February costs 1.8% upper than a 12 months in the past

The tempo of US hog slaughter was once upper than anticipated in February as processors bid up hog costs in line with wholesalers’ higher call for for beef, in line with the newest USDA Farm animals, Dairy and Poultry Outlook document.

February ended with estimated federally inspected (FI) hog slaughter numbers simply shy of eleven million head, virtually 5% upper than a 12 months in the past after accounting for the month’s further slaughter day.

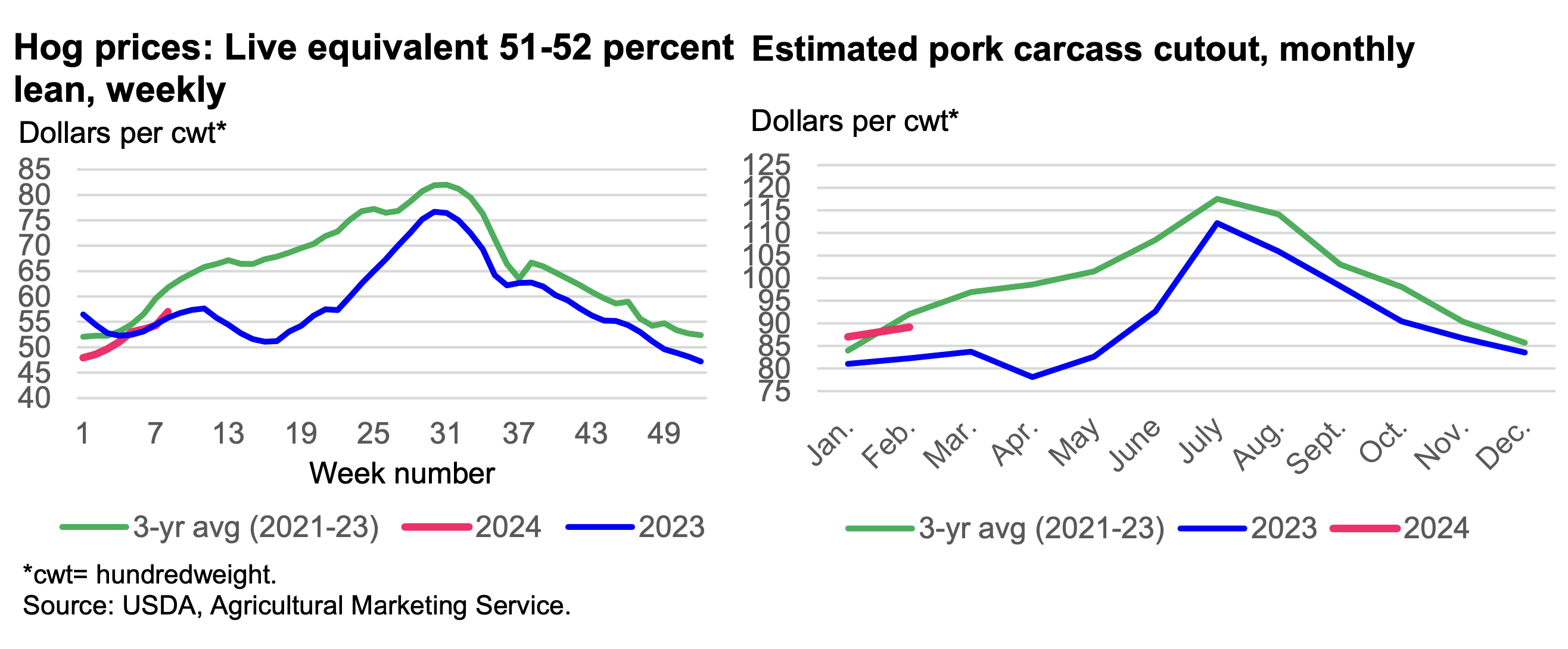

The February reside similar worth of 51–52% lean hogs averaged $55.24 consistent with cwt, 1.8% upper than a 12 months in the past. In a similar way, processors and wholesalers bought about 2.4 billion kilos of beef—virtually 5% greater than in February 2023—at estimated beef carcass cutout values of $89.14 consistent with cwt, 8.3 p.c upper than a 12 months in the past. Higher wholesale call for—upper volumes of beef bought at upper costs—most probably supplied enough margin for processors to pay upper costs for higher numbers of hogs.

