Supply: Rabobank information unencumber

In line with the most recent Rabobank quarterly red meat file, international red meat markets are being influenced by way of slow financial expansion, susceptible intake, and recurrent illness outbreaks. After a powerful first part of the yr, international industry is predicted to weaken going ahead. Regardless of softening feed costs, manufacturing prices must stay above pre-Covid ranges.

Gradual financial expansion has been impacting shoppers all over the world. They’re buying and selling down, purchasing smaller parts, and switching channels. Nonetheless, red meat – which is less expensive than red meat and top class seafood and dearer than poultry – holds a rather strong place on shoppers’ plates.

Efficiency varies from area to area, then again, matter to availability and costs within the native marketplace, explains Chenjun Pan, Senior Analyst – Animal Protein at Rabobank. “In Europe, red meat intake stays underneath force because of ongoing prime costs. In the USA, call for used to be moderately under expectancies to start out the summer season, as uncooperative climate and deficient air high quality challenged the beginning of the grilling season. And in China, red meat intake stays susceptible, because of the underperforming economic system and warmth waves around the nation.”

Industry to weaken in 2nd part of yr

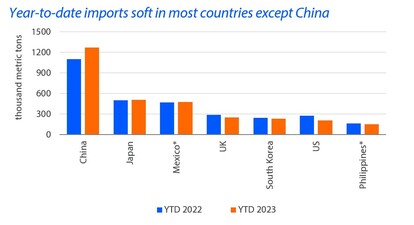

Beef industry used to be rather sturdy within the first part of 2023, pushed by way of an build up in imports in China, even though industry to the USA and the Philippines noticed subject material declines. Japan, some other main importer, noticed flat industry, with a slight shift in sourcing from Europe to the USA. UK imports confirmed an important decline as inflation careworn call for.

Pan: “For the second one part of 2023, we think international industry to be weaker than in similar duration final yr, as inventories of frozen red meat are prime in China because of susceptible intake, pressuring imports. Additionally, tighter provide within the EU restricts shipments out of the area.”

Imbalance between provide and insist

The EU and UK red meat provide declined materially within the first 4 months of 2023, with some international locations seeing falls at double-digit charges. This tight provide helps prime costs, in flip pressuring intake.

China has the other scenario, as red meat provide continues to exceed call for, pressuring costs and inflicting multiple-month losses for manufacturers. Liquidation of the sow herd in China will proceed in the second one part of the yr. In the USA, which additionally has a considerable provide, manufacturers have rather wholesome stability sheets after two years of oversized income. Given projected losses, then again, US herd liquidation must ramp up into 2024.

Provide may be challenged by way of unstable feed costs and rather low shares. Corn and soybean costs had been unstable getting into July because of climate problems, Black Sea grain hall uncertainty, and the smaller-than-expected soy planted spaces and larger-than-expected corn spaces in the USA. “We predict feed costs to melt in Q3 however stay supported by way of rather low stock-to-consumption ratios in many nations,” says Pan. “Whilst there’s some room for costs to drop additional within the coming months, they’re going to keep above pre-Covid ranges.”

She continues: “Rabobank expects a modest development in manufacturing prices in the second one part of 2023, as productiveness enhancements most likely offset feed value volatilities.”

Illness demanding situations linger

“Herd well being enhancements proceed to be a significant process for manufacturers international as illness outbreaks affect manufacturing,” says Pan. “African swine fever (ASF) continues to affect manufacturing in Asia and Europe. Whilst outbreaks most often slowed in the second one quarter of the yr, they seem like power in some areas, inflicting disruptions to native provide. As well as, porcine reproductive and breathing syndrome (PRRS) stays a problem in Spain, inflicting a subject material drop in manufacturing.”