US Fed officers now be expecting rates of interest to stick upper for longer

“Upper for longer” is now the trending catchphrase amongst marketplace watchers following the loss of life of “transitory inflation” and the briefly fading “financial cushy touchdown.” Fed Chairman Powell commented on the Sept. 20 assembly that in spite of his 5.25% in mixed hikes so far, client spending, employment, and inflation had been all nonetheless working warmer than he preferred.

When Powell adopted up via pronouncing “the method of having inflation sustainably down to two% has a protracted approach to pass,” house developers, auto producers and debtors had been hit with some other spell of queasiness because the 10-year Treasury yield jumped to 4.5%, the absolute best stage since 2007. The common new 30-year fixed-rate loan is recently sitting at 7.4%, the absolute best since President Invoice Clinton used to be in workplace.

A detailed studying of the September Federal Open Marketplace Committee transcripts issues to the overall conclusion that whilst Fed committee contributors now view charges as being at or very close to their cyclical top, in addition they consider the in a single day fee will stay plateaued above 4% neatly into 2025.

Boston Fed President Collins mentioned, “I be expecting charges will have to stick upper, and for longer, than earlier projections had recommended, and additional tightening is under no circumstances off the desk.”

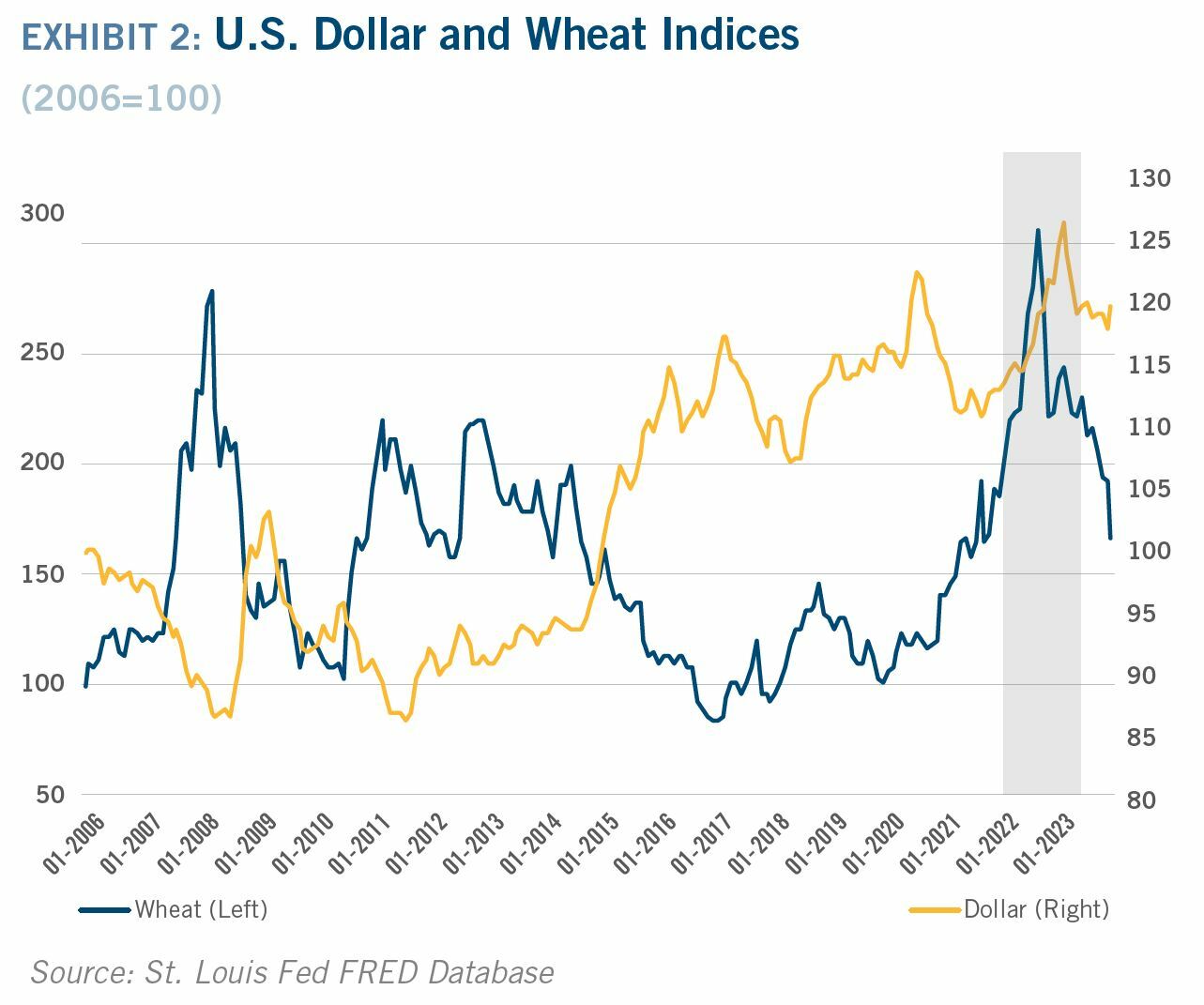

Whilst the United States financial system is outperforming expectancies, the remainder of the arena – Europe and China particularly – has fallen some distance in need of them. Due to the United States now being the arena’s financial “strongman” and our rates of interest trending “upper for longer,” the greenback has gotten more potent than somebody had up to now anticipated (Showcase 1).

