Whilst 2023 noticed some balance go back to the pig sector, the place can we move from right here stays clouded in uncertainty? ALISTAIR DRIVER explores the state of the pig herd, the marketplace possibilities and extra because the pig sector seems proceed at the street to restoration in 2024

2023 has been a yr of partial restoration and relative balance for the British pig trade, following two years of turmoil, angst and crippling monetary losses.

The trade is without a doubt in a greater position than it was once twelve months in the past, with some losses recouped and funding, tentatively a minimum of, going down once more.

However the place we move from right here in 2024 isn’t simple to gauge towards the backdrop of an unsure market, with, as at all times, EU and international elements to the fore, and a pig manufacturing base this is nonetheless, partly, missing the boldness and finance to in reality rebuild for the long run.

The construction of the trade is converting, with the built-in sector, led very a lot via Cranswick, continuously expanding its marketplace percentage as opposed to the independents, whilst the trade’s infrastructure inevitably reduced in size all the way through 2023, together with the lack of a big abattoir, Pilgrim’s Ashton plant.

Upload to this, ongoing enter value issues, endured labour constraints, a looming Basic Election, quite a lot of coverage questions and extending demanding situations and alternatives from the sustainability schedule, to not point out the ever present shadow of African swine fever (ASF).

In abstract, there’s a lot to sit up for in 2024, however a variety of doable pitfalls, too.

Pig herd restoration?

Simply ahead of Christmas, Defra launched its UK June census figures, which gave a sobering indication of the place the trade was once, and nonetheless is, at the lengthy street to restoration.

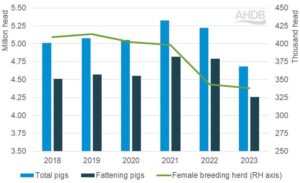

The overall UK pig herd reduced in size via 10.3% to 4.7 million in June 2023, representing a lack of greater than half-a-million pigs in twelve months, and the smallest determine recorded since 2012.

The overall UK pig herd reduced in size via 10.3% to 4.7 million in June 2023, representing a lack of greater than half-a-million pigs in twelve months, and the smallest determine recorded since 2012.

This was once solely pushed via an 11% fall within the collection of fattening pigs to 4.3m, the bottom quantity since 2015. This, in flip, mirrored the continued affect of the 14% contraction of the feminine breeding herd between June 2021 and June 2022, a anxious duration that noticed the lack of 55,000 sows, allied with the detrimental affects the summer time 2022 heatwave on fertility.

The census figures tally with traditionally low Defra per month UK slaughter throughputs, that have been 9.1% down thus far within the yr to November, despite the fact that November’s blank kill, down 4.8% yr on yr, in comparison with 8% in October and 10% in September, advised the distance could be ultimate.

Trade analyst Mick Sloyan identified that the Defra slaughter figures confirmed that Northern Eire has transform a extra important participant this yr, accounting for 18% of overall UK slaughter in comparison with 16% 5 years in the past.

As for the United Kingdom breeding herd, the most efficient that may be stated is that it has stabilised. The entire breeding was once down via simply 0.2% on June 2022 to 428,000 head, however there have been various traits inside of it that may comprise tips that could the long run.

As for the United Kingdom breeding herd, the most efficient that may be stated is that it has stabilised. The entire breeding was once down via simply 0.2% on June 2022 to 428,000 head, however there have been various traits inside of it that may comprise tips that could the long run.

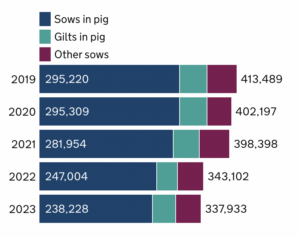

The entire feminine breeding herd misplaced any other 5,000 sows to face at simply 338,000, a 1.5% decline on best of 2022’s 14% drop and the bottom the feminine breeding herd recorded prior to now 21 years.

However whilst the collection of sows in pig was once down 3.6% year-on-year, the collection of gilts in pig was once up via a notable 13% and the collection of gilts meant for first time breeding higher via 6.5%. Boars getting used for carrier recorded a lack of 5.4% year-on-year.

Anecdotally, there will have been some modest breeding herd enlargement in the second one half of of the yr – the December survey effects may not be to be had till smartly into 2024, then again.

