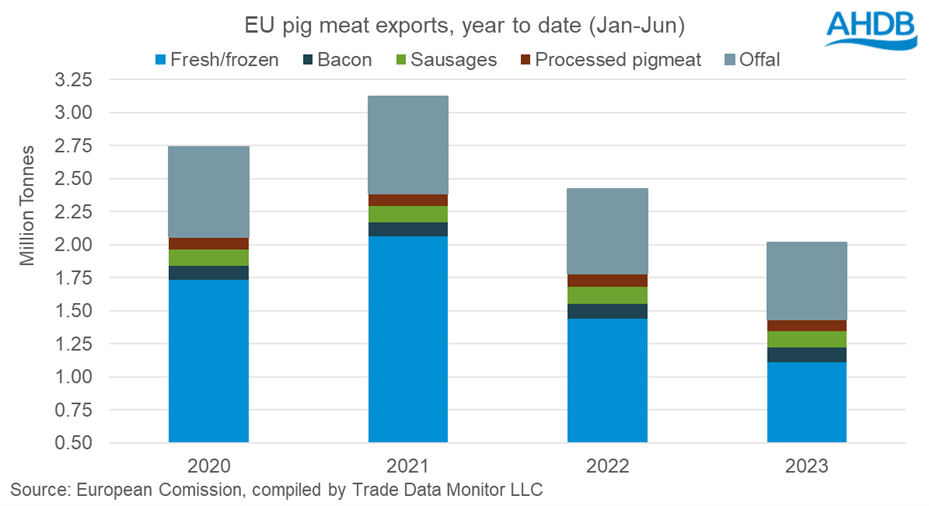

AHDB research has proven that EU exports of pig meat are down 17% year-on-year.

Virtually 2.02 Mt was once exported between January and June 2023, the smallest quantity for the six-month length since 2015.

Fr eya Shuttleworth, senior analyst at AHDB, reported that overall pig meat exports have fallen 17% in comparison to the similar length in 2022. She stated: “The recent/frozen class has noticed the biggest declines, shedding 23% to at least one.11 Mt. That is the smallest quantity since 2015, when shipped volumes of unpolluted/frozen red meat had been lower than 1 Mt. All product classes have noticed volumes decline; exports of each offal and processed pig meat are down 10%, whilst bacon and sausages recorded smaller declines of four% and three%.”

eya Shuttleworth, senior analyst at AHDB, reported that overall pig meat exports have fallen 17% in comparison to the similar length in 2022. She stated: “The recent/frozen class has noticed the biggest declines, shedding 23% to at least one.11 Mt. That is the smallest quantity since 2015, when shipped volumes of unpolluted/frozen red meat had been lower than 1 Mt. All product classes have noticed volumes decline; exports of each offal and processed pig meat are down 10%, whilst bacon and sausages recorded smaller declines of four% and three%.”

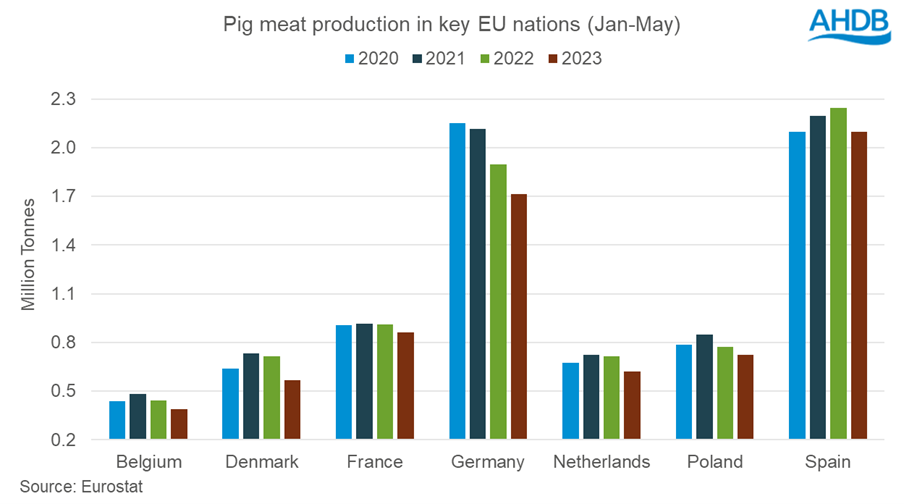

Ms Shuttleworth reported that the decline was once because of a discount in provides at the continent, with a 9% (8.68 Mt aid in quantity between January and Would possibly in comparison to the similar length ultimate yr. Declines were recorded in all EU countries, with the biggest adjustments noticed in Germany, Denmark and Spain.

