“My mom dreamt of operating a series of retail outlets. This used to be within the eighties, when get admission to to capital used to be scarce, and operating just a unmarried retailer used to be conceivable. I do assume that at a unique time, in a unique position, she may have constructed a miles better franchise,” says Hardika Shah, the founder and CEO of Kinara Capital.

This concept remained in Hardika’s thoughts all through her 20s and 30s as she navigated lifestyles and located her footing as a control advisor in Silicon Valley. Rising up in Mumbai in a center magnificence circle of relatives, her lifestyles and upbringing used to be some distance from unusual.

Whilst her mom owned a small trade, her father, who’s blind, taught at a women folk’s school. They challenged societal conditioning and standard roles, and battled in opposition to all odds to provide their two women the entirety they had to fulfil their desires — even supposing that concerned promoting their suburban Mumbai house and transferring to a smaller condo to fund Hardika’s undergraduate schooling in america.

But even so supporting his personal daughters, Hardika’s father additionally supplied financial assist to blind faculties through sponsoring braille printers. The idea that of giving again and its social have an effect on used to be drilled into her. As an grownup, when she came upon about social entrepreneurship as an grownup, she discovered the lacking puzzle piece.

Then after 23 years of being in america, she returned to India in 2011 to release Kinara Capital. It supplies unsecured loans to Micro, Small and Medium-sized Enterprises (MSMEs) inside 24-48 hours and has helped over 1,25,000 trade house owners thus far. Her imaginative and prescient used to be to offer capital to small trade house owners in order that everybody may just enlarge their ventures.

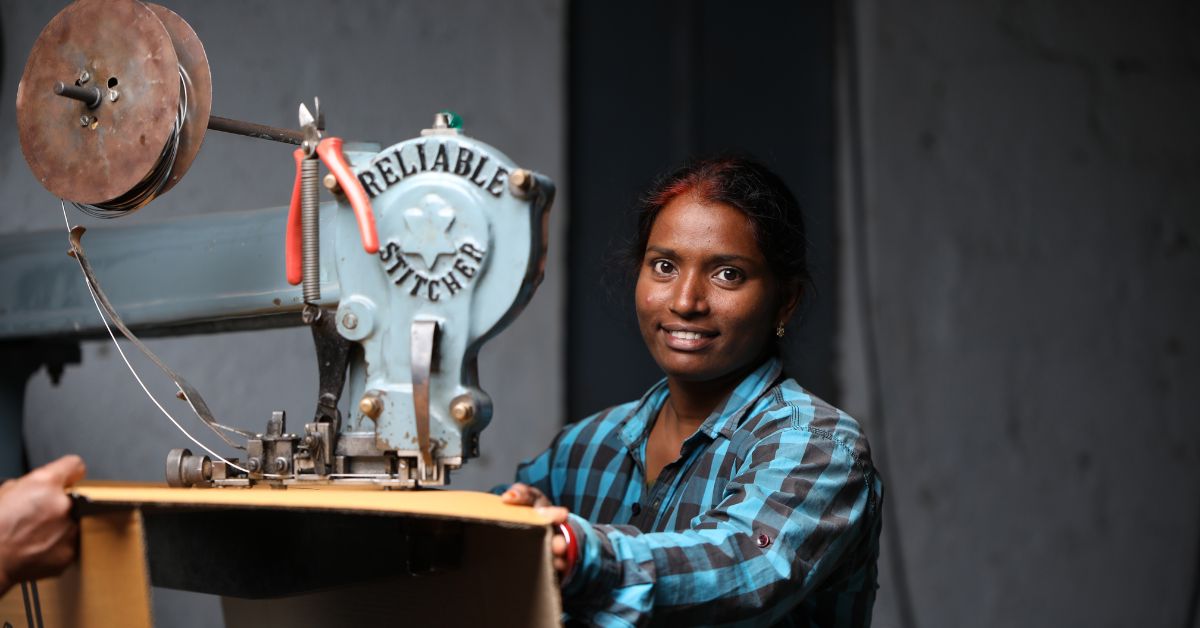

Her trade has a unique center of attention on women folk, be it of their non-public group, the place nearly 60 p.c most sensible control are women folk, or via their ‘HerVikas’ programme, that gives discounted trade loans for women-owned MSMEs to assist them take their companies to the following stage.

