Aside from the lower in Eu exports to China, Eu exporters additionally face a weakening of gross sales to different Asian markets, which call for extra subtle and high-value-added beef merchandise.

In 2023, Japan and South Korea have been suffering from vital inflation. Within the 3rd quarter, client meals costs rose by means of 9.4% in Japan and by means of 4.5% in South Korea in comparison to 2022. This unsure financial context has resulted in a drop in client call for, particularly within the eating place business, a sector that calls for imported merchandise.

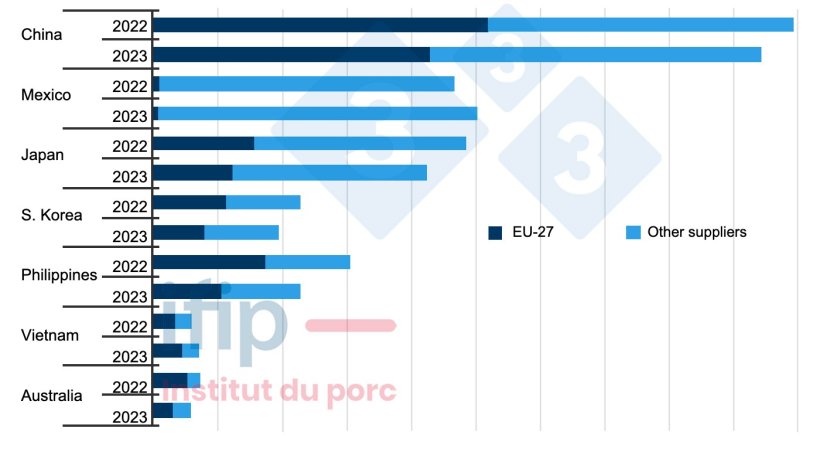

For this reason within the first 8 months of the 12 months, imports of beef merchandise fell by means of 12.5% year-on-year for Japan and by means of 14.1% for South Korea. Europeans have been the toughest hit by means of the weakening of purchases from those two markets. However, Brazilian exporters, which prior to now had little presence in those Asian nations the place call for for processed merchandise is more potent than in China, won marketplace percentage.

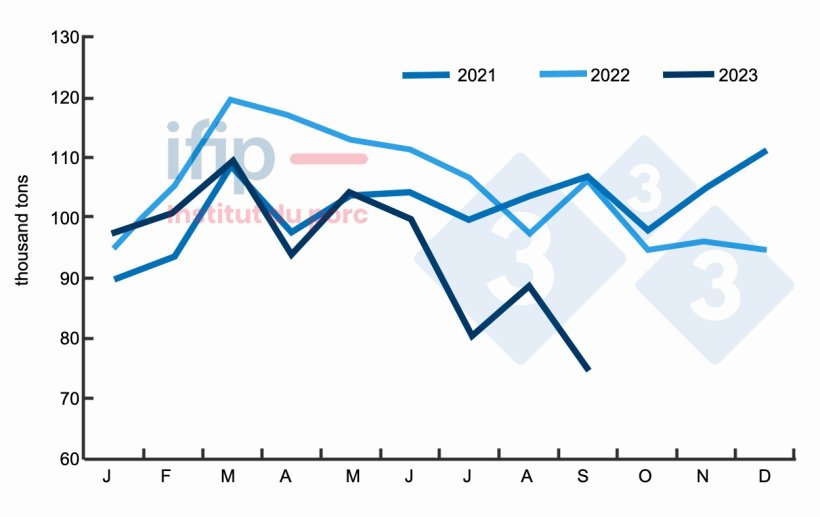

Eastern imports (thousand lots; with the exception of are living pigs). Supply: IFIP in line with Eurostat customs knowledge, TDM.

In 2023, the export marketplace was once marked by means of the lack of Eu marketplace percentage in many nations, competing with Brazilian and American origins.

On the root of the EU’s lack of competitiveness are worth variations between generating spaces and the lower in Eu manufacturing. This context is compounded by means of an detrimental financial atmosphere for purchases by means of the primary world importers, which slowed international industry within the 3rd quarter.

Out of doors Asia, enlargement drivers for Eu exporters are restricted as a result of they get advantages little from the dynamism of Mexican call for. The USA accounts for 83% of Mexico’s provide, adopted by means of Canada (13%), Brazil (2%), and in spite of everything Spain (1%). In Australia, call for has fallen (-21%) and most effective Eu volumes are affected (-45%). Different providers are consolidating their positions (+41%), particularly america.

Regardless of the autumn in Eu beef manufacturing, the export marketplace is responding to the problem of balancing carcasses and the valorization of all beef merchandise. Just like the Brazilians and the American citizens, Eu exporters are exploring an crucial diversification in their markets out of doors Asia or Latin The united states.

Main international importers and their providers (1000’s of lots; with the exception of are living; cumulative 9 months). Supply: IFIP in step with Eurostat customs, TDM.