Greater than 80% of shoppers understand that meals costs have larger a bit or so much over the past three hundred and sixty five days, consistent with the Might 2024 Shopper Meals Insights File (CFI).

The survey-based file out of Purdue College’s Heart for Meals Call for Research and Sustainability assesses meals spending, shopper pleasure and values, improve of agricultural and meals insurance policies and accept as true with in data assets. Purdue mavens performed and evaluated the survey, which integrated 1,200 customers around the U.S.

The Bureau of Exertions Statistics’ shopper worth index measure of meals inflation displays a 12-month building up in meals costs of two.2%, down from 4.4% a 12 months in the past. “Whilst meals inflation has slowed in 2024, customers are feeling the cumulative impact of the prime inflation we’ve skilled,” mentioned the file’s lead writer, Joseph Balagtas, professor of agricultural economics at Purdue and director of CFDAS.

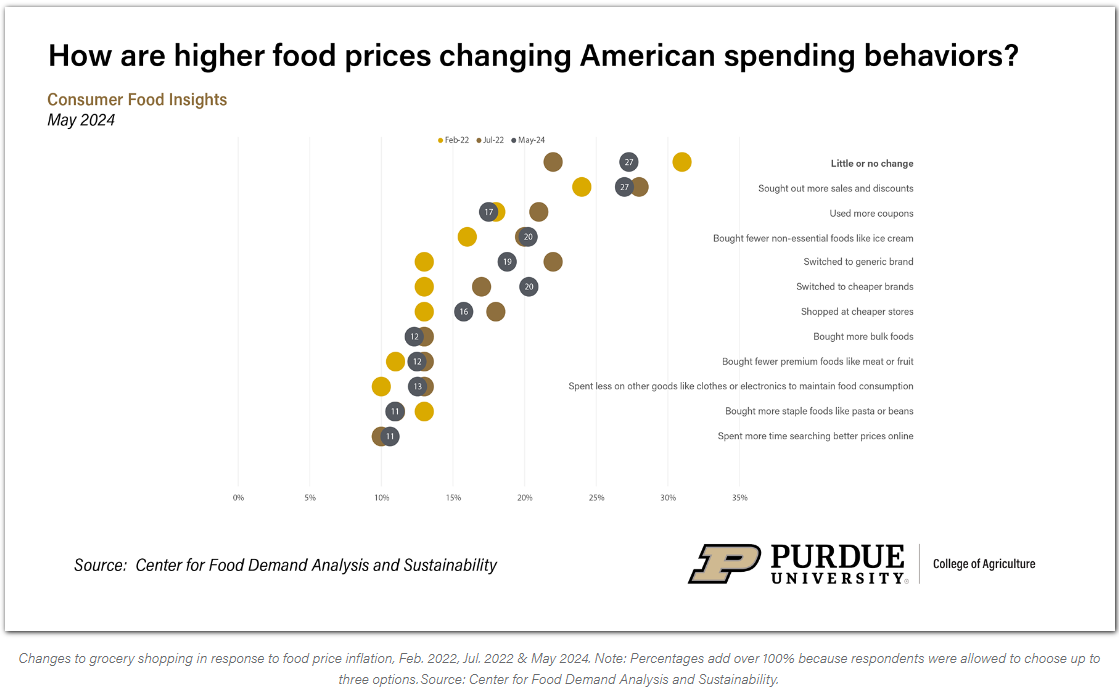

The Might CFI survey requested customers to file their studies and responses to emerging meals costs over the past three hundred and sixty five days. The survey integrated a query requested in the past in February and July 2022, seeing how customers have tailored their grocery buying groceries in keeping with meals worth inflation.

The researchers discovered that the commonest buying groceries variations to meals inflation are looking for out gross sales and reductions, switching to inexpensive and generic manufacturers, and purchasing fewer nonessential meals like ice cream.

