Swine Insights World

As of late, we’re diving deep into a subject that’s shaping the worldwide beef business. We’re speaking about business consolidation and its results, just right and unhealthy at the international beef business. Whilst I’ll be the use of the U.S. for example, rising markets like China and Southeast Asia are following a identical trail and can be sensible to be told from our enjoy right here in The usa. So, let’s dissect how this consolidation affects markets and what classes may also be realized.

Elastic Provide: Flexibility of Small Farms

Previous to the 1990’s, the U.S. beef business consisted most commonly of quite small farms maximum of that have been diverse operations the place the pigs have been just one income circulation in conjunction with different cattle and vegetation. Those small-scale operations had the agility and versatility to evolve to marketplace prerequisites. When costs have been just right, farmers may just briefly ramp up manufacturing. Conversely, if the marketplace was once saturated, those small avid gamers may just simply downsize or briefly go out the business looking forward to a greater alternative.

This sort of setup allowed for what economists name an “elastic provide.” Recall to mind it as a rubber band; you’ll be able to stretch it out or let it contract in accordance with the forces implemented. As a result of such a lot of avid gamers contributed to the provision, no unmarried entity was once the most important. This dispersed menace made the marketplace tough and dynamic.

On the identical time, call for was once most commonly predictable. Home according to capita beef manufacturing has been quite solid in the USA for plenty of a long time. Exports have been low, in truth, as lately because the early 1990’s, the USA was once a small web importer of beef. So, we had an elastic provide and a predictable call for. The mix moderated volatility within the markets. Like lately, margins have been somewhat low however so was once capital funding and marketplace was once quite low as neatly.

