AHDB is forecasting simplest very restricted restoration in each red meat manufacturing and pig breeding numbers in 2024, in spite of a lot more beneficial marketplace stipulations, as manufacturers stay very wary about increasing their herds.

Its 2024 Red meat Outlook predicts that pigmeat manufacturing will develop by means of lower than 1% this 12 months, following an 11% year-on-year contraction in 2023, as blank pig slaughter fell to its lowest quantity in a decade at the again of the dramatic contraction within the breeding herd in 2022.

The pig trade returned to profitability during the last 9 months of 2023, at the again of falling prices and emerging costs, peaking at just about 216p/kg in August, with AHDB estimating reasonable internet margins over Q2, Q3 and This autumn of £22/pig, £25/pig and £19/pig respectively. This adopted 10 successive quarters of damaging margins, on the height in far more than £50/pig, throughout which the trade is estimated to have misplaced greater than £750 million.

Even though the price of key inputs, akin to feed and gas has eased, inflation has remained traditionally prime and better rates of interest usually are negatively impacting operating capital, AHDB famous.

In the meantime, after sturdy expansion within the first part of the 12 months, UK pig costs had been on a gentle downward pattern since overdue summer time, shedding 14 since early August, following extra dramatic downward, motion within the EU marketplace. This has supposed manufacturer sentiment has remained unsure, in spite of the costs ultimate forward of prices to supply wholesome margins, AHDB stated.

Provide

After a ten% decline in slaughterings in 2020 UK, pig provide stays tight provide for pigs and AHDB forecasts this may occasionally proceed in the course of the first part of 2024.

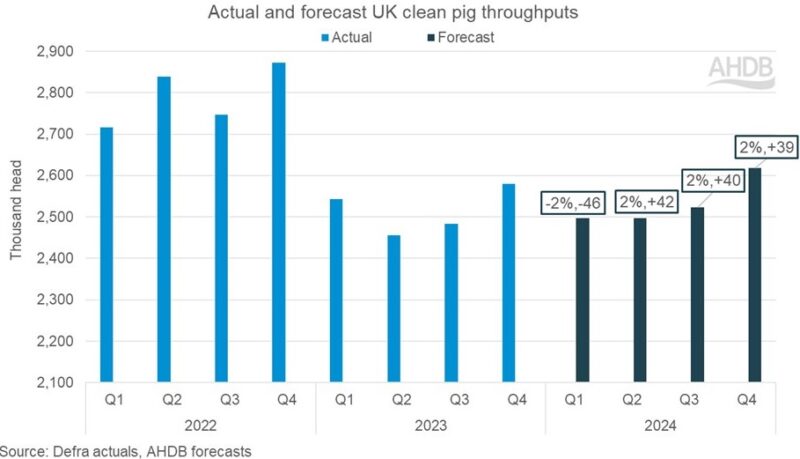

That is weighted in opposition to Q1 with throughputs again 12 months on 12 months as many processors pulled pigs ahead for kill on the again finish of closing 12 months to fulfill Christmas call for. Even though numbers in Q2 are predicted to marginally select up, by means of 2% 12 months on 12 months, that is in comparison to a ancient low and numbers forecast to be similar to Q1.

A small uptick in throughputs, additionally round 2%, is anticipated over the second one part of 2024, because the gilts supposed for first-time breeding recorded within the June 2023 census get started farrowing.

Total, AHDB forecasts that pig meat manufacturing in 2024 will develop marginally by means of 0.6% 12 months on 12 months to round 933,000 tonnes, pushed by means of a zero.8% building up within the blank pig kill, totalling someplace close to 10.14 million head for the 12 months. This forecast is in accordance with reasonable carcase weights of 89 kg, ultimate in step with 2023.

AHDB identifies various ‘dangers’, alternatively, that would have an effect on this forecast, together with additional outbreaks of Swine Dysentery, which continues to provide demanding situations for the trade, and the ‘ever provide’ risk of ASF crossing our borders.

Excessive climate occasions may even have a proscribing affect. The summer time heatwave of 2022 hampered the fertility of breeding inventory, influencing manufacturing within the early a part of 2023. It’s been reported that opposed rainy climate witnessed in contemporary months is taking its toll on farm productiveness, particularly on out of doors gadgets, AHDB stated.

Breeding herd

In spite of advanced farm margins, AHDB stresses that ‘hesitancy stays inside trade, as the brand new 12 months continues the theme of uncertainty’.

Easing pig costs, prime inflation charges and an forthcoming normal election are proscribing hobby in large-scale funding, and as an alternative of increasing herd sizes in 2024, AHDB expects to peer an extra focal point on ‘herd rejuvenation’.

