Farm animals analyst Jim Wyckoff shared this week’s international pig information

October lean hog futures costs have slumped and hit a six-week low because the bears have won the near-term technical benefit, to indicate extra problem worth power within the close to time period. Essentially, america money hog marketplace has deteriorated. Wholesale red meat costs have grew to become decrease. Carcass values Wednesday at noon fell 96 cents to $107.67 on 141.96 quite a bit. Losses have been popular, regardless that picnics and ribs each noticed positive aspects. That is the bottom quote for wholesale costs for the reason that first week of July. Extra of the similar is most probably within the coming weeks as slaughter charges upward thrust seasonally and client call for is reduced through the looming finish to the grilling and BLT seasons.

Weekly USDA export gross sales for US red meat, pork

Red meat: US web gross sales of 15,100 MT for 2023 have been up 2 % from the former week, however down 13 % from the prior 4-week moderate. Will increase have been basically for South Korea (4,600 MT, together with decreases of 400 MT), China (3,200 MT, together with decreases of 100 MT), Japan (2,700 MT, together with decreases of 300 MT), Mexico (1,600 MT, together with decreases of 100 MT), and Taiwan (700 MT, together with decreases of 100 MT). Overall web gross sales of 100 MT for 2024 have been reported for Japan. Exports of 15,800 MT have been down 2 % from the former week and four % from the prior 4-week moderate. The locations have been basically to South Korea (4,200 MT), Japan (3,500 MT), China (2,800 MT), Mexico (1,600 MT), and Taiwan (1,100 MT).

Red meat: US web gross sales of 28,700 MT for 2023 have been up 29 % from the former week and 36 % from the prior 4-week moderate. Will increase have been basically for Mexico (9,400 MT, together with decreases of 300 MT), Japan (4,900 MT, together with decreases of 200 MT), China (3,500 MT, together with decreases of 100 MT), Canada (3,100 MT, together with decreases of 400 MT), and South Korea (3,000 MT, together with decreases of one,000 MT). Overall web gross sales of two,800 MT for 2024 have been for South Korea. Exports of 28,600 MT have been up 7 % from the former week and 11 % from the prior 4-week moderate. The locations have been basically to Mexico (13,100 MT), China (3,600 MT), Japan (3,300 MT), South Korea (2,400 MT), and Canada (1,700 MT).

Tyson plans to promote China poultry unit

Tyson Meals plans to promote its China poultry industry, Reuters reported, mentioning other people with wisdom of the placement. The corporate has reportedly employed Goldman Sachs to advise at the sale and despatched initial data to possible consumers, together with a lot of non-public fairness corporations. The assets didn’t say why Tyson was once making plans to promote the industry.

Upper Chinese language hog costs anticipated in H2

Chinese language red meat processing massive WH Staff Ltd expects hog costs in China to upward thrust 10% to twenty% in the second one 1/2 of 2023 from the primary six months, supported through more potent call for and smaller provide glut. The pinnacle of WH Staff forecast the median hog worth to achieve about 16 yuan ($2.20) consistent with kilogram (kg) in the second one 1/2 of this yr, up from a median of 15.12 yuan within the first 1/2, however the moderate 2023 worth would nonetheless be considerably less than 2022. WH Staff executives additionally mentioned the new heavy rains and flooding in northern China didn’t impact its manufacturing.

Plant-based meat choices fight to take care of early momentum

Regardless of preliminary robust pastime, the marketplace for plant-based meat choices within the U.S. is dealing with demanding situations in keeping up momentum, in step with a brand new file from CoBank’s Wisdom Alternate. Upper costs in comparison to conventional meat merchandise have ended in a decline in repeat purchases through customers. The fee differential, together with lingering destructive perceptions about style, price, and flexibility, stay stumbling blocks for the plant-based meat class, the file notes.

Plant-based meat gross sales surged in 2020 because of client interest and greater discretionary revenue all over pandemic-induced meals shortages. Then again, not up to 1/2 of those that to begin with attempted plant-based merchandise endured buying them, in step with client analysis company Mintel.

Gross sales of meat choices have regularly diminished since 2021, with a pointy decline prior to now yr. Quantity gross sales dropped through 20.9% for the 52-week length finishing in July 2023, according to information from Circana, a client conduct analysis company.

For the plant-based meat class to regain traction, the file says, diversification of codecs is the most important. Whilst frozen and refrigerated choices nonetheless dominate, shelf-stable sorts have noticed expansion, expanding through 82% in 2022. Those merchandise, equivalent to plant-based variations of tuna, ham, and rooster, be offering comfort and enchantment to a broader target audience.