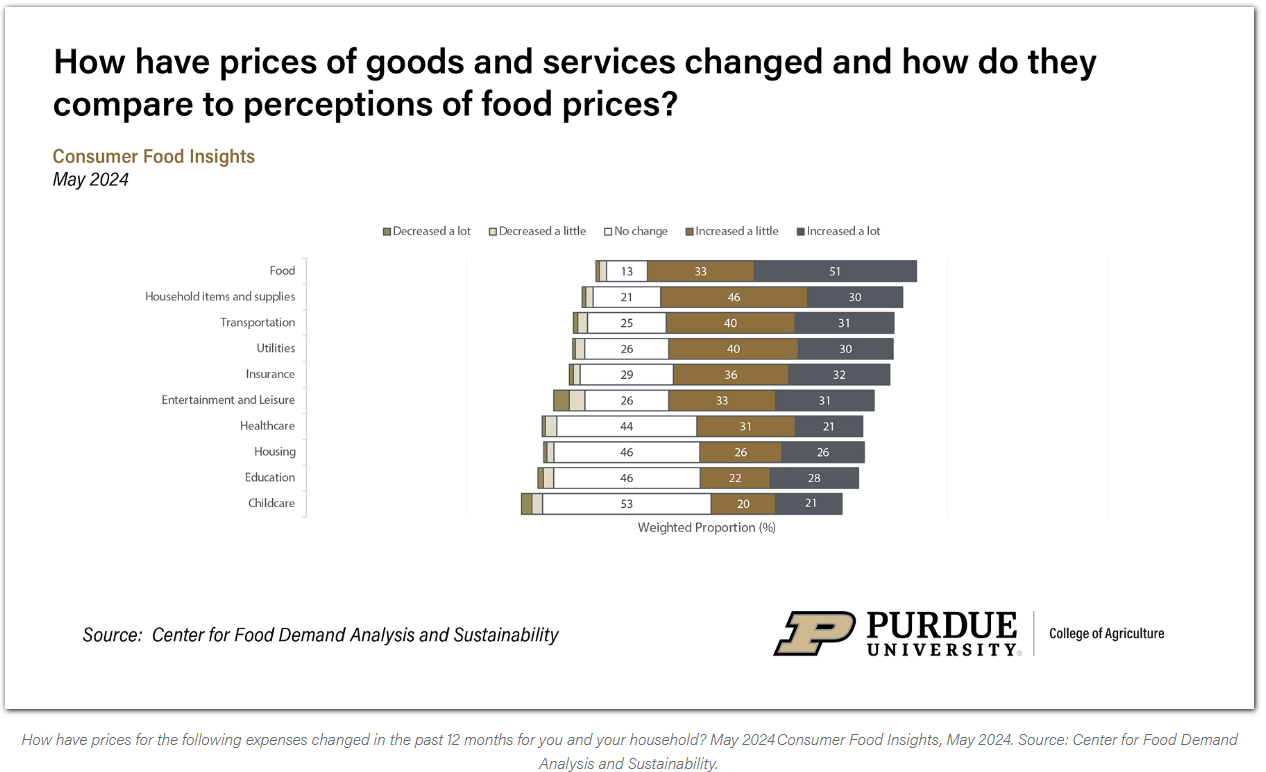

“We additionally sought after to know the way perceived adjustments in meals costs examine with perceived worth adjustments for different commonplace family bills,” Balagtas mentioned. “Shoppers had been much more likely to file worth will increase for meals than for every other excellent or carrier within the economic system.”

In a similar fashion, when requested which items and products and services noticed the most important year-over-year worth building up, 56% of shoppers decided on “meals,” regardless of authentic inflation knowledge that display costs of insurance coverage, housing and kid care have risen sooner than costs for meals prior to now 12 months. “It’s imaginable the prime frequency with which we store for meals may just make upper meals costs extra salient to customers. Media consideration to meals may just additionally play a job,” Balagtas mentioned.

The Might survey revisited generational variations analyzed in previous stories by means of categorizing customers into Gen Z (born after 1996), millennials (born 1981-1996), Gen X (born 1965-1980), and boomer-plus (born ahead of 1965).

“One house the place we see larger generational variations when asking about fresh shopper studies is the supply of investment that buyers reported depending on to buy meals,”

Balagtas mentioned. “Round 37% of Gen Z and millennial customers file drawing on financial savings or going into debt to finance their meals purchases over the last 12 months in comparison to 28% of Gen X and best 13% of boomer-plus customers. It’s regarding to peer over a 3rd of younger adults desiring to stretch their budget to manage to pay for meals.”

Meals lack of confidence is best possible amongst Gen Z adults, with round one-third of shoppers from this workforce additionally reporting having hassle gaining access to high quality meals. That is a lot upper than the velocity of meals lack of confidence amongst older Gen X (13%), and boomer-plus (5%) customers.

“Extra analysis is wanted, however those effects are most probably pushed partly by means of a stage-of-life impact, as source of revenue and wealth building up are drivers of meals safety and have a tendency to extend with age,” Balagtas mentioned.

The April shopper worth index measure of meals worth inflation — the newest to be had — remained unchanged from March at 2.2%. The inflation charge turns out to have stabilized, having stayed round 2.2% for the closing 3 months, famous Elijah Bryant, a survey analysis analyst at CFDAS and co-author of the file.

“In keeping with the middle’s knowledge, shopper estimates of meals inflation over the last 12 months of 6.2% and expectancies for the approaching 12 months of three.6% proceed to stay upper than the CPI estimate,” Bryant mentioned. This implies that shopper studies with meals costs were other than the authentic dimension.

“Shoppers’ inflation estimates proceed to hover round 6%, appearing that the dramatic building up in meals inflation in earlier years would possibly nonetheless be affecting shopper meals worth sentiment. On the other hand, customers were constantly extra constructive about long term meals costs relative to their inflation estimates over the last three hundred and sixty five days,” Bryant mentioned.

Shoppers are requested to allocate 100 issues a number of the six attributes — style, affordability, vitamin, availability, environmental have an effect on and social duty — in keeping with the significance of every of their grocery buying selections. Regardless that CFDAS started measuring meals values on a quarterly foundation in January 2024, the researchers have not begun to watch vital adjustments within the significance degree of those attributes.

“Style, affordability and vitamin proceed to be closely regarded as by means of customers when creating a buying resolution on the grocery retailer, while environmental have an effect on and social duty are of decrease significance,” Bryant mentioned. “American citizens’ values have confirmed to be somewhat constant regardless of adjustments to the commercial panorama over the last couple of years.”

The survey effects display generational variations in meals values, too, between the more youthful Gen Z and millennial teams and the oldest boomer-plus workforce. More youthful generations position extra worth at the environmental and social duty in their meals when opting for what to shop for. Older customers are extra eager about style.

The frequency of sure buying groceries and consuming behavior additionally differs throughout age teams. For example, more youthful customers are much more likely to select nonconventional meals in comparison to older customers.

“We see this with natural meals, grass-fed pork, cage-free eggs and plant-based proteins,” Bryant mentioned. On the other hand, all customers without reference to age file checking meals date labels steadily.

“We additionally apply older customers file consuming unwashed produce, uncooked dough and uncommon meat much less steadily than more youthful customers,” he mentioned. This aligns with variations noticed in possibility attitudes amongst customers of various ages. “Younger adults are extra prepared to take dangers with their meals than older adults,” Bryant mentioned.