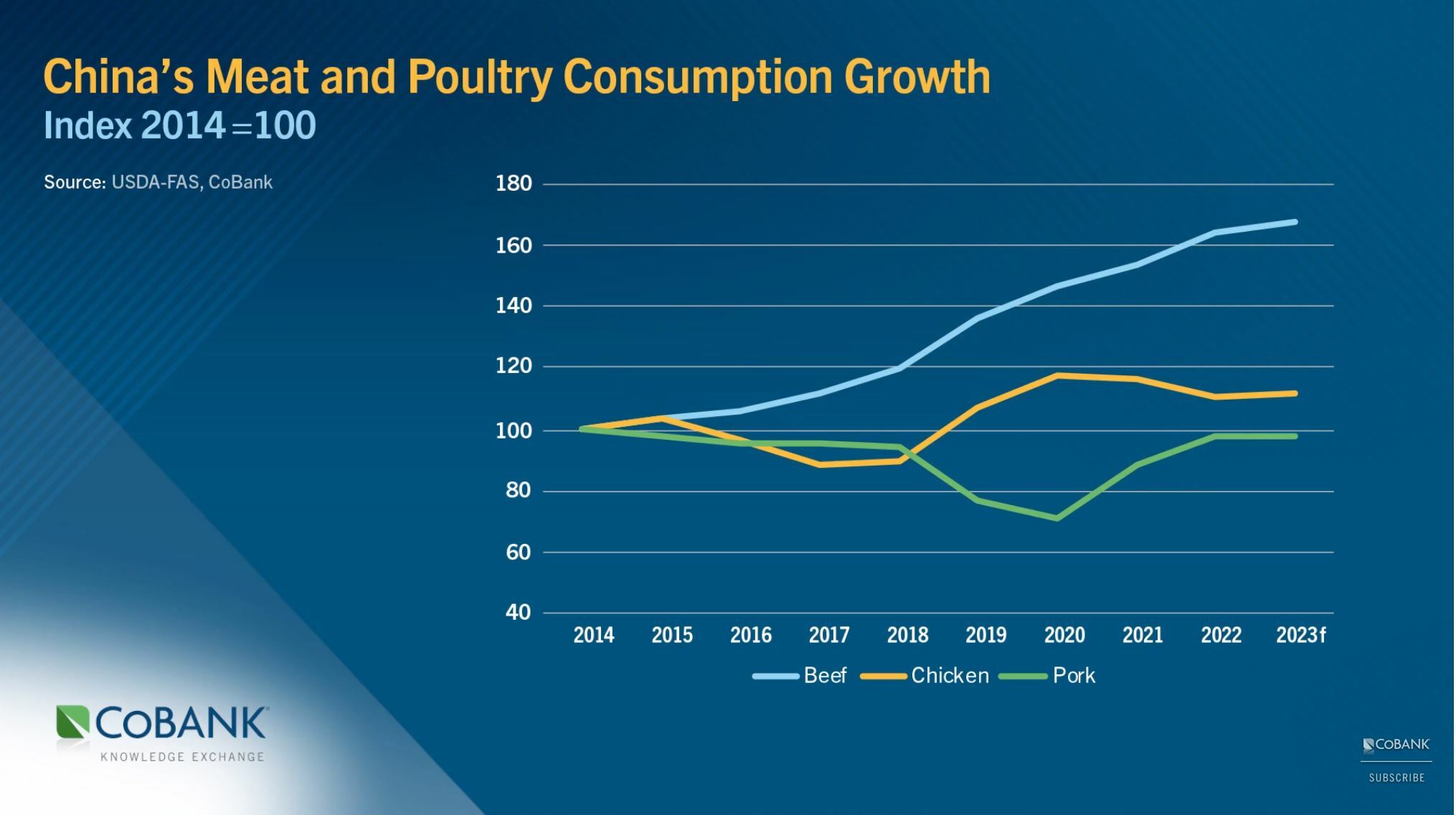

Cushy home call for for beef and a murky outlook for U.S. beef exports are compounding the marketplace demanding situations. Consistently top retail beef costs and a decline in food-at-home spending within the U.S. are proscribing home intake enlargement. Globally, call for for U.S. beef has come underneath drive as China’s hog provides have rebounded from the outbreak of African swine fever (ASF). The totality of inauspicious marketplace stipulations, which come with upper borrowing prices, will prohibit U.S. herd growth and tighten hog provides.

“In the end, those demanding situations all fall at the shoulders of beef manufacturers,” stated Brian Earnest, lead animal protein economist for CoBank. “Along with pressuring hog and beef provides, the present marketplace stipulations are derailing hog manufacturers’ growth plans. And despite the fact that the fee construction warranted further manufacturing, call for is part of the puzzle that wishes addressing.”