Top costs have restricted the penetration of plant-based merchandise to higher-income families, usually round 10% of families. To reach wider adoption, in step with the file, the class wishes innovation when it comes to product range and scalability. Well being and environmental issues have pushed pastime, particularly amongst more youthful customers. Then again, addressing worth, comfort, and familiarity can be pivotal for the good fortune of plant-based choices.

GOP senators introduce invoice to forestall EPA’s animal agriculture emissions reporting

Sens. Roger Marshall (R-Kan.) and Deb Fischer (R-Neb.) proposed regulation aimed toward fighting the Environmental Coverage Company (EPA) from requiring cattle and poultry manufacturers to file air emissions coming up from animal waste. The invoice outlines that emissions from animal waste can be exempt from the Emergency Making plans and Group Proper-to-Know Act (EPCRA). Whilst an exemption from the EPCRA was once up to now established via rules, the ag sector has sought to enshrine this exemption into legislation. Sen. Marshall said that this regulation clarifies that low-level cattle emissions, which represent not up to 4% of overall U.S. greenhouse fuel emissions, don’t seem to be data crucial or treasured to first responders. The invoice is supported through 15 different Republican senators and enjoys backing from a lot of agricultural and cattle organizations.

USDA Per month WASDE file for August

LIVESTOCK, POULTRY, AND DAIRY: The forecast for 2023 US crimson meat and poultry manufacturing is lowered from closing month on diminished pork, red meat, and broiler forecasts. Red meat manufacturing is diminished on decrease steer and heifer slaughter and lighter dressed weights even if cow slaughter is greater. Red meat manufacturing displays lighter dressed weights even if slaughter is raised quite. Broiler manufacturing is lowered on decrease anticipated eggs set and endured quite low hatchability.

US red meat manufacturing is unchanged from closing month. Enlargement in broiler manufacturing is slowed with decrease costs anticipated to scale back manufacturer margins. The slower tempo of egg manufacturing expansion in 2023 is predicted to hold into early 2024. Red meat imports for 2023 are adjusted to replicate contemporary industry information however no alternate is made to the forecasts for second-half 2023 or 2024. The meat export forecast is unchanged for 2023. Exports are raised for 2024 from closing month on greater anticipated provides of pork. Red meat imports and exports are adjusted to replicate June information, however no alternate is made to the forecasts for the rest of 2023 or 2024. Broiler exports are lowered for 2023 and 2024 on decrease anticipated manufacturing. Turkey exports are raised on decrease anticipated costs.

The following week’s most probably high-low worth buying and selling levels:

October lean hog futures–$76.00 to $82.00 and with a sideways-lower bias

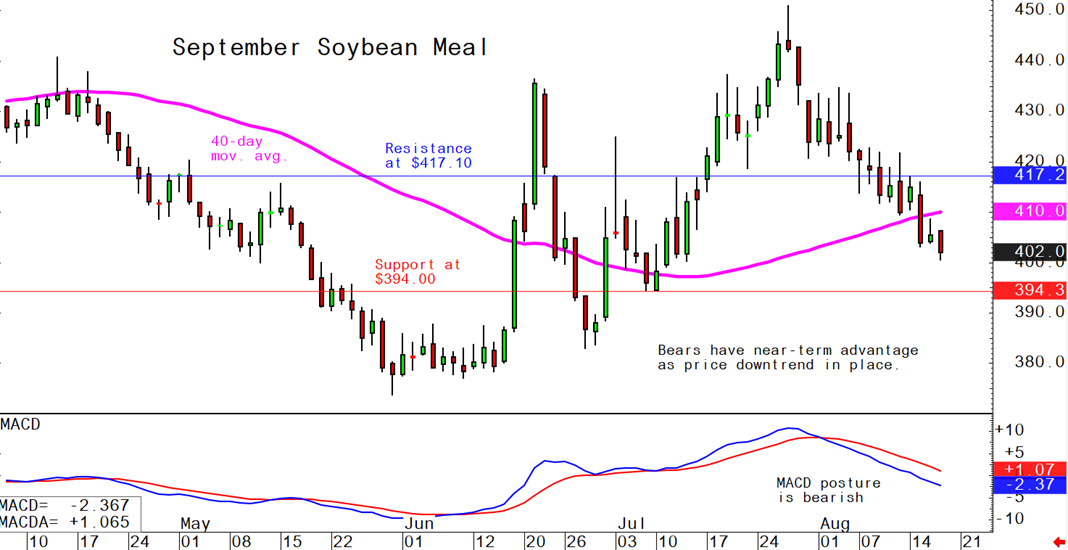

September soybean meal futures–$390.00 to $420.00, and with a sideways-lower bias

December corn futures–$4.70 to $5.10 and a sideways-lower bias

Newest analytical day-to-day charts lean hog, soybean meal and corn futures