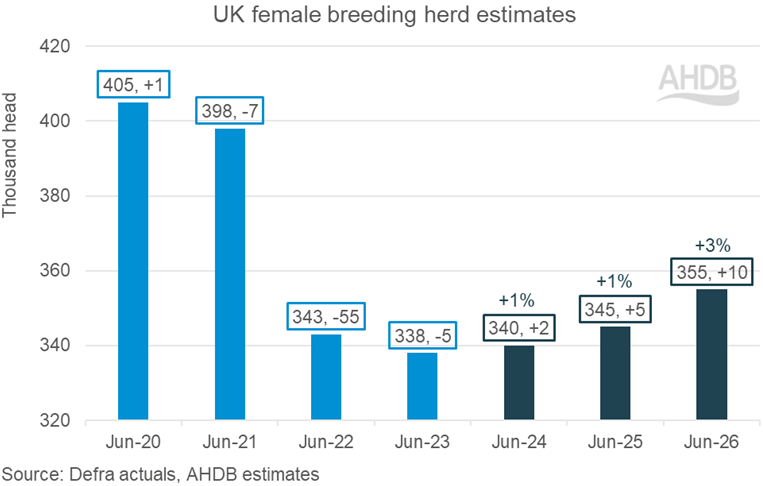

In this foundation, it forecasting the breeding herd to just inch up by means of round 2% to round 340,000 head, adopted by means of ‘subdued expansion’ over the following couple of years because the marketplace rebalances.

Business

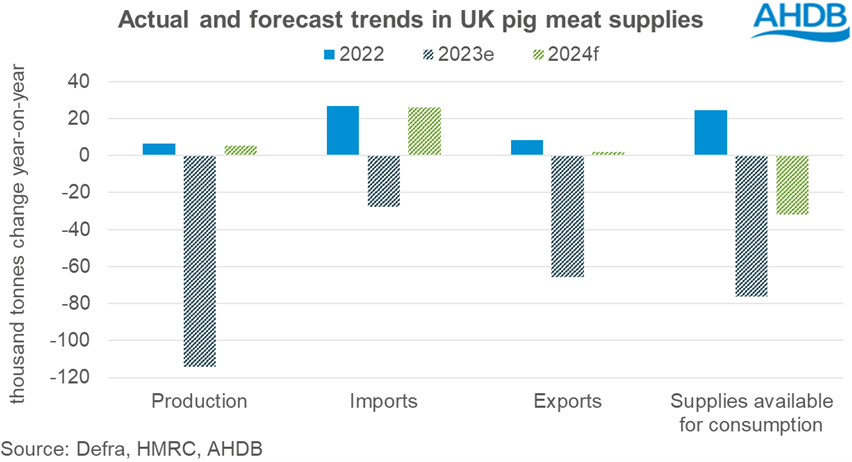

Imports of pig meat to the United Kingdom had been down 2% 12 months on 12 months in quantity phrases in 2023 (Jan – Nov), even though that doesn’t inform the whole tale.

Within the first 4 months of the 12 months, imported pig meat volumes had been down on reasonable 14% 12 months on 12 months following reduced home call for, tight EU availability and little differential between UK and EU pricing. On the other hand, since Might per month import volumes had been recording expansion 12 months on 12 months, averaging 5%, pushed by means of an building up in the associated fee differential between UK and EU product along advanced call for, particularly in foodservice, which in most cases holds a better weighting of non-British product.

AHDB anticipates this pattern will proceed into 2024, with imported volumes of pig meat finishing the 12 months up 3% on 2023.

With retail and foodservice call for forecast to fall, the ongoing worth differential between EU and UK product continues may see larger call for for inexpensive cuts from the EU.

UK pigmeat exports had been down 19% (Jan – Nov) closing 12 months at the again of decrease manufacturing and better pricing.

AHDB is forecasting a 1% building up in UK pig meat export volumes for 2024, in accordance with a marginal building up in manufacturing, however volumes are anticipated to stay traditionally low.

Costs

AHDB expects the United Kingdom proceed carefully following actions within the EU marketplace to care for competitiveness. With provides nonetheless operating tight in each areas, costs would possibly stabilise because the 12 months progresses, however in the long run the stability of provide verses adjustments in call for all over the 12 months will dictate the place pig costs sit down, it stated.

Call for

Overall red meat volumes declined by means of 1% in 2023, as expansion in foodservice was once no longer sufficient to stability for retail losses, in step with AHDB/Kantar knowledge for the 52 weeks finishing December 24, 2023).

For 2024, AHDB expects general red meat volumes for 2024 to be down by means of 2% in comparison to 2023 and by means of 4% in comparison to 2019, on account of eating-out no longer returning to pre-Covid ranges and retail gross sales of meat affected by the cost-of-living disaster.

Retail red meat volumes are predicted to say no throughout 2024, as the associated fee distinction between red meat and hen is widening, which might see extra consumers switching out of the red meat class than it good points from red meat and lamb.

The out-of-home marketplace for red meat could also be prone to combat. Dine in, on-the-go and takeaways are anticipated to say no quite year-on-year as customers prohibit spending and select to take breakfast and lunch to the place of business from domestic.