In spite of, the entire breeding herd drop, the rise in gilt numbers displays indicators of ‘progressed trade sentiment’ and ‘tentative’ breeding herd restoration, reflecting the easier monetary state of the field, in line with AHDB crimson meat analyst Tom Dracup stated.

However AHDB believes this means best ‘wary enlargement’ for some manufacturers, with little prospect of the trade ‘bouncing again to the heights of 2021 relating to pig numbers, throughputs or manufacturing’.

Mr Dracup is expecting ‘a small restoration in blank pig numbers in 2024, with a minor build up within the blank kill’.

In its annual International Animal Protein Outlook, Rabobank forecasts ‘wary’ UK red meat manufacturing enlargement of two%, at the again of ‘upper manufacturing intentions’ in the second one half of of 2023.

If feed purchases are a trademark of manufacturing intentions, AHDB’s contemporary pig feed manufacturing knowledge, appearing a 6.3% decline between July and October, does now not level to approaching pig herd restoration.

Marketplace possibilities

Pig farmers, on reasonable, returned to benefit in 2023, in particular in the second one and 3rd quarters, as margins averaged £22/pig and £25/pig respectively, following 10 successive quarters of detrimental margins and estimated overall losses of greater than £750m.

Margins had been squeezed slightly in This autumn, with the SPP dipping beneath 215p/kg in mid-December, after averaging 224p/kg in Q3. This autumn internet margins will have to nonetheless be round £16/pig, in line with trade analyst Mick Sloyan.

Mr Dracup stated the enhanced margins have supplied ‘some alternative to re-stabilise trade after a surprisingly difficult duration’.

“However longer-term self belief stays within the steadiness, as the United Kingdom and EU marketplace re-adjusts to manufacturing shocks, massive adjustments in industry actions because of international worth disparities (lowering the EU’s skill to export), along intake pressures each locally and within the wider EU proceeding to purpose some problem for marketplace values.”

Probably the most large drivers of the declining UK pig worth for the reason that summer time has been falling EU pig costs. The EU reference worth fell from 215p/kg in July to beneath 185p/kg in December, with the distance between the United Kingdom and EU reference costs widening from unmarried figures to round 30p, making imports very aggressive.

Mr Dracup added: “All eyes rightly stay at the EU market as we glance into our respective crystal balls for 2024. Maximum analysts are expecting manufacturing decreases within the EU block of between 6 and seven% via the tip of 2023.

“Whilst we look forward to the macro pressures on manufacturing to stay, we foresee this easing from the present ranges as we transfer into 2024, with EU manufacturing estimates again within the area of an extra 2% fall for the entire yr forward.

“Industry flows are reputedly creating into a brand new commonplace, with predictions of the EU’s skill to export outdoor the block restricted via worth issues at the international degree, suggestive of higher inner product motion. This may increasingly unquestionably power some drive from imports into the United Kingdom market.

“Given those actions, following conventional post-Christmas intake pressures, we would possibly start to see some energy creeping into the EU market as we transfer into the spring of 2024, with call for re-establishing quite forward of the manufacturing declines within the EU.”

In relation to home provide, a consultant of one of the crucial pig advertising and marketing corporations stated manufacturers had completed a just right task of pulling ahead pig numbers within the run-up to Christmas, however predicted that pig numbers can be tight in early 2024.

“With illness problems, other people going out and the entire rainy climate we’ve had, we’re predicting that pigs may just run very quick within the spring of subsequent yr,” he stated.

Finely balanced

Trade analyst Mick Sloyan described the marketplace possibilities for 2024 as ‘finely balanced, with international elements very a lot in play’, with a ‘few causes for a modest party’, after the new turmoil.

Trade analyst Mick Sloyan described the marketplace possibilities for 2024 as ‘finely balanced, with international elements very a lot in play’, with a ‘few causes for a modest party’, after the new turmoil.

He stated the retail marketplace has held up ‘remarkably smartly’ within the face of emerging costs and the patron squeeze, with Kantar knowledge appearing that within the yr to the tip of November, the whole price of red meat and processed merchandise higher via 10% whilst quantity gross sales fell via best 2.4%.

“The primary worry for British manufacturers is that the most powerful efficiency has come within the sausage, bacon and sliced cooked meats a part of the marketplace, the place British meat has a decrease marketplace percentage and is extra at risk of pageant from imports,” he stated.