The Converting Panorama

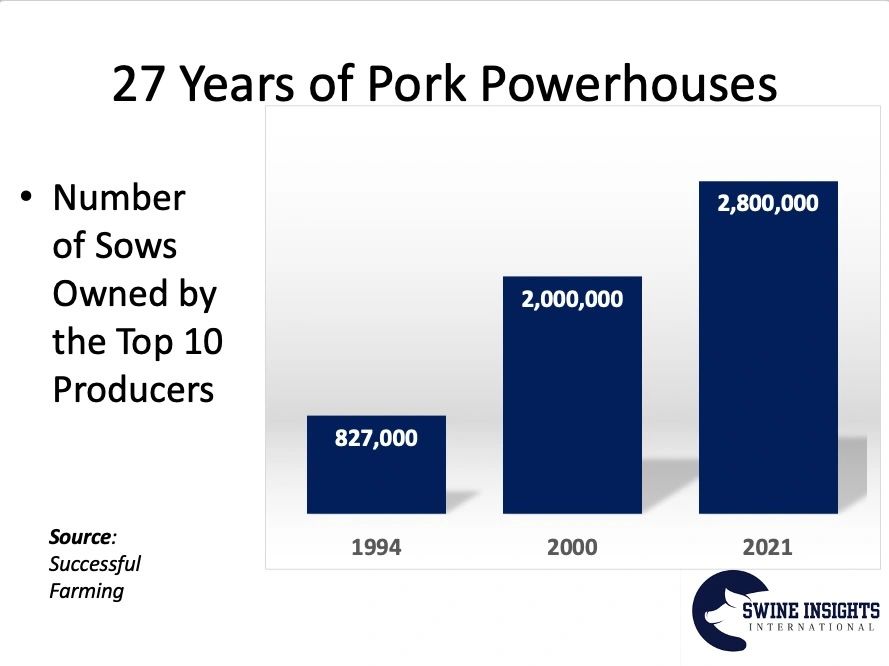

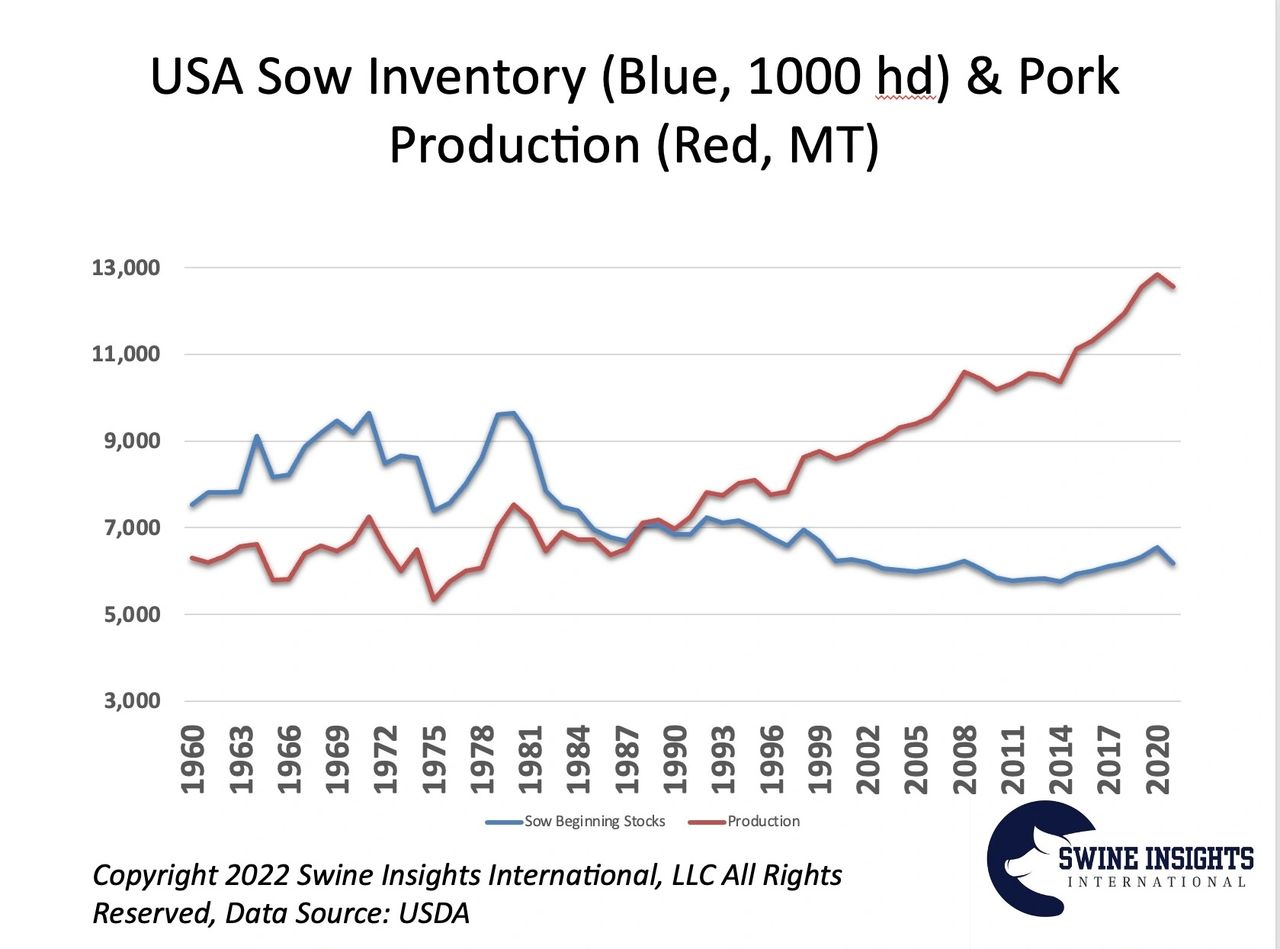

Starting within the 1990’s, a now acquainted development started. The business started to industrialize, and massive corporations started gaining marketplace proportion. Those new, larger farms introduced speedy enhancements in productiveness and potency. The tendencies of beef manufacturing and sow stock on the nationwide stage which had traditionally in large part tracked in combination started to diverge. Beef manufacturing, measured in metric lots, started to upward thrust often and dramatically whilst the sow stock stabilized and later started to say no (See Chart 1). We have been generating far more beef with the similar and even fewer sows. Those are all very sure tendencies after all, nevertheless it additionally introduced adjustments that weren’t essentially really useful.

