In 2023, beef manufacturers are grappling with important demanding situations, and the hope for a turnaround in 2024 is paramount. This yr has witnessed exceptional consolidated losses within the business, resulting in monetary difficulties for lots of manufacturers and prompting some to go out beef manufacturing. Sadly, this cycle of adversity turns out to afflict the business each and every decade or so, leading to ongoing consolidation as profitability turns into elusive because of unprofitability and manufacturing problems.

Compeer Monetary conducts quarterly monetary research on manufacturers inside our portfolio, depending on audited statements or high-confidence evaluate high quality statements. The most recent information, reflecting the second one quarter numbers for 2023, confirms that the business remains to be mired in critical monetary rigidity.

Yr-to-date figures disclose that the typical manufacturer incurred an operational lack of $16.44 consistent with hundredweight (cwt.) earlier than making chance control selections. On the other hand, hedge actions supplied a glimmer of hope, contributing a mean achieve of $7.60 cwt. Nevertheless, this best in part offset the losses, leading to a internet year-to-date lack of $9.64 cwt. or $20.69 consistent with head through June 30. The main driving force in the back of those losses stays the constantly excessive working prices, with manufacturers averaging $91.41 cwt. after factoring in hedge process within the first part of 2023.

The have an effect on at the steadiness sheet has been as expected, with really extensive declines in each running capital and proprietor’s fairness for the reason that get started of the yr. One key indicator for assessing the long-term viability of operations is operating capital, with an ordinary benchmark of $600 consistent with sow or sow equivalents. Sow equivalents follow to those that acquire phase or all in their hog inventories. At the start of 2023, the typical running capital consistent with sow stood at an outstanding $1,138, just about double the specified quantity. On the other hand, this determine declined through $200 consistent with sow within the first 3 months and some other $143 consistent with sow throughout the second one quarter. Lately, the typical manufacturer keeps $795 consistent with sow in running capital. Thankfully, successful months in July and August supplied some aid, enabling an build up on this determine because the business enters the fourth quarter. Proprietor’s fairness has additionally been impacted, with the typical manufacturer’s fairness status at 51% through the top of the second one quarter, down 3% from the primary quarter’s finish.

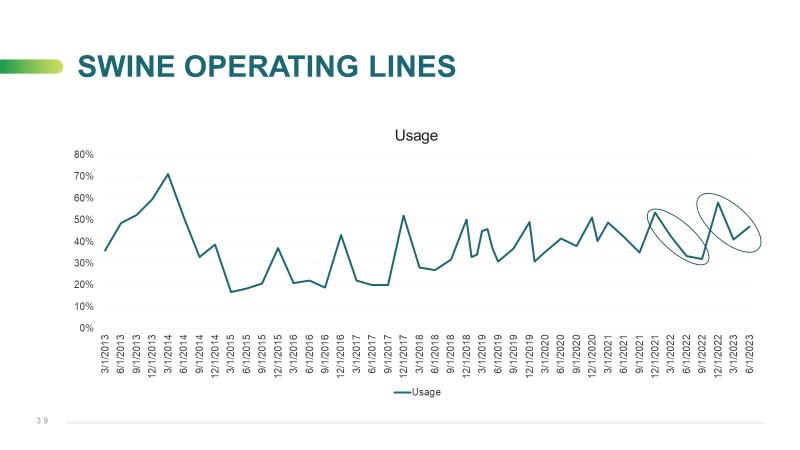

As anticipated, the typical utilization of working strains of credit score continues to upward push. Generally, utilization charges would lower and hover across the mid-30% vary via the second one quarter. On the other hand, the representation beneath demonstrates that the typical advance fee for manufacturers is now nearing 50%, and with expected losses for the rest of 2023, it’s going to climb to round 60%.

Nonetheless, there may be optimism at the horizon. Studies point out that corn yields are surpassing expectancies, and December corn futures are these days priced at round $4.80. In comparison to the $7.00 corn costs seen a yr in the past throughout the harvest season, this implies attainable financial savings of a minimum of $20 consistent with head in feed prices. Coincidentally, this determine aligns intently with the per-head losses skilled within the first part of 2023. As high-priced hogs are changed with animals eating lower-cost feed, there’s a chance of assuaging running capital necessities. On the other hand, manufacturers will have to brace themselves for the following two quarters, as additional steadiness sheet deterioration is anticipated to because of ongoing losses. On the other hand, with decrease feed prices and certain benefit margins expected for the summer season, the business would possibly get started rebuilding steadiness sheets in the second one quarter.

Steve Malakowsky is the Director of Swine Lending, with over 25 years of enjoy at Compeer. For extra insights from Steve and the Compeer Swine Staff, discuss with Compeer.com