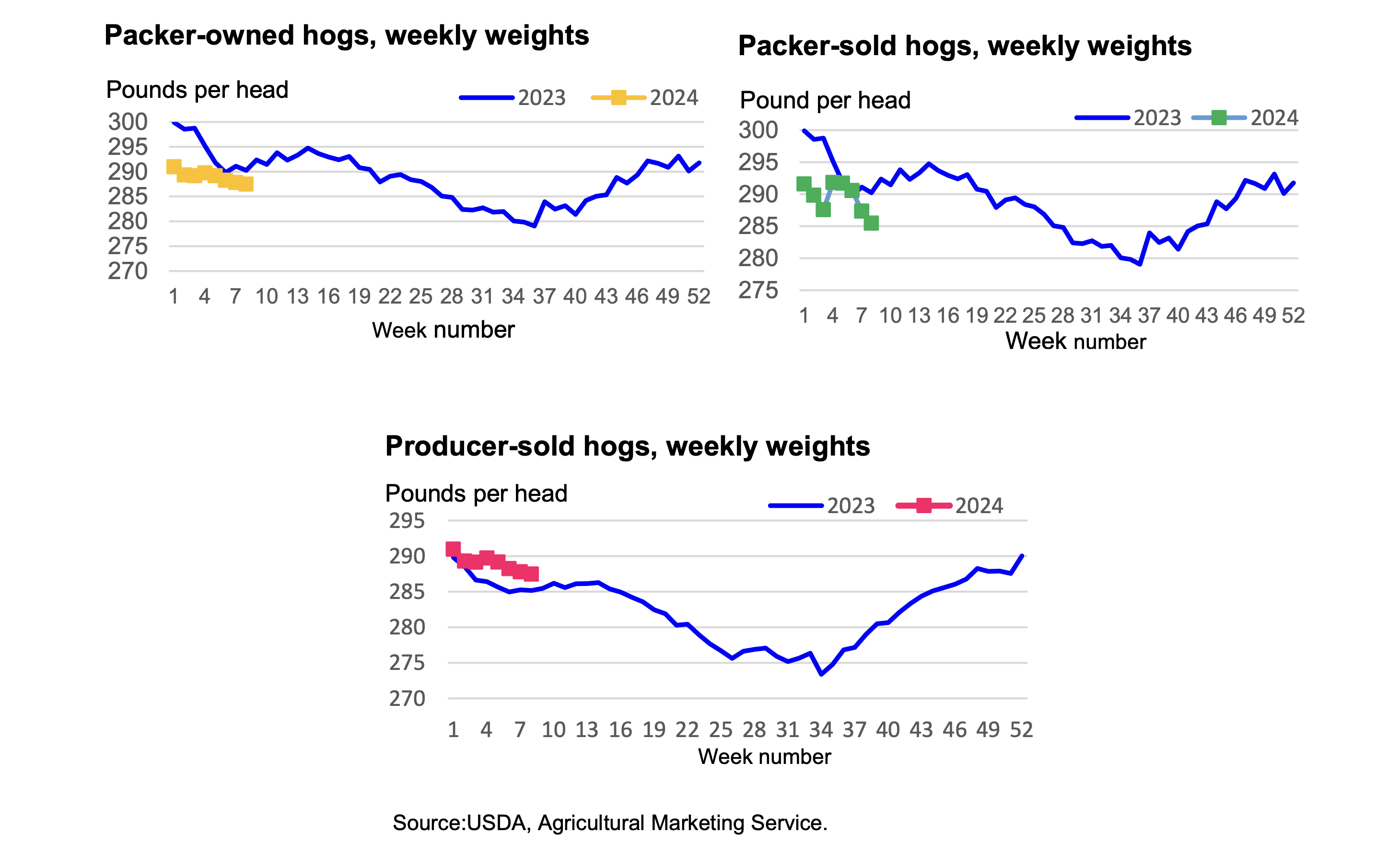

First-quarter beef manufacturing is raised about 30 million kilos to just about 7.2 billion kilos, 1.3 p.c more than a 12 months in the past. It’s most probably that one of the hogs supplying the extra manufacturing have been packer-sold and packer-owned hogs, whose less than year-earlier weights─regardless of decrease feed prices this 12 months—recommend that they have been pulled ahead in line with higher beef call for. It’s notable that producer-owned hog weights this 12 months are, to this point, above year-ago ranges, suggesting an unanticipated run-up in wholesale call for by way of processors.

Call for for hogs in 2024 is predicted to be maintained by way of persisted power in beef call for. Carcass cutout values for January and February recommend that whilst probably not to succeed in 2021–22 ranges, values will have to pattern above the ones of 2023. Wholesale beef call for is predicted to be supported by way of top relative retail costs of beef substitutes, usually top grocery costs in turn out to be much less of a presence, specifically in Asian markets because of decrease EU beef manufacturing and upper costs.

First-quarter costs of 51–52% reside similar lean hogs are anticipated to reasonable $55 consistent with cwt, about equivalent to the similar length ultimate 12 months.

2d-quarter costs are raised to $65 consistent with cwt, virtually 15% above the similar length ultimate 12 months.

3rd-quarter hog costs are raised $1 from ultimate month’s forecast to $67 consistent with cwt, greater than 3% less than the 3rd quarter of 2023.

The fourth-quarter forecast stays $56 consistent with cwt, virtually 5% more than a 12 months previous. The revised forecasts reasonable to $61, virtually 4% upper than the common for 2023.