Having a look to 2024, he forecast that home provide is ‘not likely to modify considerably as manufacturers can be very wary about enlargement’.

“The go back to profitability this yr, whilst unquestionably welcome, has lined lower than half of the common losses made all the way through 2022. This has left many companies in a vulnerable monetary place and not able to finance enlargement even supposing they want to,” he wrote within the Weekly Tribune.

“Call for seems encouraging, however a lot is determined by how a lot drive client spending is beneath. Endured drive on client spending may just assist to maintain call for in 2024.”

He additionally predicted additional drive from EU imports, including that the EU outlook ‘hinges on call for’. “EU manufacturing isn’t more likely to alternate considerably for identical causes to the United Kingdom, so it comes right down to how smartly EU exporters can compete on international markets,” he stated.

“That is more likely to be very tricky, particularly within the first half of of subsequent yr. Pig costs in america, the EU’s main competitor, proceed to fall sharply. These days, reasonable carcase costs are lower than half of the extent they had been in July this yr.

“Costs additionally proceed to weaken in China. However, because the announcing is going, ‘the treatment for low costs is low costs’, so we would possibly see manufacturing fall and the associated fee place toughen in the second one half of of the yr.”

Value outlook

Enter prices stay traditionally top, however just like the pig worth, the image has progressed this yr. Pig manufacturing prices averaged 195p/kg in Q3, in comparison with a top of 240p/kg in Q2 2022, at the again of falling feed prices, which fell from 175p/kg to 121p/kg over the duration.

Enter prices stay traditionally top, however just like the pig worth, the image has progressed this yr. Pig manufacturing prices averaged 195p/kg in Q3, in comparison with a top of 240p/kg in Q2 2022, at the again of falling feed prices, which fell from 175p/kg to 121p/kg over the duration.

Feed wheat costs, dropped again considerably over the yr, quoted at round £185/tonne for January ahead of Christmas, however soya stays dear.

The outlook for 2024 is unsure, and can, as at all times, be formed via international climate patterns and geo-political occasions.

Addressing the NPA Pig Trade Team’s December assembly, the feed trade consultant stated. “Wheat is beneath £200/tonne however in case you glance to the futures, for November 2024, there’s a top rate on best, which displays the tricky state of affairs available in the market with the elements in this day and age. Barley’s buying and selling down within the £160s, however, once more, there’s about an £18 top rate for November subsequent yr.

“Soya lately shot as much as £500, nevertheless it has come go into reverse to £450. That is associated with climate, greenback actions and China.”

She identified that numerous manufacturers have after all come off upper priced contracts, in some instances round £300/t for wheat, which can considerably toughen the entire value outlook.

Writing within the corporate’s Outlook 2024, Anderson’s Harry Batt famous that, regardless of diminished feed costs, there’s nonetheless ongoing drive on value of manufacturing, which stays 20-30p above the five-year reasonable. Labour and electrical energy prices have endured to upward thrust, compounded via expanding rates of interest. The common value of the running capital for a pig have higher from £1.52 to £4.55 in step with kilogramme within the closing 18 months.

“This can be of serious worry for quite a lot of manufacturers that experience invested considerably during the last 5 years,” he stated.

“I might query how manufacturers can meet environmental and social objectives whilst encouraging other people to paintings within the trade if the benefit margins aren’t there. Definitely, the most efficient alternative to have environmental internet carbon 0 red meat is via development a winning trade for all.”

What’s the temper amongst manufacturers?

The PIG conferences are at all times a just right gauge of the trade temper. All over the regional round-up, manufacturers had been transparent that there’s ‘extra positivity available in the market’ with pigs in benefit, tempered via worry over falling costs.

The South-Central consultant expressed worry in regards to the pig worth coming down at a time when cereal costs are probably going to upward thrust once more and the soya worth is top.

He additionally highlighted that manufacturers are proceeding to depart the field, with any other massive manufacturer within the area deciding to cull their herd.

The Midlands correspondent added: “There’s just a little extra positivity available in the market. The associated fee is coming down slowly, and it’s extra strong. Profitability is there on the minute, so expectantly it carries on into subsequent yr.”

In his New Yr message to individuals, NPA chair Rob Mutimer stated: “This yr has felt reasonably just like the hangover from the 2 earlier years of carnage.