The Catch: Decreased Elasticity

Those higher corporations are steadily extremely leveraged, that means they’ve taken on important debt to gasoline their growth of huge, technologically complicated farms. This monetary construction makes it a ways much less possible for them to scale back operations briefly when provide outstrips call for. The result’s lowered elasticity of the provision chain. Moreover, the all of a sudden increasing productiveness briefly outstripped the quite flat home call for. Thankfully, the USA is among the maximum cost-efficient puts on the planet to boost pigs, so US beef discovered keen consumers all over the world for our extra manufacturing and exports soared. America exported not up to 2% of all beef produced within the early 1990’s and via the 2020’s that had grown to just about 30%.

Once more, the brand new markets have been a blessing for beef manufacturers, however the U.S. beef business has turn into more and more reliant on exports. When world call for is excessive, that is improbable for trade. However this dating has a depressing facet: volatility. With a much less elastic provide and extra unpredictable call for, marketplace volatility larger considerably. The brand new fact was once upper highs and decrease lows and sessions of losses have been longer than the previous.

In recent times, the U.S. has exported an important quantity of beef to China. When African Swine Fever decimated China’s pig inhabitants, U.S. exports soared. Then again, geopolitical tensions and business wars can flip this profitable marketplace right into a high-risk project in a single day, affecting all of the provide chain again house. World marketplace call for could be very tricky to venture. No longer handiest does it contain international financial components which provides new variables, it additionally comes to non-economic components like politics and demographics which might be tricky, if no longer unattainable, to are expecting with any cheap accuracy.

