Crimson meat has misplaced proportion to chicken, comfort merchandise

Longer term, crimson meat has misplaced proportion to chicken and comfort merchandise, in keeping with a up to date AHDB marketplace document. Consistent with the Defra Circle of relatives Meals Survey, UK shoppers have diminished their blended family intake of pork, pigmeat and sheep meat by way of virtually 62% from 1980 to 2022, while rooster meat received proportion.

In 1980, overall pigmeat used to be essentially the most ate up protein, adopted by way of pork, lamb, rooster and fish. As client life and personal tastes have advanced through the years, the proportion of proteins has shifted considerably.

Pork skilled essentially the most scale back, in particular during the 1990’s, coinciding with BSE and Foot and Mouth illness. Intake shifted from 14.5kg according to capita once a year in 1980, to five.0kg in 2022. Alternatively, an expanding quantity of meat fell below able foods, pies, spreads and canned merchandise. This makes up for one of the most pork shortfall, providing comfort and price credentials.

In addition to the usage of other cuts of meat, each decreasing intake and buying and selling down by way of protein sort were key methods for shoppers to save lots of on their grocery prices.

Since our client tracker analysis started in affiliation with YouGov in 2015, value has been a key issue regarded as when opting for meat, with most up-to-date analysis indicating value is a very powerful issue for 78% of shoppers (AHDB/YouGov, Nov 2023).

Lamb intake has been declining since 1980, when volumes matched rooster. Hen has since grow to be the most affordable protein (Kantar), cuts equivalent to rooster breast are reported by way of shoppers to be simple to prepare dinner with, above that of crimson meat merchandise (AHDB/YouGov, November 2023) *. The decline for pigmeat seems to be much less prevalent, however from 1980 to 2022, 8.2kg much less used to be ate up once a year according to capita (Defra circle of relatives meals survey, 2023).

Well being components give a contribution fairly to those adjustments in consuming conduct, with shoppers much more likely to understand rooster and fish as essential to a nutritious diet, much less fatty, and much more likely to be eaten of their family than crimson meat (AHDB/YouGov, July 2015 to November 2023).

In relation to protein proportion out-of-home, a an identical tale can also be advised for retail. Crimson meats have observed sluggish decline since 2001, with poultry gaining quantity (Defra out-of-home estimates, 2023).

Extra not too long ago, in-home intake declines

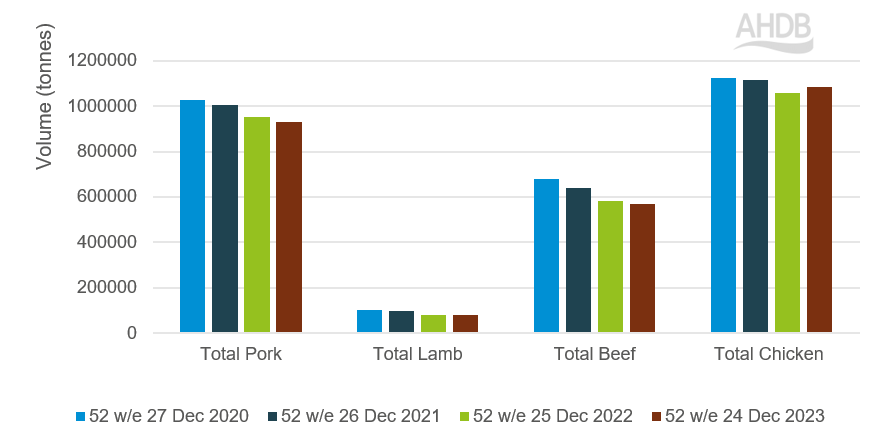

When having a look at newer developments, retail information displays that overall volumes for pork, red meat and lamb bought have all skilled declines during the last 4 years. Hen noticed enlargement of two.4% over the 52 w/e 24 December 2023, although 2022 ranges had been not up to the former two years (Kantar).

Retail quantity purchased over 52 w/e length

Supply: Kantar, volumes bought 52 w/e 24 December 2023

Analysis performed by way of AHDB with YouGov signifies that meat reducers have scale back because of animal welfare, the surroundings, and well being causes, however a dominating reason why for chopping again on meat intake is value (AHDB/YouGov, November 2023).

