The EU beef marketplace is appearing welcome indicators of stabilising after plummeting because the summer season and hanging drive on the United Kingdom marketplace within the type of reasonable imports.

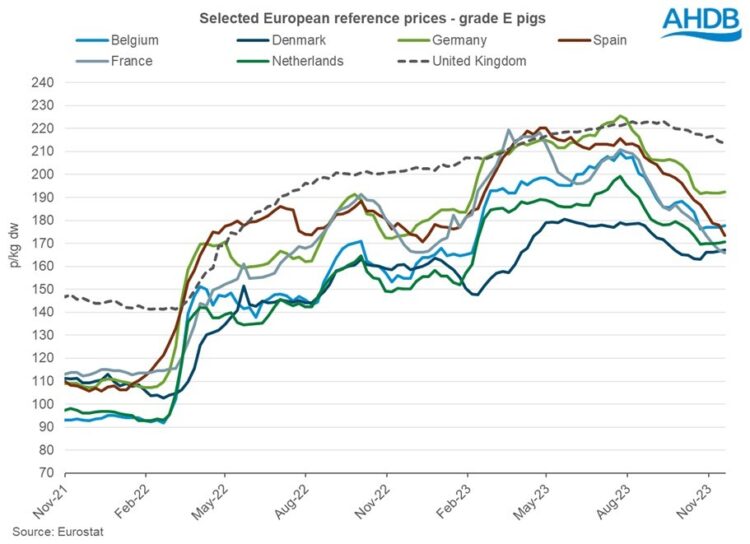

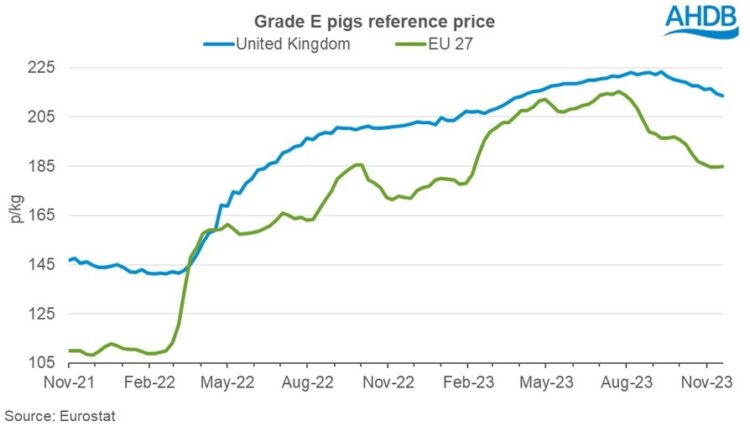

The EU reference pig value has persevered to fall all over Q3 however display some tentative indicators of stabilising, recently sitting at 184.93p/g for the w/e November 19, having slightly moved for the previous 3 weeks.

Call for each within the EU and globally has been easing all over 2023, leading to a decline within the pig value of slightly below 31p from the height of 215.45p/kg July this yr. The Ecu Fee is forecasting little trade within the present downward development observed in EU pig costs.

However the EU reasonable value has declined by way of simply over 2p during the last month, a extra subdued decline than prior to now observed, with some key manufacturers recoding minor value will increase in the latest weeks.

This general downward development in costs has been pushed by way of the huge drops skilled in Spain (-13p) and France (-11p). Alternatively, costs in different key areas had been extra strong in contemporary weeks, with Germany, the Netherlands and Belgium seeing costs build up by way of round 1p in the most recent four-week duration, AHDB analyst Ella Roberts mentioned.

Denmark has observed a worth build up of virtually 4p, then again, tendencies display persistently decrease costs in Denmark. It will have to be recognised that throughout the important thing manufacturers costs do stay increased above the ones observed in 2022, Ms Roberts added.

The United Kingdom value recently sits at 213.69p/kg for the w/e 19 November 2023, simply in need of 29p above the typical EU value.

The United Kingdom value recently sits at 213.69p/kg for the w/e 19 November 2023, simply in need of 29p above the typical EU value.

Because of marketplace drive following the drop in EU costs, UK pig costs have additionally been in decline for the final couple of months, albeit at a steadier charge than the ones observed at the continent. For the w/e the November 19 2023, the United Kingdom reference value used to be simply 9.54p not up to the cost top observed in w/e September 10.

Manufacturing

Manufacturing ranges for 2023 (as much as July) have persevered to fall quick in comparison to 2022, with tight provide reported among key EU pigmeat manufacturers.

There used to be an general decline of 8.2%, with the most important declines observed in key pigmeat generating international locations similar to Germany (-9%), Denmark (-21%), and Spain (-5%). This prone to had been pushed by way of an general aid in EU pig slaughter observed in 2023 (as much as July) of 8.5%, Ms Roberts added.

Prime enter value during the last two years have eroded margins in EU beef generating international locations, leading to many opting to depart the field and a decline in pig numbers and beef manufacturing. Regardless of a small easing in enter prices, the price of manufacturing stays prime for beef manufacturers all over the EU, in particular power and feed element costs.

“Alternatively, with feed costs slowly easing in Europe, manufacturing charges are prone to see some restoration in opposition to the tip of 2023 and into 2024, in step with the Ecu fee’s newest forecast,” Ms Roberts mentioned..

Exports

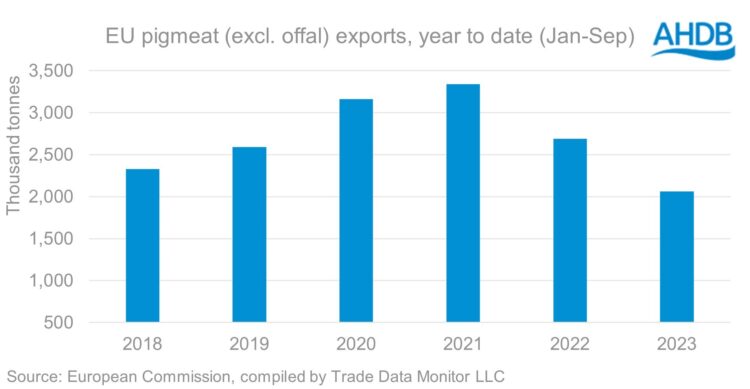

General EU exports of pigmeat (except for offal) have declined year-on-year, recently sitting at 2.06 Mt for the yr so far (January-September). That is the bottom quantity since 2015 and pushed by way of lowered product availability because of declining manufacturing.

Any other restricting issue on EU export alternatives has, till not too long ago, been pricing, Ms Roberts added. It’s reported by way of the EU fee that because of better price cutting war at the international marketplace EU manufacturers of have misplaced quantity percentage in key markets together with Japan, Australia, and the Philippines. Volumes shipped to China have fallen 27% and at the moment are very similar to ranges observed in 2018.

The United Kingdom stays the most important importer of EU pigmeat (except for offal) with a 28% marketplace percentage on quantity and is the one key importer to extend their import volumes in 2023, by way of a marginal 5,900t (1%). UK intake of beef thru foodservice is rising yr on yr most likely contributing to the rise, paired along decrease EU pricing in comparison to UK product.

EU exports of pigmeat are estimated to finish the yr down 16% in comparison to 2022. Alternatively, if pig costs proceed to say no, there could also be room for development in 2024.