“We’re a minimum of seeing certain margins which is a blessing, however self belief a number of the majority of manufacturers remains to be very low with many having to restructure their trade and plug monetary holes from the former years.

“Fortunately, herd numbers are beginning to stabilise, and self belief will expectantly begin to toughen right through 2024.”

Hugh Crabtree, the NPA’s vice chair, stated there was once ‘just a little of motion’ at the funding entrance within the constructions and gear sector. “My knowledge is that the development corporations appear to have paintings going ahead into subsequent yr,” he stated.

However chatting with impartial manufacturers, it’s transparent that, whilst some are feeling extra positive in regards to the long term, others stay scarred via contemporary occasions and are reluctant to dedicate an excessive amount of on herd restoration or enlargement for concern of historical past repeating itself.

That is towards a backdrop of an ongoing shift in pig possession from the impartial sector to the company sector, with Cranswick, particularly, proceeding to develop its pig herd in 2023, together with the £32m acquisition of Elsham Linc, with 8,000 sows and a feed mill. Cranswick is now greater than 50% self-sufficient in pigs, with the promise of additional enlargement to return, along main funding in its processing amenities.

There were examples in 2023 of strikes against extra sustainable processor-retailer pig contracts, with a lot higher consciousness of on-farm prices, however it’s not unexpected that some impartial manufacturers stay unsure about their long term.

By contrast backdrop, all eyes can be on development with Defra’s overview of contractual follow within the provide, forward of a Basic Election in 2024.

Mr Sloyan stated: “Folks react to drive in several tactics. In 2022, some abattoirs reacted via shorting historical provide agreements, making a backlog of pigs on farm. That resulted within the govt inquiry into equity within the provide chain.

“Paintings is underway on new laws to verify truthful contracts and clear marketplace knowledge to allow truthful pageant to happen. There may be an pressing want for the ones laws to be presented ahead of aggressive drive out there as soon as once more encourages corrosive behaviour within the provide chain.”

Rabobank’s international forecasts for 2024

Rabobank’s annual International Animal Protein Outlook record forecasts that, globally, animal protein manufacturing enlargement will sluggish as margins stay tight in 2024, with manufacturers and processors desiring to conform to maintain good fortune.

Rabobank’s annual International Animal Protein Outlook record forecasts that, globally, animal protein manufacturing enlargement will sluggish as margins stay tight in 2024, with manufacturers and processors desiring to conform to maintain good fortune.

Enter prices and inflation are more likely to fall, however will stay at a better stage than pre-pandemic, and, together with tighter provides, will push animal protein costs up and constrain international intake in 2024, it predicts.

Rabobank’s analysts forecast that, general, red meat manufacturing will ‘contract modestly’. The record is damaged down into the other markets.

Europe: EU red meat manufacturing is forecast to say no via 3% in 2024, a slowing of the contraction of the previous two years. The go back to certain margins at the again of file costs and easing feed prices has slowed the decline of the sow herd within the 8 primary EU pig generating international locations.

In the United Kingdom, ‘wary’ enlargement of two% is forecast, at the again of ‘upper manufacturing intentions’ on pig farms in the second one half of of 2023.

China: Red meat manufacturing is expected to stay flat or drop quite in 2024 on this key international marketplace, following a herd contraction in 2023. Extra rationalisation is anticipated in This autumn 2023 and Q1 2024 to rebalance provide and insist.

Chinese language red meat imports higher via 6% within the first 9 months if 2023, slowing within the fourth quarter. Rabobank analysts expect additional enlargement of 0 to five% subsequent yr, as Chinese language call for recovers, and stock ranges decline.

Red meat manufacturing enlargement could also be forecast in Vietnam.

Brazil: Brazilian red meat manufacturing is forecast to extend via 3-4% in 2024, with Brazilian red meat exports, that are set to achieve a file this yr, predicted to extend once more, via 2-4%, because of quite upper import volumes in China and in other places.

North The united states: North American pig breeding herds are anticipated to peer ‘modest contraction’ subsequent yr, as pig costs proceed to lag at the back of emerging prices. Rabobank is forecasting a nil.6% decline in North American red meat manufacturing, with better falls in america and Canada offset partially via a 1.6% build up in Mexico.

US exports are, however, anticipated to upward thrust via an extra 3% after a ‘sturdy’ 2023.