Right here’s how Hardika constructed this trade which has dispensed over Rs 6,760 crores thus far.

Seeds of social entrepreneurship

After coming into junior school, Hardika wasn’t too satisfied about the truth that she may just handiest make a selection one matter to main in. She used to be occupied with more than one topics, and wanted for a path that will permit her that liberty.

All through the similar time, her father who taught political science, would common the American library in Mumbai. He used to take his daughters there every now and then. Right here, Hardika got here around the classes taught in American schools.

“I found out liberal arts, the place you’ll be able to learn about quite a lot of topics and nonetheless get a graduate stage. It used to be simply what I sought after and once I learnt about it, it changed into my function to pursue this path in america,” Hardika tells The Higher India.

Hardika’s upbringing used to be non-traditional in numerous techniques. Her mom have been ostracised through her circle of relatives for her collection of spouse and confronted many struggles, but the circle of relatives selected to be at liberty and reside a lifestyles stuffed with love, happiness and desires.

Along with her unconventional upbringing, her folks allowed her and her sister to dream large, paintings all through junior school, have other lifestyles stories and most significantly, cross out of the country for an undergraduate stage, which used to be reasonably extraordinary then.

Hardika labored summers after completing Elegance 10, the place her first activity used to be operating as a marketplace researcher for shampoo fragrances. After that, she labored as a font fashion designer.

“Simply earlier than going to university, I needed to create fonts for Indian languages at the laptop. Since they sought after any person who may just deal with computer systems and had an inventive thoughts, I were given the activity and labored there for 3 months,” provides the Bengaluru resident.

Whilst she controlled her pocket cash, elevating finances for her undergraduate stage in america used to be no imply feat. Hardika stocks that she spent nearly 18 months getting ready for the entire other tests, however most commonly simply looking for avenues for her price range.

“It used to be in point of fact no longer affordable to visit america within the 80s. Liberal arts schools then gave some monetary assist, nevertheless it used to be very restricted,” she provides.

Her folks got here to her rescue and offered their area to fund her schooling, transferring to a smaller rented condo.

The then teen entered Knox School in Illinois, USA, the place she pursued a BA in laptop science. The stage gave her the chance to check the entirety from international historical past, anthropology, economics to symbolic good judgment with the exception of typical topics.

After her undergraduate stage, she labored at Accenture in Chicago, Singapore, Sydney, after which again once more in america in San Francisco in monetary products and services, generation and consulting for just about 19 years.

Her paintings additionally introduced her to India nearly 10 years later, within the submit liberalisation generation. For any person operating within the Silicon Valley, she discovered a stark distinction and a large hole in accessibility that had to be stuffed.

She then made up our minds to spend her weekends each summer time as a social have an effect on trade mentor.

“I might spend time with marketers the world over, together with India, and assist them expand their trade concepts, fashions and likewise face similar demanding situations,” she provides.

She adopted this mentorship up with an government MBA on the College of California, Berkeley, Haas College of Industry. She spotted a trend within the demanding situations confronted through other folks in India, and one routine problem emerged — get admission to to capital.

Discovering the lacking piece of the puzzle

“I spent 3 months in India with bankers, techies, and self-help teams to grasp the place the distance in get admission to to capital lay earlier than beginning Kinara. Finally, micro finance and Non-Banking Monetary Corporations (NBFCs) had expanded rather well within the nation through then, and have been in a position to satisfy the wishes of other folks in rural India,” provides Hardika.