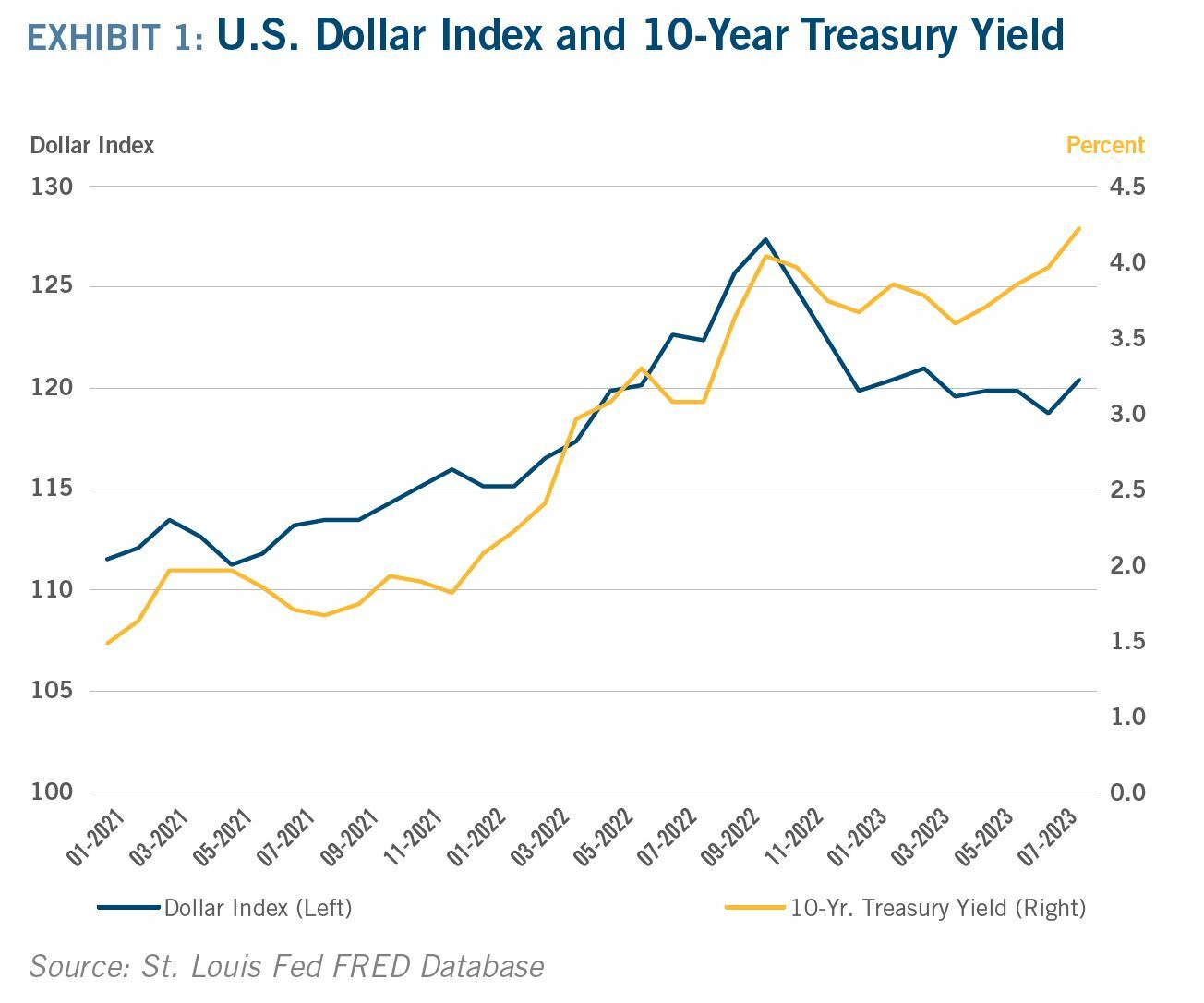

The extremely strange geopolitical/financial occasions throughout the 2020-2022 time-frame (pandemic shutdowns, provide chain chaos, rampant inflation, the Ukraine invasion, and simultaneous central financial institution tightening) resulted within the anomalous historical scenario the place commodity costs and the greenback had been each shifting upward in tandem. However the ones occasions at the moment are fading as marketplace drivers, and in our view, the historical elementary inverse dating between the wide array of commodities and the greenback has returned largely.

The worldwide wheat marketplace illustrates this example obviously (Showcase 2). Beginning on July 24, Chicago wheat futures fell for 9 instantly weeks whilst ICE greenback index futures rose for 9 instantly weeks. That’s not a twist of fate however a go back to normality: For the 20-year length previous to COVID, the straightforward correlation between the per 30 days greenback index and per 30 days wheat costs is -0.77, the place -1.0 represents a really perfect 1:1 inverse dating. The petroleum marketplace recently stays an outlier alternatively, with costs nonetheless emerging amid OPEC+ and Saudi manufacturing cutbacks, sanctions on Russian oil, and declining investments via the most important oil corporations.

Nearly all of global transactions are nonetheless carried out in greenbacks, and a sturdy greenback makes US exports dearer and imports less expensive – either one of which disproportionally harm the spine of the agricultural financial system: agriculture, sturdy items production, mining, and wooded area merchandise. Mixed with slower international financial enlargement, it’s a double whammy – our export consumers can’t come up with the money for to purchase US merchandise.