Highlights

- For many who had forgotten about seasonality in red meat costs, the previous few weeks had been a just right reminder. Red meat provides declined in Jun/July and early August because of a mix of decrease slaughter and decrease carcass weights. We estimate that since early Might red meat provides are down 9%.

- Uncertainty about California Prop 12 regulations first of all ended in stock depletion and consumers sitting at the sidelines. Then the rule of thumb rationalization supposed that product in stock may well be bought in California during the finish of the yr. This additional compounded the seasonal scarcity as freezer provide that may in most cases be used to offset the seasonal decline now’s being carried to fill California call for.

- Bellies, trim, and hams have observed the most important value positive factors whilst recent red meat costs, particularly butts, have skilled the traditional seasonal decline put up July 4 vacation.

Complete Record

Red meat Cutout Climbs On Seasonal Call for, Brief Purchased Patrons, Lack Of Frozen Provide

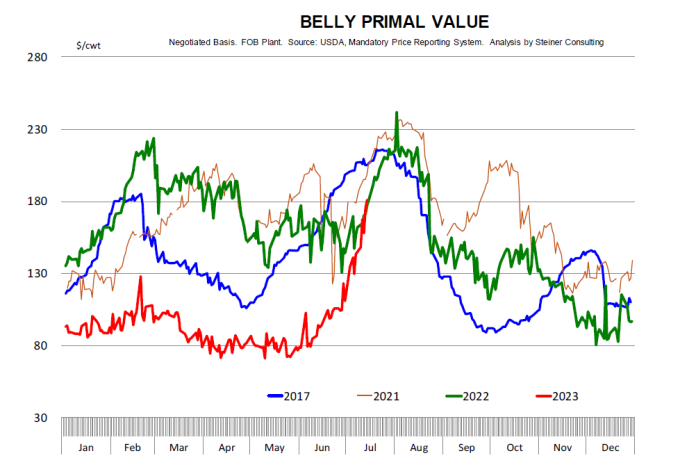

The red meat cutout has been transferring upper in the previous few weeks. This is apparently sudden marketplace individuals that for one explanation why or some other made up our minds to forget about seasonality. By means of some distance the most important contributor to the positive factors within the cutout has been the stomach primal. Partially it’s because bellies had been extraordinarily beneath valued for a lot of the yr and costs remained beneath drive via Might.

Historically stomach costs begin to achieve some traction within the spring. Then again, this time round, the mix of slower gross sales at foodservice, abundant freezer inventories and unsure call for in California had consumers sitting at the sidelines. That vary in June.

Since June 8, the price of the red meat cutout has moved up about $30/cwt (+35%). Greater than part of the rise is because of upper costs for bellies. On the finish of the week, the price of the stomach primal was once pegged at $181/cwt, 130% upper than simply 4 weeks in the past. Right through this era hog slaughter has been continuously transferring decrease, which is customary for this time of yr. In early Might weekly hog slaughter was once 2.465 million head. The common weight of a hog carcass at the moment was once about 216 kilos.

Hog Slaughter

For the week finishing July 1, hog slaughter was once 2.332 million head. It was once beneath 2 million head right through the vacation week. This week it was once 2.34 million head. The decline in slaughter has obviously ended in much less product to be had on a day by day/weekly foundation within the spot marketplace. Hog weights have additionally declined right through this era, which affects the full tonnage to be had as neatly. We predict the common hog carcass weight lately is working at round 209 kilos (forget about the USDA development estimate of 212, it’s going to be revised decrease). That’s a three% decline in manufacturing earlier than we account for the decrease slaughter. After we account for each slaughter and weight, red meat manufacturing is down about 9% in comparison to the place it was once in early Might. A lot has modified in spot provide dynamics, which occurs with regards to once a year and consumers all the time do neatly to bear in mind.

California Prop 12 and Frozen Stock

However what about Prop 12 and the ones large freezer inventories? It will not be a twist of fate that stomach costs began to achieve traction as soon as the foundations about Prop 12 implementation and dealing with of inventories began to be clarified. , having a large freezer stock of bellies was once no longer a curse. It presented providers that use frozen bellies the facility to proceed to promote into California via finish of the yr. If prior to now bellies had been being presented spot as a result of how a lot there have been within the freezer, now that freezer provide was once transferred into the longer term and notice availability dried up. Patrons that had been reckoning on a number of spot provide now must scramble slightly. Beginning July 1, manufacturing that doesn’t conform to Prop 12 now has to seek out some other house. Ultimately that will likely be one thing that catches up with the stomach marketplace. However within the close to time period, we’re at seasonal lows in relation to manufacturing. And this can be a just right time to promote bacon at retail. Closing week, USDA had retail bacon options up 31% vs. yr in the past and whilst costs had been beneath $5/lb., 13% decrease y/y.

Worth Chart

Forecasts

Steiner Consulting Crew produces the Nationwide Red meat Board e-newsletter in response to knowledge we imagine is correct and dependable. Then again neither NPB nor Steiner and Corporate warrants or promises the accuracy of or accepts any legal responsibility for the knowledge, evaluations or suggestions expressed.