AHDB file that the newest USDA figures display that red meat manufacturing in China will decline in 2024, with weakening shopper call for and a slowing economic system.

The rustic is forecasting a 1% decline in red meat manufacturing to 55.95 Mt subsequent yr on account of decrease slaughter numbers because of diminished pig numbers and proceeding struggles with animal well being.

Soumya Behera, senior analyst at AHDB, mentioned: “Decrease pig costs thus far in 2023 have resulted in a difficult setting for Chinese language pig manufacturers. Because of this, some were promoting pigs early and lowering their manufacturing capability, with some smaller manufacturers exiting the business altogether. Greater culling and considerations over animal illness outbreaks have led to some animals going to slaughter prior to achieving perfect marketplace weights. The present forecast for this yr’s red meat manufacturing in China is 56.50 Mt.”

Costs

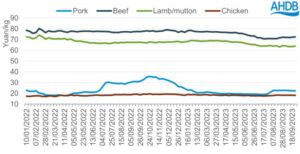

There was motion in wholesale costs in China over the last yr, starting from 35.7 yuan/kg in October 2022 to lows of 18.8 yuan/kg in July 2023. Issues have appeared up, somewhat, over the last few months with costs emerging ti 22.4 yuan/kg on the finish of September.

Ms Behera defined: “Marketplace intervention is slightly commonplace follow for the Chinese language executive. After red meat costs surged over iciness, reserves have been launched to the marketplace in February to stabilise costs. To the contrary, in July the Chinese language executive is reported to have stockpiled 40,000 tonnes of red meat, consistent with USDA, to refill nationwide reserves which supported costs.”

Round 60% of all meat ate up in China is red meat and this proportion has persevered to develop over fresh yr, in particular within the middle-class inhabitants. On the other hand, professionals had anticipated to peer a pointy build up in intake following the lifting of covid restrictions and this uplift didn’t happen. As a substitute, the economic system has slowed with present demanding situations for the sphere set to proceed. Intake is predicted to dip in 2024 with hospitality and retail call for keeping up an identical ranges to this yr.

Round 60% of all meat ate up in China is red meat and this proportion has persevered to develop over fresh yr, in particular within the middle-class inhabitants. On the other hand, professionals had anticipated to peer a pointy build up in intake following the lifting of covid restrictions and this uplift didn’t happen. As a substitute, the economic system has slowed with present demanding situations for the sphere set to proceed. Intake is predicted to dip in 2024 with hospitality and retail call for keeping up an identical ranges to this yr.

Imports

January to August of 2023 noticed China import a complete of one.90 Mt of pig meat. Despite the fact that this is a rise of 165,000 tonnes in comparison to remaining yr, this can be a relief of one.74Mt on 2021. 61% of that is recent/frozen produce (1.16Mt, up 10% yr on yr) while nearly all the remainder of the import quantity is offal.

Spain is still the primary exporter to China, with 436,000 t of red meat merchandise being shipped this yr. In spite of this, volumes have fallen leading to a discount in marketplace proportion from 26% in 2022 to 23% in 2023. Ms Behera mentioned: “It is a development repeated throughout Europe as manufacturing declines cut back the quantity of to be had product. The United Kingdom marketplace proportion has fallen from 5% remaining yr to 4% this yr, with a complete of 81,000 t of pig meat shipped to the China for the yr to this point.”

The USA, Brazil and Canada have all recorded important yr on yr quantity will increase. This has grown the marketplace stocks of the United States and Brazil to 16%, up from 14% and 15% respectively remaining yr. Canada now holds a 9% marketplace proportion, up from 6% in 2022.

China has lifted restrictions on imports of red meat from Russia, which means any other key competitor may just come to the marketplace within the coming months.

Ms Behera concluded: “China stays a key participant within the world red meat marketplace, eating round 40% of the sector’s red meat. Home manufacturing and pig meat import volumes are consistent with the ones recorded prior to the outbreak of ASF within the area. Comfy provide approach call for will likely be instrumental in riding the marketplace within the coming months.”