Wholesale beef costs proceed to transport upper as some consumers were stuck quick. A lot of the new building up in value is because of upper abdominal costs however loin and ham costs have observed a notable seasonal building up.

Steiner and Corporate produces the Benefit Maximizer document on behalf of Nationwide Beef Board in accordance with data we consider is correct and dependable. On the other hand neither NPB nor Steiner and Corporate warrants or promises the accuracy of or accepts any legal responsibility for the information, critiques or suggestions expressed.

Highlights

- Wholesale beef costs proceed to transport upper as some consumers were stuck quick. A lot of the new building up in value is because of upper abdominal costs however loin and ham costs have observed a notable seasonal building up.

- Hog slaughter used to be upper than expected as packers have loved upper margins and glance to fill orders from shoppers which are quick product. Hog carcass weights are trending down, suggesting manufacturers stay present. This will have to proceed to underpin hog/beef costs within the very close to time period, however expectancies are for costs to ease decrease as provide continues to extend within the fall.

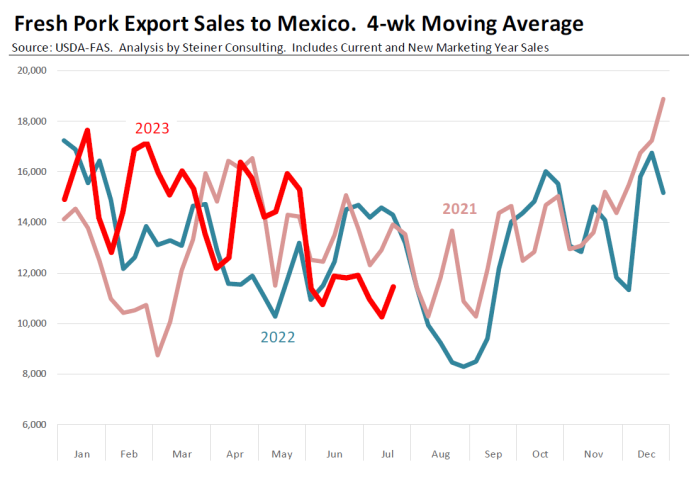

- Ham costs pulled again final week however with giant gross sales reported to Mexico that can be quick lived.

- Decrease retail costs and customers buying and selling down have supported loin gross sales up to now. Loin costs are anticipated to be decrease within the fall on upper provide.

Complete Record

Beef Cutout Climbs On Seasonal Call for, Quick Purchased Patrons, Lack Of Frozen Provide

During the last two months, the price of the beef cutout has larger because of upper costs for bellies, hams, and contemporary beef. A few of this building up could also be attributed to seasonal components similar to decrease provides and larger call for for bacon and contemporary beef. On the other hand, there also are indications that consumers could have misjudged the placement by means of having not up to standard stock and speculating on a possible call for have an effect on from the implementation of Prop 12.

Right through this two-month length, the beef cutout has risen by means of about $32 consistent with hundredweight (+40%), with 70% of that acquire attributed to better abdominal costs. The worth of the abdominal primal has surged to $214 consistent with hundredweight, which is a outstanding 200% building up in comparison to two months in the past. Different beef costs have additionally risen, with loins up by means of 18% and hams up by means of 30%.

Futures these days expect a vital decline from the present value ranges heading into the autumn. The unfold between the October contract and the present CME index signifies seasonal components are at play, simply as they have been in June and July. Hog slaughter numbers were expanding, and by means of early October, weekly hog slaughter is predicted to upward push by means of 8.5%. Moreover, the common weight of barrow and gilt carcasses is predicted to climb by means of 2.8% in the similar length, leading to an approximate 10% swing in beef provides from present ranges.

Regardless of the predicted shifts in provide, there stay a number of unanswered questions on call for. Bellies play a vital function, however hams are an important for the autumn marketplace. The call for for ham primal is intently tied to home vacation call for and exports, specifically to Mexico. Gross sales to Mexico within the spring supported ham values, however the contemporary prime costs could have impacted gross sales in contemporary weeks. On the other hand, it kind of feels that export consumers took good thing about the associated fee drop to position extra orders, suggesting that ham exports will proceed to be neatly supported heading into the autumn.

Referring to home call for, it’s believed that Prop 12 is not going to have as vital an have an effect on on hams as it would on different beef pieces like bellies, loins, and butts. Cooked hams have turn out to be extra not unusual for vacations, and cooked ham gross sales in California don’t wish to be Prop 12 compliant. Additionally, present stock ranges don’t seem to be overly burdensome, and extra provide might be required to satisfy fall call for.

Taking into account most of these components, the futures marketplace is these days pricing a $90 ham marketplace for October. That is extra conservative in comparison to final yr’s top of $110 for ham values, however it’s nonetheless observed as a cheap outlook for the object at the present.

Beef Chilly Garage Provide

In contemporary weeks, there was a large number of dialogue about stock construction forward of Prop 12, however the information does now not appear to reinforce this perception. In reality, beef stock depletion in June used to be better than in earlier years. Considerations about Prop 12 eligibility and better costs may have contributed to this example.

By way of the tip of June, the whole quantity of beef in chilly garage used to be 490.2 million kilos, which is 9.1% not up to the former yr and six.5% not up to the five-year moderate. The inventories skilled a vital decline of seven.8% in comparison to the former month, whilst the common decline during the last 5 years used to be 3.9%.

Generally, ham inventories building up in June, however final month used to be an exception, with inventories best relatively upper than in Would possibly and now 1.2% not up to the former yr. This may well be observed as a favorable signal for ham values within the 3rd quarter. However, abdominal inventories declined by means of 14.5% in comparison to the former month. Even if the stock drawdown in June averaged 9% during the last 5 years, abdominal inventories began from a far upper stage and are nonetheless about 33% upper than a yr in the past. Regardless of this, the bigger inventories don’t seem to be an issue these days as those that personal the provision are most probably taking a look to reinforce California call for within the coming months.

Beef ribs stock noticed a pointy decline as customers took good thing about the associated fee building up and cashed out in their positions. By way of the tip of June, general rib stock used to be 62.7 million kilos, appearing a 42% lower in comparison to the former yr.

Beef trim stock additionally skilled a decline of 12% in comparison to the former month, which is upper than the common 5% drawdown noticed within the final 5 years. The decrease inventories, mixed with the seasonal decline in provide all the way through July, led to considerably upper beef trim costs lately.

In contrast to pork, the USDA does now not supply a regional breakdown of stock numbers. On the other hand, export remarkable gross sales have larger by means of double digits from a yr in the past, indicating that extra beef is staged for export than final yr. This signifies that the to be had beef stock for home use could also be even not up to the total numbers counsel.

Value Chart

Forecasts