FCC addresses distinctive sides 3 sub-sectors

The poultry sector has finished a exceptional task in addressing the demanding situations that experience come from outbreaks of avian influenza in recent times, writes Graeme Crosbie of Farm Credit score Canada (FCC). Despite the fact that the virus continues to be provide, the field can confidently restrict the effort and time required to reduce illness unfold and relatively center of attention efforts only on manufacturing to satisfy evolving call for for rooster, eggs, and turkey. We cope with the original sides of every of those 3 subsectors underneath.

Weaker broiler costs pushed by means of decrease feed prices

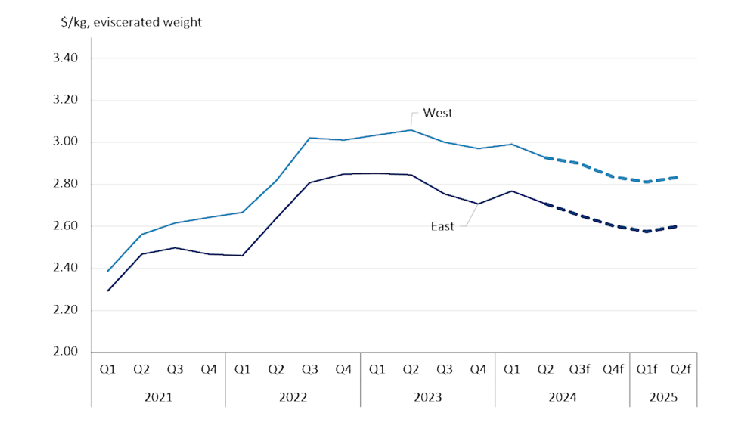

Broiler costs peaked in 2023 and feature slowly retreated since. We’re forecasting this decline to proceed in the second one part of 2024 ahead of stabilizing in spring 2025 (Determine 1).

Determine 1: Broiler costs, noticed and forecast

Resources: Statistics Canada, FCC Economics

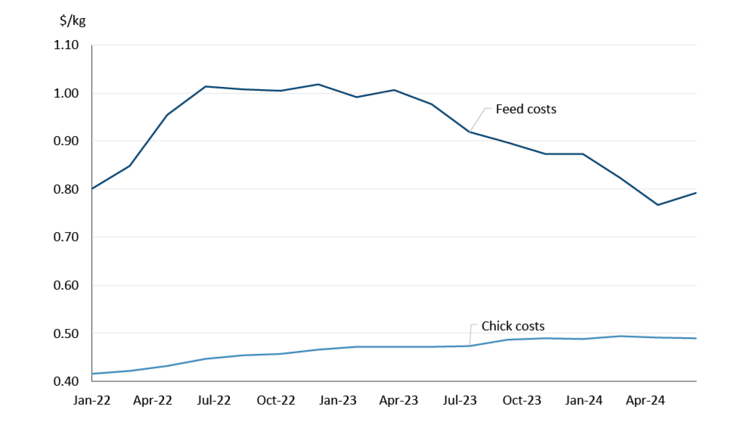

The decline in farm gate costs displays easing feed prices. In Ontario, the feed price part of the farm gate minimal are living value rose to over $1.00/kg in the summertime of 2022 however started falling in the second one part of 2023 in keeping with decrease grain and oilseed costs. Feed costs are down -22% relative to their top within the A-180 quota length (December 2022 – February 2023). Chick prices, alternatively, had been constantly expanding during the last two and a part years, partly a results of the provision scarcity led to by means of the avian flu (Determine 2).

Determine 2: Ontario feed and chick prices by means of quota length

Supply: Rooster Farmers of Ontario

Broiler manufacturing enlargement amid excessive inventories, imports

Making an allowance for the demanding situations led to by means of avian flu, general broiler manufacturing in 2023 used to be unusually robust (3.3% enlargement). For 2024, the USDA is forecasting manufacturing enlargement to sluggish to one.7% which, if learned, will be the lowest fee of enlargement since 2014 (with the exception of 2020 and the onset of the pandemic).