The most important credit score hole, the advisor discovered, used to be within the ‘lacking heart’, of other folks wanting loans within the vary of Rs 1 lakh to Rs 10 lakh.

Assembly those small trade house owners, SHGs, women folk marketers, ended in a deja vu second.

Didn’t her mom face the similar downside 25 years again? Why used to be no person in a position to mend this credit score hole for this source of revenue crew, puzzled Hardika.

Made up our minds to make certain that no person must have unfulfilled desires because of loss of capital like her mom, the 53-year-old made up our minds to unravel the issue. Offering collateral used to be a significant issue on this bracket, which she solved via Kinara Capital through offering unsecured loans.

“The largest hole throughout tier 1, 2 and three towns used to be unsecured trade lending, as lots of the debtors don’t have land or belongings to provide as collateral. I made up our minds to concentrate on other folks in those towns who’re at the edge of inclusion,” she provides.

What units Kinara Capital aside?

With Kinara Capital’s release in 2011, Hardika raised finances from social have an effect on funding finances like Michael & Susan Dell Basis, Patamar Capital, Gaja Capital, British World Funding (BII) and extra.

Kinara vets its shoppers with the assistance of AI and Device finding out, with the remaining mile supply carried out through its officials. They’ve 133 branches throughout 100 towns within the nation, and feature dispensed over 1,25,000 loans thus far, with property underneath control of over Rs 3,170 crores.

The rates of interest vary from 20 to 32 p.c on a lowering steadiness foundation, with the common tenure starting from 36 to 38 months.

“Our underwriting is 95 p.c virtual and 5 p.c bodily, via our gross sales officials on flooring. It’s a combined tech style with a bodily department community the place lots of the underwriting and collections are carried out on-line,” provides the social entrepreneur.

She says that 20 p.c in their per thirty days disbursements cross to current shoppers, serving to them develop their companies.

One among Kinara’s purchasers, Divya explains how the corporate’s coverage helped her.

She runs an organization referred to as Brookwoods Applied sciences in Bengaluru, and sought after to take a mortgage for her trade. Since her trade used to be not up to a yr outdated, maximum lenders refused.

“Maximum NBFCs and banks lend after a trade completes 3 years of operations. Kinara didn’t have such prerequisites and gave us a mortgage, which helped us immensely. All of the procedure used to be streamlined and on-line. An officer from their group got here for inspection and sanctioned the mortgage in no time,” she says.

Divya has been in a position to develop her corporate to a turnover of Rs 3 crores in 3 years.

Via all this, Hardika states that Kinara is winning nowadays and rearing to succeed in extra trade house owners.

The cause of Kinara’s lifestyles started thank you to a lady entrepreneur, and therefore it’s a no brainer that their HerVikas programme, which gives reductions to ladies marketers to spice up their companies, stays a success.

The programme has dispensed Rs 700 crores prior to now 5 years, providing a 1 p.c passion cut price, 60 day reimbursement vacation, 50 aid in processing charges.

With a three.5 p.c to 4 p.c Non-Acting Asset (NPA) price, Hardika needs to succeed in extra MSMEs within the coming years, hoping to succeed in 2 lakh further shoppers within the subsequent 3 years.

“There’s a perception that unsecured trade lending is dangerous and shoppers will disappear together with your cash. Our numbers turn out that that is thus far clear of the reality. Shoppers are thankful to have get admission to to capital and pay off on time. In addition they use the cash judiciously to develop their companies,” she says.

Going ahead, she hopes to make stronger extra jobs through attaining extra small companies. She doesn’t need any trade proprietor with possible to lose out as a result of loss of get admission to to capital.

“My mom may have been a large franchise proprietor had Kinara been provide then. Let no different entrepreneur lose out on their possible because of loss of get admission to to capital. Let there be no regrets, ifs and buts,” says Hardika.

Edited through Padmashree Pande, Pictures Courtesy Kinara Capital