Animal protein manufacturing expansion to gradual however proceed, in spite of unfavorable marketplace stipulations

- Animal protein corporations face tightening margins as manufacturing expansion is predicted to proceed, however at a slower tempo.

- Enter prices to ease however manufacturers will want to adapt to structural adjustments in marketplace stipulations, the Outlook forecasts.

- Poultry and aquaculture manufacturing are set for modest expansion, however red meat, red meat and wild catch seafood are prone to contract.

Animal protein manufacturing expansion will gradual as margins stay tight in 2024, with manufacturers and processors desiring to conform to maintain good fortune, in step with Rabobank’s annual World Animal Protein Outlook document.

After 4 years of expansion in animal protein manufacturing globally, 2024 will see the tempo gradual and even decline throughout some species, the specialist meals and agribusiness financial institution predicts.

The shift comes as manufacturers and processors navigate tighter margins because of structural adjustments to marketplace stipulations. Upper manufacturing prices and tighter provides will push animal protein costs up and constrain international intake in 2024.

Enter prices and inflation are prone to fall however will stay at a better stage than pre-pandemic. There also are indicators that buyers are rising used to better costs and, in some markets, keen to pay a top quality top class.

Some marketplace adjustments seem to be everlasting, Rabobank notes. Demographic shifts will see the labour marketplace tighten and lift manufacturing prices, whilst decreased inhabitants expansion will gradual intake.

Somewhere else, there can be power to spend money on upgrading manufacturing methods to serve rising marketplace wishes, meet regulatory necessities and cater to converting client personal tastes round sustainability. Hostile climate stipulations and illness additionally provide demanding situations.

Justin Sherrard, international strategist animal protein at Rabobank, mentioned: “It’s a testomony to the resilience and versatility of businesses alongside animal protein provide chains that they keep growing manufacturing and ship on buyer expectancies, amid such difficult marketplace stipulations. Regardless of a price of residing disaster hanging power on client budget, there is still call for for animal protein, and firms were in a position to triumph over demanding situations, from prime prices to regulatory uncertainty and illness, to capitalise on it.

“For firms to maintain the good fortune of the previous few years, it’s crucial that they adapt to the structural adjustments out there. As an alternative of merely using out the hurricane, animal protein companies want to take inventory in their strengths and get ready to transition their provide chains to working in an atmosphere with prime prices and tight margins.

“Firms must double-down on making improvements to their productiveness, assessment their present portfolios, toughen provide chain partnerships, build up funding in new product construction and alter their pricing methods to navigate the demanding situations of the approaching 12 months.”

Manufacturing expansion

Rabobank’s analysts forecast marginal year-on-year manufacturing expansion within the primary markets of North The united states, Brazil, Europe, Oceania, China and Southeast Asia of 0.6 million heaps – or 0.5% – to a complete of 247 million heaps subsequent 12 months. That is towards a 2.1 million heaps, or 1% expansion, in 2023.

Poultry and aquaculture would be the simplest two species teams to look manufacturing develop in 2024, predicts Rabobank, regardless that it is going to be slower than in 2023. Red meat will proceed the decline noticed in 2023, shifting with adjustments in farm animals cycles in North The united states, whilst red meat manufacturing may also contract modestly.

Wild catch seafood will go back to its longer-term trend of declining manufacturing after a 12 months of growth in 2023.

Salmon appears to be like set to be certainly one of 2024’s good fortune tales. Following two years of manufacturing contracting and flatlining, provide will increase by means of 4-5%, and its relative worth competitiveness towards different proteins will spice up call for.

Alternatively, plant-based meat choices will proceed their decline with shoppers and traders. Foodservice is predicted to be the important thing purchaser for gamers within the class in 2024.