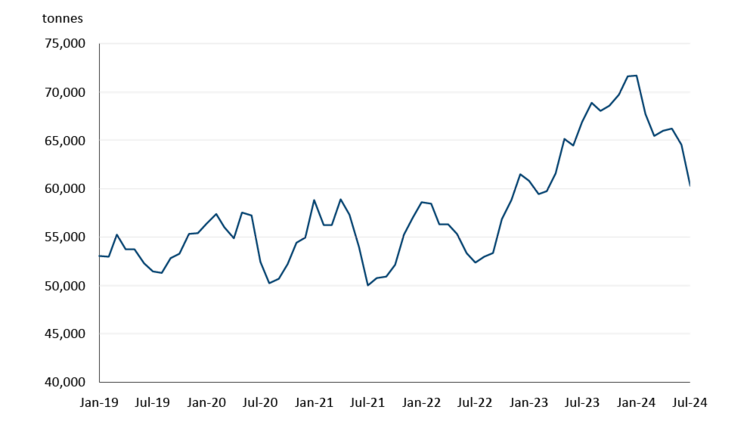

The Rooster Farmers of Ontario 2023 Annual Record famous that “record-high frozen inventories led to conservative [quota] allocations for the primary 4 months of 2024.” With decrease manufacturing at the beginning of the yr, call for used to be met with rooster inventories which have been drawn down -16% from January to July (Determine 3). Shares of frozen rooster have been traditionally excessive heading into 2024 and are most often drawn down within the spring and summer season months, even though particularly ultimate summer season the other took place and stock ranges surged. A go back to extra ancient ranges of frozen shares bodes neatly for manufacturing within the latter part of the yr and into 2025.

Determine 3: Shares of frozen rooster down -16% since January

Supply: Statistics Canada

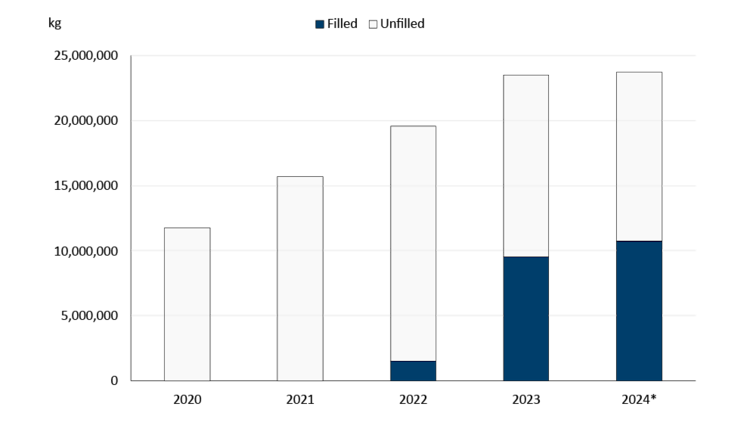

Uncertainty round import volumes issues a super deal. Quite a lot of industry agreements permit for a undeniable quantity of rooster to be imported tariff-free (i.e., the negotiated restrict) even though in truth it’s not all the time the case that the imports happen. As an example, in 2023 and below Complete and Innovative Trans-Pacific Partnership (CPTPP), handiest 40% of the negotiated restrict used to be if truth be told imported. Then again, to this point in 2024, imports have amounted to 45% of the negotiated restrict with part of the yr last (Determine 4). The surge in imports below CPTPP is in large part the results of imports from Chile who joined the settlement in February 2023. Business information presentations Chile is now the 3rd biggest supply of imported rooster at the back of america and Brazil.

Determine 4: CPTPP imports of rooster and rooster merchandise, 2020 to 2024

*2024 worth is year-to-date thru to and together with June.

Supply: International Affairs Canada

Negotiated limits of rooster imports are actually successfully capped. As you’ll see in Determine 4, the negotiated restrict larger by means of 3.9 million kgs every yr for the reason that CPTPP’s implementation however in 2024 the rise used to be handiest 0.2 million kgs as the sped up phase-in length concluded. Negotiated restrict will increase can be capped at 1% (roughly 0.2 million kgs) for every of the following 12 years. It will have to be famous that during 2023, rooster imports below CPTPP amounted to roughly 0.7% of general manufacturing for the yr.

General call for for rooster is up to this point in 2024 however underneath possible. Tighter family budgets have restricted client purchases of rooster relative to personal tastes. June used to be the primary month since 2022 that rooster value will increase have been less than red meat and beef costs; will have to this development proceed, it is going to be additional supportive of call for.