Courses for Rising Markets

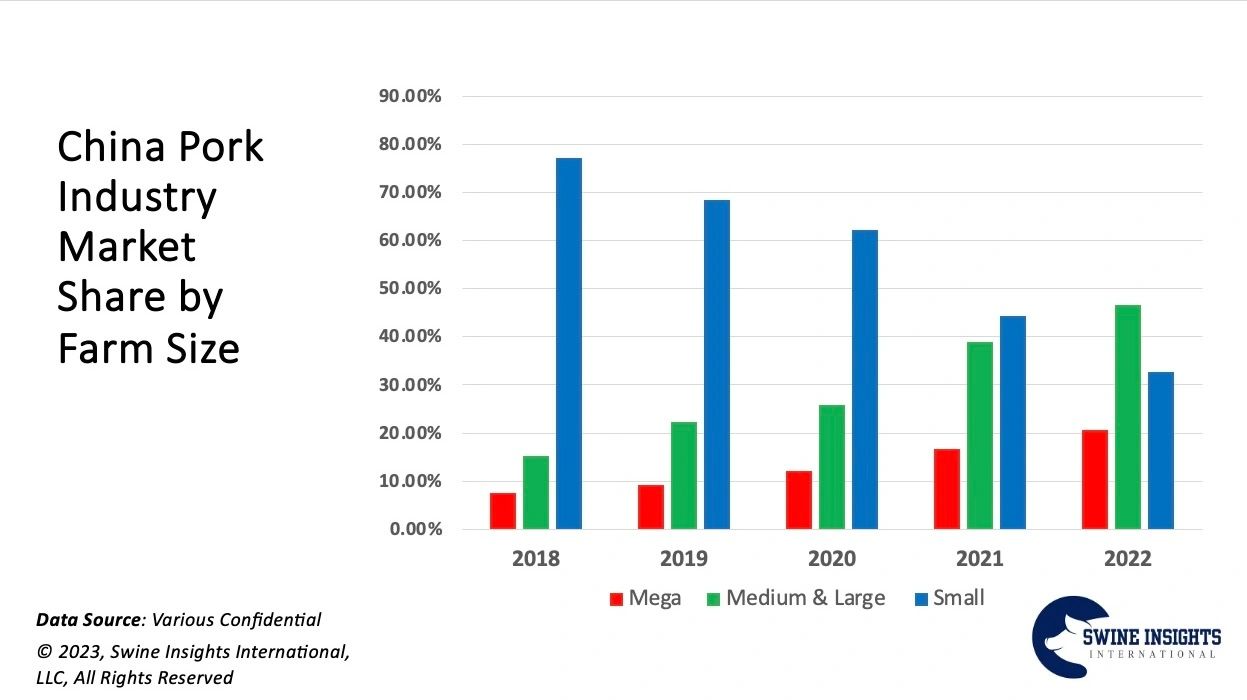

Now, let’s flip our focal point to rising markets. China and to a lesser extent, Southeast Asia, are lately experiencing speedy business consolidation (See Chart 2). They’re seeing ranges of consolidation in an issue of only a few years that took over twenty to completely increase in the USA and different extra mature markets. As they practice within the footsteps of the U.S., they’re additionally more likely to inherit probably the most demanding situations that include the transitions, comparable to lowered provide elasticity and larger vulnerability to marketplace prerequisites.

It’s the most important for rising markets to strike a steadiness. On one hand, consolidation can result in operational efficiencies, support biosecurity and assist meet calls for with out over the top reliance on imports. At the different, it will result in a brittle, much less responsive provide chain, at risk of even minor fluctuations in call for. We’ve already begun to peer such demanding situations emerge in China with lengthy sessions of vital losses skilled via an business or even a couple of years in the past infrequently skilled losses in any respect, a lot much less important losses.

To additional complicate issues, the consolidation has came about so briefly that they haven’t had time to increase gear and methods to care for the brand new fact. Through the years, the USA business has advanced subtle menace control methods and established gear like futures markets, to care for the volatility. Those gear are simply now rising in markets like China and SE Asia and there’s a massive schooling hole. The common Chinese language manufacturer, even fairly massive manufacturers, have just a tenuous take hold of of elementary hedging methods, a lot much less extra subtle approaches to managing volatility. Moreover, the futures markets, the place they exist, are nonetheless immature and are unstable themselves as they’re applied basically via speculators.

What’s On The Horizon?

I’d speculate that this pattern of consolidation will persist except we see some type of regulatory intervention which is extremely not going. Business consolidation isn’t unhealthy, if reality, it’s fairly just right and important in an effort to support resilience to animal illness demanding situations and support the commercial and environmental sustainability of beef manufacturing. Like several sure, alternatively, there may be a unfavorable facet and manufacturers and coverage makers in rising markets can be sensible to be told from our enjoy in the USA.

What Can Be Executed?

Business consolidation isn’t inherently just right or unhealthy. It has pushed technological innovation and operational efficiencies that small-scale farms may just handiest dream of. Then again, we will have to recognize the complexities it introduces to the provision chain and marketplace dynamics. A nuanced way that acknowledges the most likely larger volatility might be key. Manufacturers will have to paintings onerous not to handiest support operational efficiencies, however to additionally skilled themselves about menace control methods that may assist them arrange the inevitable swings. They will have to additionally paintings to protected get right of entry to to important capital to live to tell the tale sessions of losses which can be more likely to be upper and longer.

Coverage makers and business leaders will have to paintings to ascertain the important menace control infrastructure to assist manufacturers arrange enter prices and income. Meals safety calls for solid manufacturing capability so get right of entry to to menace control gear, insurance coverage and investment sources might be vital to make sure a solid meals provide. Making sure truthful pageant will have to even be a concern or those massive organizations can in no time turn into too giant to fail and require huge govt bailouts when losses turn into an excessive amount of.

If manufacturers, business organizations and governments can paintings intently in combination, they may be able to be sure that this transition is most commonly sure. Finding out from extra mature industries can assist them steer clear of even larger demanding situations which can be bobbing up from the unparalleled rapidity of business consolidation.

In regards to the Creator: Todd Thurman is an World Swine Control Advisor and Founding father of Swine Insights World, LLC. Swine Insights is a US-Primarily based supplier of consulting and coaching services and products to the worldwide beef business. To be told extra concerning the corporate, ship an electronic mail to [email protected] or discuss with the website online at www.swineinsights.com. To be told extra about Mr. Thurman’s talking and writing, discuss with www.toddthurman.me