A numerous image for areas

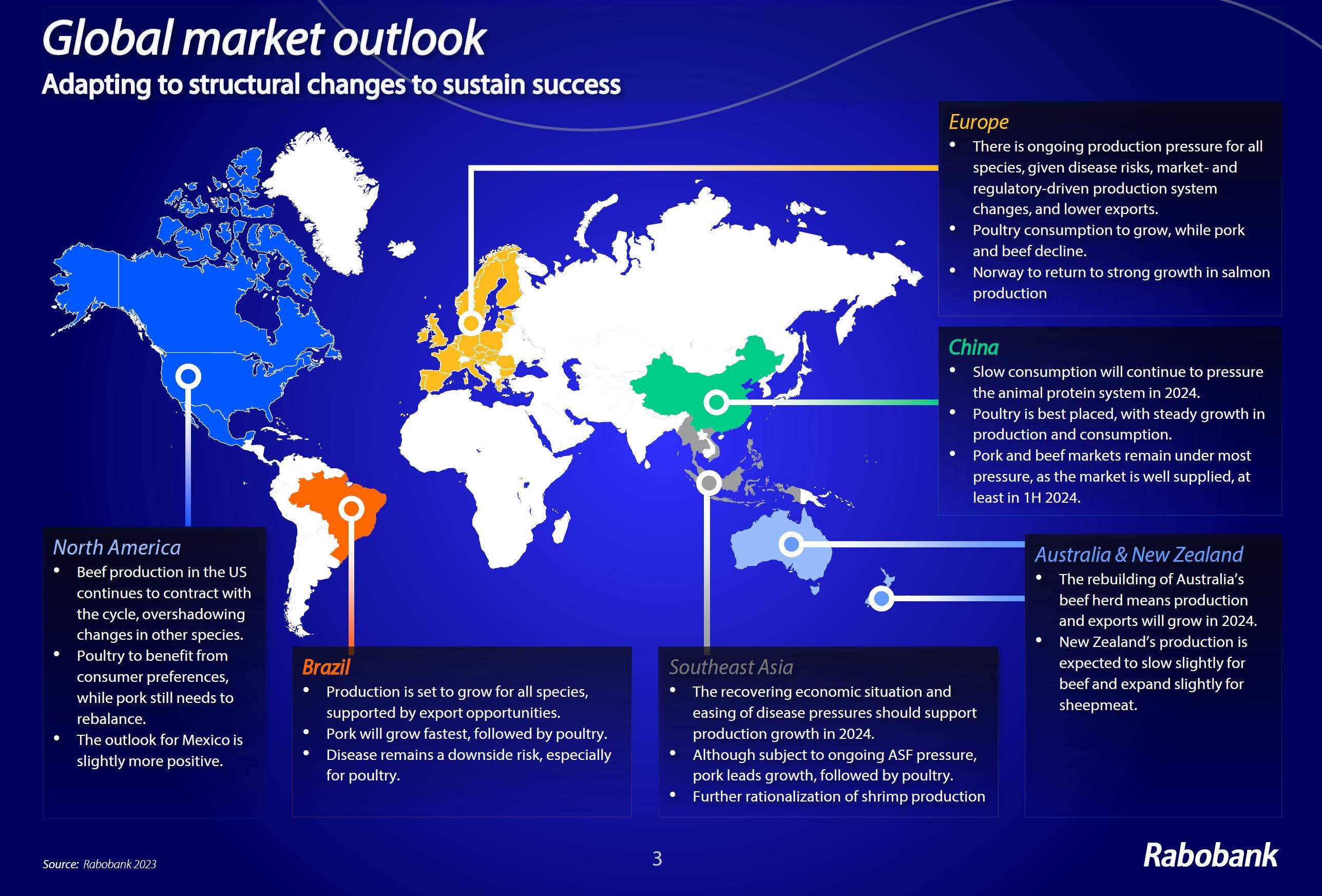

On a regional stage, Brazil and Southeast Asia will display the quickest manufacturing expansion for poultry and meat. In Brazil, manufacturing will develop throughout all species Rabobank tracks, led by means of red meat and poultry, regardless that it is going to gradual towards 2023 ranges. In the meantime, China and the Oceania international locations of Australia and New Zealand will see marginal expansion, with poultry absolute best positioned in China and red meat and red meat below power. Europe and North The united states will see an general manufacturing contraction.

Justin Sherrard added, “No longer all structural adjustments out there are unfavourable – many provide new alternatives for companies to strengthen their processes and merchandise. The ones corporations that may reveal agility in adapting to the brand new atmosphere and navigate client willingness to pay for positive personal tastes will be capable of profit from the tighter marketplace and are available out on best.”

Working for just about a decade, Rabobank’s World Animal Protein Outlook document is the sphere’s simplest international forecasting document, comparing the possibilities for a spread of protein classes together with meat, poultry and aquaculture.