Trade losses to power herd contraction in 2H 2023 and 2024

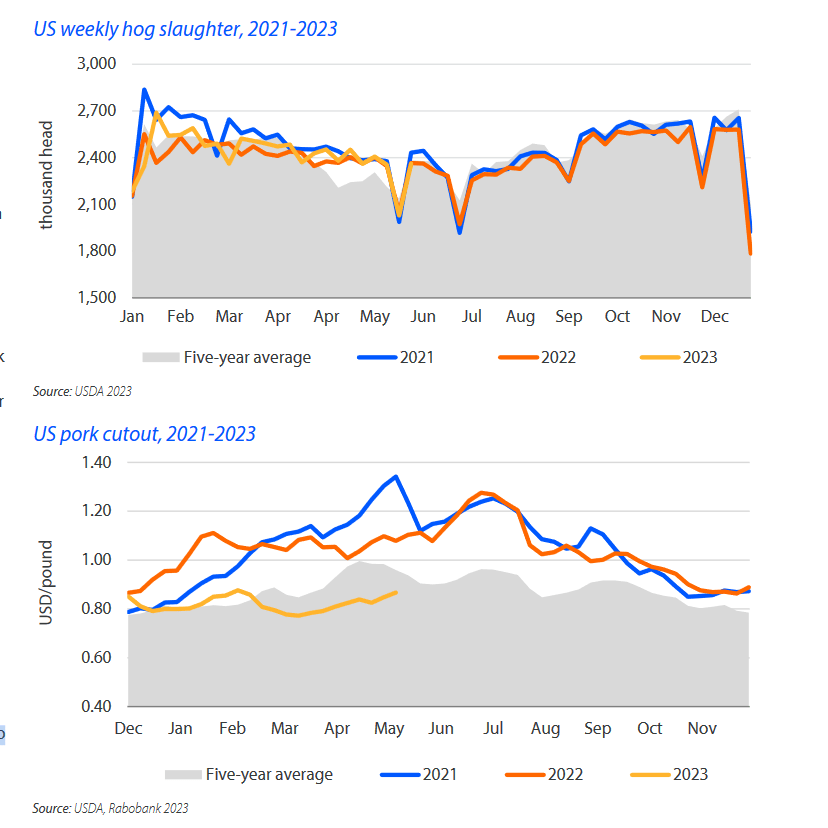

*Hog costs moved upper in contemporary weeks on seasonally tighter provides and progressed visibility across the integration of Proposition 12 in California. Decrease weekly slaughter (-1% YOY) and lighter weights (-1.6% YOY) have decreased manufacturing since past due Would possibly, serving to to stabilize costs. Whilst manufacturers proceed to fight all over what’s historically a season of more potent margins, a rebound in costs and a gentle decline in feed prices have progressed the near-term outlook. Whilst present sow slaughter stays low, we predict contraction within the sow herd to start out in 2H 2023. Depressed returns additionally enhance our outlook for decrease farrowing intentions within the upcoming Hogs and Pigs stock document. In response to our present outlook, we predict a minimum of a 7% decline in america sow herd over the following 12 to 18 months shall be wanted as a way to repair herd profitability.

*Red meat costs stay vulnerable on a sluggish begin to the grilling season. The red meat cutout is 20% under year-ago ranges, as sharply decrease abdominal costs (-46% YOY) proceed to weigh on carcass values. Weaker loins (-17% YOY) and ribs (-36% YOY) failed to supply enhance, despite the fact that there was a modest development in ham values from depressed ranges previous this spring. A loss of retail promotions and the ensuing top red meat costs have slowed intake this spring. Red meat stays a just right worth for outlets (as opposed to red meat), and with progressed visibility at the enforcement of Proposition 12, we predict an build up in red meat function task to force gross sales over the summer time. Heavy inventories of red meat in chilly garage in April (+6% YOY) are anticipated to say no over the summer time however may stay a problem for bellies. Red meat costs must proceed to peer some development in 2H 2023 given expectancies for decrease manufacturing and progressed intake and exports.

*April red meat and red meat selection meat exports had been up 10% YOY in quantity, to 196,099 metric lots, and up 7% YOY in worth. Red meat volumes to China/Hong Kong (+26% YOY), South Korea (+43% YOY), and Mexico (+5% YOY) grew, whilst gross sales to Japan (-2% YOY) and Colombia (-41% YOY) slipped. Red meat imports from all locations dropped (-33% in quantity), given depressed native markets. We’re lately forecasting 2023 export expansion of 8% YOY given the low relative price of US red meat in world markets.

*Mexican hog costs are step by step shifting upper after bottoming in past due Would possibly. Regardless of the development, hog costs are down 20% YOY and eight% under the five-year moderate on vulnerable packer call for. Regardless of some development in margins on decrease feed prices, the business is shifting to cut back the sow herd to raised align manufacturing and insist. Red meat costs proceed to transport decrease, down 16% as opposed to the Q1 2023 moderate and six% under year-ago ranges. Weaker home and export call for and secure imports (+1.4% YOY) proceed to weigh down the home marketplace, pressuring costs. We predict manufacturing expansion to sluggish to two.1% in 2023.