Egg manufacturing attaining new listing degree

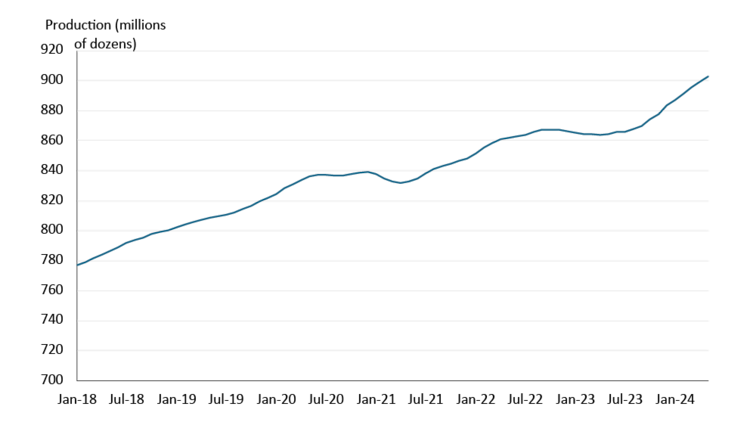

The farm gate value of eggs larger in February and is projected to stay strong within the latter part of 2024. Egg manufacturing has rebounded from decrease manufacturing ranges in 2023 that corresponded with the avian flu outbreak: between June 2023 and Might 2024, 903 million dozen eggs have been produced, the largest 12-month tally on listing (Determine 5). Overall manufacturing prices have edged somewhat decrease to this point in 2024 however nonetheless stay traditionally excessive.

Determine 5: Egg manufacturing again on target, attaining listing highs

Sum of earlier 365 days manufacturing

Supply: Statistics Canada, FCC Economics

The U.S. has taken complete good thing about further tariff-free get entry to for eggs and egg merchandise (e.g., shell eggs, egg powder, and so forth.) for the reason that implementation of the Canada-United States-Mexico Settlement (CUSMA). The negotiated quantity of egg and egg merchandise allowed to go into the rustic has been crammed every yr; certainly, we’re handiest midway thru 2024 and the negotiated restrict of eggs and egg merchandise has already been crammed. Put otherwise, there can be no additional tariff-free imports of egg and egg merchandise from the U.S. and Mexico for the rest of 2024.

Turkey inventories, manufacturing upper – however so is call for

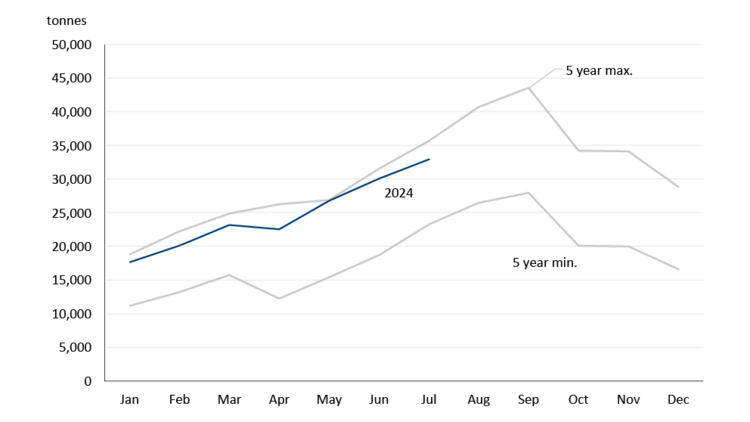

Turkey inventories historically top in September within the lead-up to the North American vacation season ahead of plummeting to seasonal lows in January. Up to now in 2024, frozen turkey inventories are trending just about the per 30 days most ranges observed during the last 5 years (Determine 6).

Determine 6. Turkey frozen shares just about contemporary ancient highs

Resources: Statistics Canada, FCC Economics

In the beginning look that is rather sudden, for the reason that turkey manufacturing fell once a year between 2016 and 2022 (from 183,000 mt to 150,000 mt). Shifts in client personal tastes have ended in a weaker call for for turkey merchandise in recent times. Then again, ultimate yr used to be the primary yr since 2016 there used to be an build up in turkey manufacturing (a 6.1% build up). Call for performed a job right here: 2023 used to be the primary time in just about a decade that consistent with capita intake of turkey larger.

As is the case with broiler costs, turkey farm gate costs larger between 2021 and early 2023 ahead of falling somewhat within the latter part of 2023. Costs declined much more in early 2024 and are forecast to be somewhat decrease in the second one part of 2024 ahead of stabilizing within the first part of 2025.

Base line

Decrease grain and oilseed costs had been a welcome aid to farm animals manufacturers, together with the ones within the poultry sector. Broiler manufacturing enlargement is also decrease this yr however manufacturer margins on a consistent with unit foundation stay wholesome: as of quota length A-187, the margin part of the farm gate value used to be up to date to mirror larger labour, capital, and running bills. Egg manufacturing is at listing highs, whilst turkey manufacturing is also turning the nook after a stretch of decrease call for and manufacturing. Decrease meals inflation will have to beef up call for for poultry merchandise, and the long-term basics for the field are sound.

Used with permission from FCC