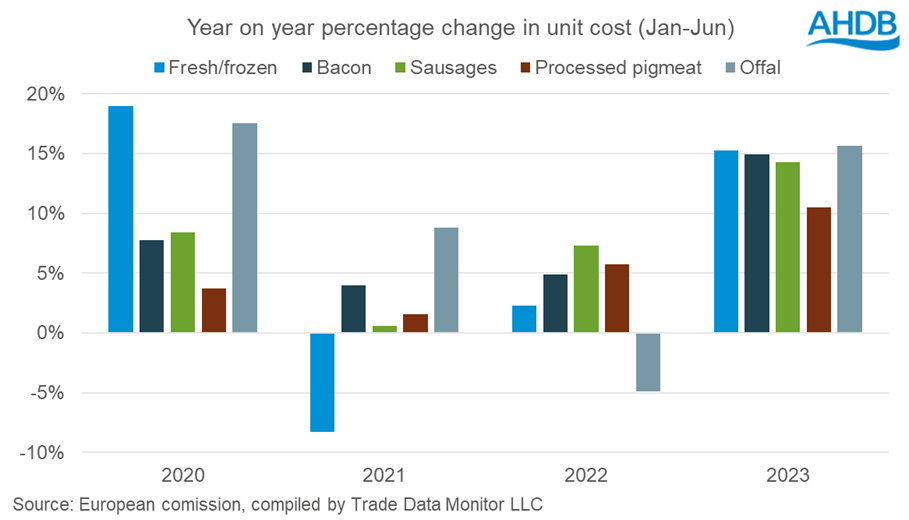

Ms Shuttleworth known that the lack of manufacturing has ended in an building up in costs. She stated: “Paired with emerging inflation, this has pushed up the worth of exports. The entire price of EU pig meat exports for the yr up to now (Jan–Jun) stands at €6.16bn. Despite the fact that it is a slight decline year-on-year (-4%), that is because of the decrease volumes, as the common unit worth (price divided through quantity) has grown 16% to €3,051/t.

“The unit worth for bacon has noticed the most powerful expansion, up just about €750, with sausages an in depth 2nd expanding through €660. Offal has noticed the smallest expansion (up €230), whilst the processed and recent/frozen red meat classes have received €520 and €400 respectively.”

The highest 5 international locations for the EU to export red meat to are unchanged. China takes the lead with 31% of EU exports (3% building up from 2022) while the United Kingdom takes its percentage as much as 20% (6% building up year-on-year). The Philippines and South Korea have noticed stocks fall to now cling 6% each and every, whilst Japan has maintained its 9% marketplace percentage.

The Eu Commissio n forecasts EU pig meat manufacturing to finish the yr 5.5% under that of 2022. Ms Shuttleworth stated: “This means there can be little trade from the present marketplace position, with exports expected to finish the yr 12% in the back of volumes from ultimate yr.

n forecasts EU pig meat manufacturing to finish the yr 5.5% under that of 2022. Ms Shuttleworth stated: “This means there can be little trade from the present marketplace position, with exports expected to finish the yr 12% in the back of volumes from ultimate yr.

“On the other hand, there stays some questions across the course of commute for pig costs. Enter prices have eased from the ancient highs noticed all over 2022 and, even supposing decrease availability of product has pushed costs up, call for is weakening. Prime costs have led EU product to be much less aggressive at the world marketplace, with shoppers at house and out of the country in search of extra inexpensive choices.”