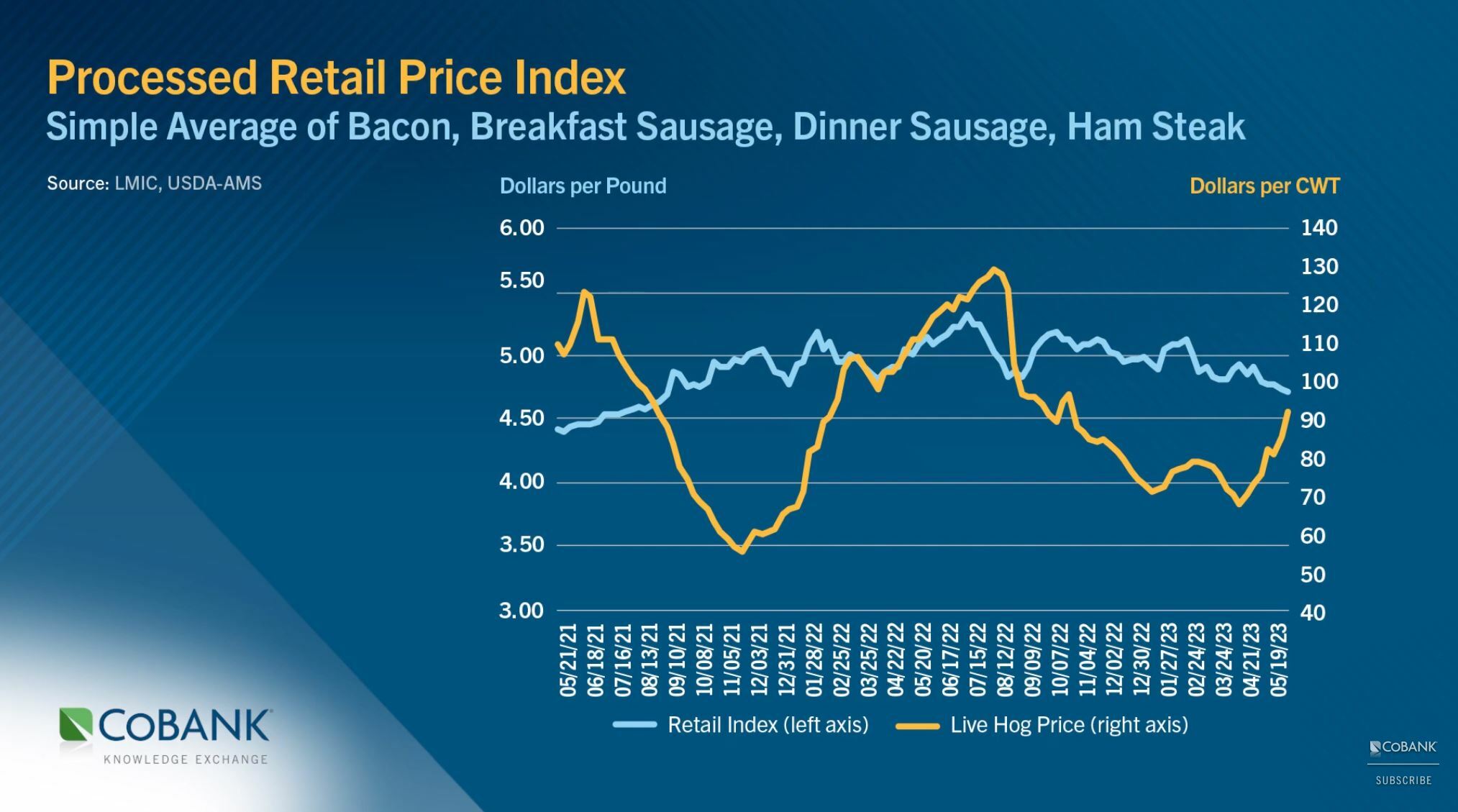

According to capita U.S. beef intake has remained necessarily flat since 1990 and averaged 50 kilos once a year during the last decade. Within the intervening time, hen intake just about doubled from 57 kilos in 1987 to 102 kilos in 2022. Kind of two-thirds of home beef finishes up in processed pieces like bacon, sausage or hams, that have carried out rather neatly lately. Alternatively, key meat case pieces like beef loins are suffering to achieve the similar appeal that boneless skinless breast meat or flooring red meat experience.

Out of doors of bacon, pizza toppings and breakfast-type pieces, beef is generally fed on at domestic. And beef thrived all over the pandemic-era lockdowns of 2020-2021, when meals choices have been both take-out or at domestic cooking. However as meals provider has totally reopened in 2022-2023, shifting retail case beef pieces has turn out to be tougher.

Exports have lengthy performed a key function within the U.S. beef trade. Roughly 25% of U.S. beef is going to export markets, essentially the most of any of the U.S. processed animal proteins. When ASF decimated China’s home hog herd in 2018, annual U.S. beef exports to China tripled in 2019, after which doubled the next yr. Since then, China’s want for U.S. beef imports have impulsively declined as its home herd rebounded.

Thankfully, Mexico has been a shiny spot for U.S. beef. Exports to Mexico eclipsed 2.3 billion kilos in 2022, a document top for any unmarried vacation spot that accounted for approximately 37% of all U.S. beef exports. And as of late’s export quantity to Mexico represents a forty five% bounce from 2016 ranges. However, uncertainty surrounding China, the sector’s biggest beef importer, and issues about deteriorating world financial stipulations cloud the outlook for U.S. exports.

“One of the crucial demanding situations going through beef manufacturers will linger for the foreseeable long run,” stated Earnest. “However long term, if retail beef costs start to go back to a standard degree it must lend a hand home call for get better. Additionally, the recognition of yard barbecuing has inspired intake of a few cuts of beef that experience traditionally struggled, which has been useful in an in a different way tough state of affairs.”