In 2023, global beef manufacturing reached 115 million lots carcass similar (tce), an build up of 0.6% in comparison to 2022. This provide expansion is related to traits in China and Brazil, which offset the Ecu lower. World call for fell by way of 3.1% 12 months on 12 months.

In 2024, the outlook depends on the dynamics of the most important manufacturers (China, the Ecu Union, the USA, and Brazil). International manufacturing is predicted to fall reasonably by way of -0.9% year-on-year whilst call for is predicted to be upper. A slight fall in global beef provide is expected, impacted by way of China, with a reasonable restoration in global call for. Ecu gamers should compete with the USA and Brazil amidst geopolitical, sanitary, industrial, regulatory, and social uncertainties.

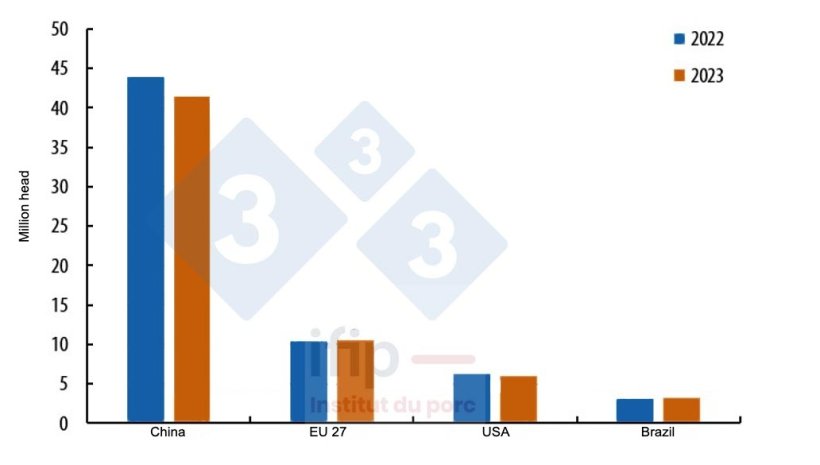

Evolution of the breeding sow herd in the principle global manufacturers on the finish of 2023/2022. Supply: IFIP in line with Eurostat, MoA, and USDA.

Ecu Union

Within the EU-27, the 2023 year-end cattle survey predicts a imaginable finish to decapitalization. In 2023, the Ecu provide fell 7.6% of slaughtered pigs, the similar of 17.3 million pigs. The slaughtering and reducing sector has been suffering from restructuring which has penalties in the marketplace. Those reorganizations will restrict Ecu manufacturing originally of the 12 months. An growth is predicted in the second one part. In 2023, exports fell sharply: gross sales of beef merchandise to 3rd markets diminished by way of 19% in quantity. Along with the drop in Ecu manufacturing and availability for export, very low beef costs at the different aspect of the Atlantic have made U.S. and Brazilian beef extra aggressive the world over. Added to this used to be a foreign money drawback for the EU: the euro’s power towards the greenback and the Brazilian actual penalized Ecu beef exports. In 2024, Ecu exporters are anticipated to have the benefit of marketplace alternatives, in particular in China, however competitiveness demanding situations stay. At the intake aspect, inflation will have to ease.

China

In 2024, Chinese language beef manufacturing is predicted to say no by way of 3%, in line with the USDA, because of difficulties within the home marketplace: African swine fever and PRRS epidemics, and a difficult 2023 for the swine trade. In spite of a promising begin to 2024, China’s financial fragility is hampering home call for, even all the way through nationwide vacations. A big provide within the face of low call for led to costs to fall sharply whilst farms, with prime manufacturing prices, turned into unprofitable. In consequence, the Chinese language swine trade has suffered important financial losses resulting in a discount of the nationwide breeding sow herd to 41 million head by way of the tip of 2023, an annual drop of five.6%.

To counter this adverse development, China’s Ministry of Agriculture introduced a brand new plan to keep watch over home beef manufacturing capability. The Chinese language govt needs to stabilize the collection of breeding sows at 39 million head, adjusting numbers in line with provide and insist. This plan requires larger marketplace and illness surveillance, with strengthened reinforce from public administrations. Imports are anticipated to get well in 2024 to catch up on this drop in provide.

United States

After a troublesome 12 months in 2023 for the U.S. swine trade, a 2.4% restoration in manufacturing is predicted for 2024 in line with the USDA. Provide will have to be stimulated by way of home call for and exports. In spite of the commercial, well being, and political demanding situations, U.S. analysts expect an growth in manufacturing because of larger productiveness and a restoration in call for. Bearing in mind the lower in herds (-3.3% sows in December 2023/22), this USDA outlook turns out constructive. On the other hand, U.S. beef will have to handle its competitiveness within the international marketplace, with expansion potentialities in Central and South The usa.

Brazil

After a excellent 12 months in 2023, manufacturing, exports, and intake are anticipated to extend in 2024. Profiting from a discount in manufacturing prices following the autumn in uncooked subject material costs and a dynamic export marketplace, the Brazilian swine trade continues to prosper because of investments by way of producers. The outlook for Brazil is subsequently excellent, with each home and exterior call for bettering.