In line with the most recent animal protein record by way of RaboResearch, the outlook for international poultry markets is bullish, pushed by way of accelerating intake enlargement in in lots of markets. After a number of years of gradual enlargement, international poultry intake is forecast to achieve 2.5% to three% in 2024, marking a go back to historical ranges.

Poultry industries international appearing smartly, however with notable exceptions

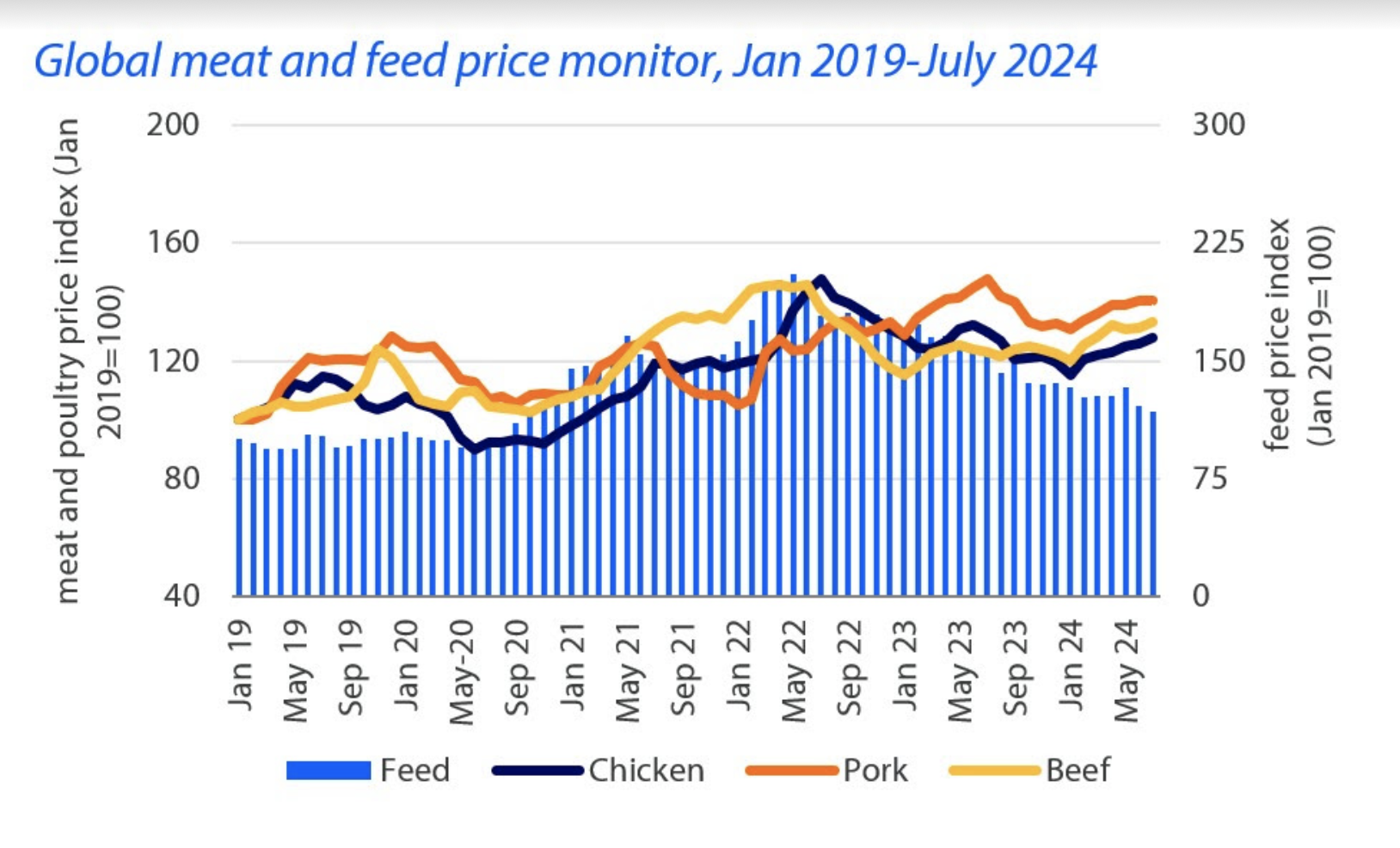

International poultry markets are appearing smartly because of decrease manufacturing prices and cast call for restoration in maximum markets. In line with Nan-Dirk Mulder, Senior Analyst – Animal Protein at RaboResearch, “Poultry’s sturdy value place in opposition to different proteins in maximum markets, together with sturdy retail call for, improving foodservice call for, and emerging sustainability methods that strengthen hen call for are supporting fast enlargement.”

Maximum poultry industries international have remained slightly winning, with emerging costs in lots of instances. The principle exceptions are China and Japan, which proceed to be afflicted by native oversupply. Rapid manufacturing enlargement, together with tougher native financial prerequisites and decrease client self belief, has resulted in oversupply, with slightly low costs and emerging shares. This has additionally weighed on imports, with huge year-on-year drops in uncooked hen imports to China and Japan within the first part of 2024.

International business will develop, however volatility is ongoing

However, total business is anticipated to stick tough in the second one part of 2024. Maximum global markets are sturdy and balanced, expanding the call for for hen imports. International business is forecast to develop in keeping with emerging international poultry call for however within the context of ongoing volatility. The weak spot in Chinese language call for will force hen ft costs, however breast meat and processed hen costs are anticipated to stay company, in keeping with sturdy marketplace prerequisites in the primary uploading markets in Europe and Asia. Intake in complicated economies like Europe, america, and Japan will continue to grow in keeping with long-term traits and higher affordability. Call for for extra value-added merchandise like processed hen and thought poultry will get better additional, returning to pattern ranges after a couple of gradual years.

Then again, dangers stay. The tensions within the Center East, and the ensuing rerouting of business by means of South Africa, proceed to weigh on business between Asia and Europe because of the longer shipping instances and better prices. “For the outlook, the primary wild playing cards can be animal illnesses and geopolitical tensions. Each can abruptly affect international business flows,” notes Mulder.

Avian influenza stays a priority

Certainly, the outbreak of Newcastle illness on a Rio Grande do Sul farm in Brazil led to an export embargo to a number of locations. Key importers like Japan, China, Saudi Arabia, and South Africa positioned restrictions on the state foundation, whilst others moved to a regional method. Even supposing no new instances had been discovered, it’s been a serious warning call for Brazil and primary uploading nations.

Avian influenza stays a problem for the business, however on reasonable, the force is relatively decrease in comparison to closing 12 months. This 12 months, the EU had the bottom choice of outbreaks since July 2019, and South Africa has remained unfastened from outbreaks in industrial farming, with hen manufacturing totally improving (despite the fact that egg manufacturing remains to be closely impacted). America has been one of the crucial exceptions, with ongoing outbreaks throughout summer time months that experience considerably impacted the egg business. As wintry weather advances within the Northern Hemisphere, dangers will upward thrust once more.

“In a context with ongoing prime dangers, similar to animal illness, feed value volatility, and geopolitical stress, provide enlargement self-discipline is vital to stay running below balanced marketplace prerequisites,” concludes Mulder. “In a different way, the present bullish marketplace prerequisites may push manufacturers to extend too confidently, resulting in oversupply like that noticed in China and Japan.”