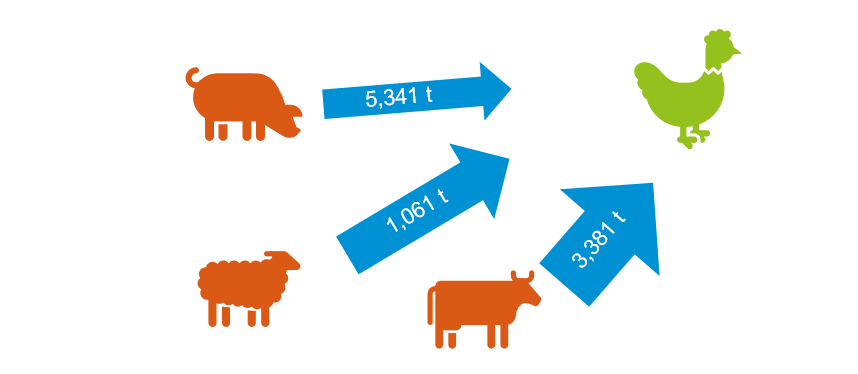

Over 2023, switching information explains that there were really extensive actions in opposition to rooster, negatively impacting all different proteins (52 w/e 24 December 2023)**. Hen can also be regarded as by way of shoppers as essentially the most flexible meat (AHDB/YouGov, November 2023), at the side of interesting to people who are value delicate, with moderate costs paid during the last two years being persistently round £1/kg not up to red meat (Kantar).

General quantity switching between proteins

Supply: Kantar, Switching precise quantity (000kg) 52w/e 24 December 2023

Dimension of visuals offers a sign of the weighting and course of quantity actions between proteins

Crimson meat positive aspects out of domestic reputation

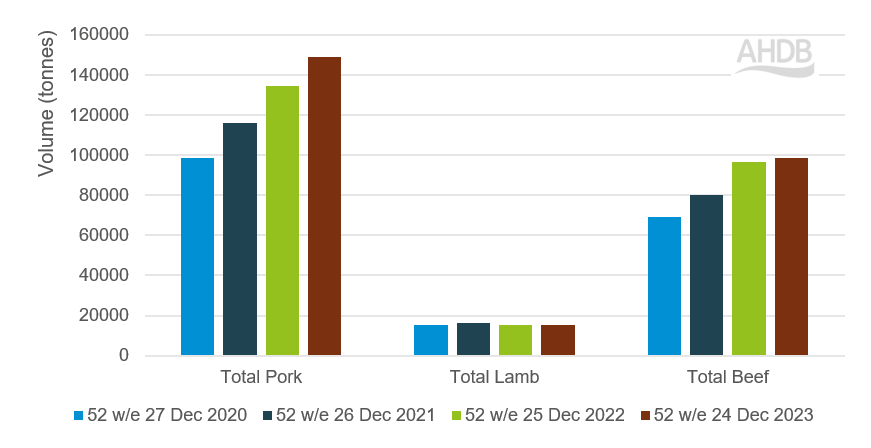

Contrasting the drop of call for in retail, crimson meat efficiency within the out-of-home marketplace has observed greater call for, but it surely has no longer but recovered to pre-covid ranges of intake.

Foodservice quantity purchased, in comparison over 52 w/e classes

Supply: Kantar, Foodservice – AHDB estimates of Kantar OOH

Contemporary developments point out that customers are on the lookout for the ones out-of-home meal events, however to succeed in this inside of their price range are buying and selling down channel to succeed in this. Alternatively, costlier meal events are nonetheless being indulged in, simply at a decrease frequency. In consequence, volumes of pork, lamb and red meat have all observed year-on-year will increase (52 w/e 24 December 2023, Kantar Out of House).

Alternatives for crimson meat

Following quite a lot of demanding situations, customers are nonetheless reported to be suffering with their family finance. With grocery value inflation now at its lowest since March 2022, can we begin to see higher uplift in crimson meat gross sales?

The AHDB 2024 Agri marketplace outlooks predicted a 1% home building up in quantity for pork however declines of -2% for each lamb and red meat volumes.

The primary quarter of 2024 has skilled company call for for lamb, and prime costs at farmgate degree. With upcoming spiritual gala’s, lamb is predicted to be the protein of selection.

Whilst value is obviously the most important influencing issue at the present, we look ahead to that reputational subjects round welfare, setting and well being will develop in significance to shoppers as client self belief returns. In consequence, it is very important deal with those reputational spaces in an effort to affect acquire intent for crimson meat merchandise, offering reassurance and self belief for customers buying crimson meat.