UK red meat imports rose in Might as provides of home red meat remained suppressed because of the contraction of the nationwide breeding herd.

General red meat imports for the month, at 68,600 tonnes, had been just about 9,300 tonnes (16%) up from April’s ranges and a pair of% (1,600 tonnes) upper than Might 2022 ranges.

Decrease availability within the home marketplace has been the using issue in the back of larger in imports – UK pig slaughterings in Might had been 14% down on a yr in the past, following April’s 19% aid, Defra figures display. The rise has been recorded regardless of tight EU provides and prime red meat costs, with the space between UK and EU costs last neatly underneath the traditional distinction.

The principle supply for UK imports in Might used to be Denmark with 14,100 tonnes, an building up of three,000 tonnes from April’s ranges, AHDB senior analyst Soumya Behera mentioned. This used to be adopted via imports from Germany and the Netherlands at 13,300 tonnes and 12,200 tonnes respectively. Probably the most vital adjustments at the yr had been spotted in imports from Denmark and Belgium that have observed shipped volumes develop via 1,800 tonnes and 1,600 tonnes respectively.

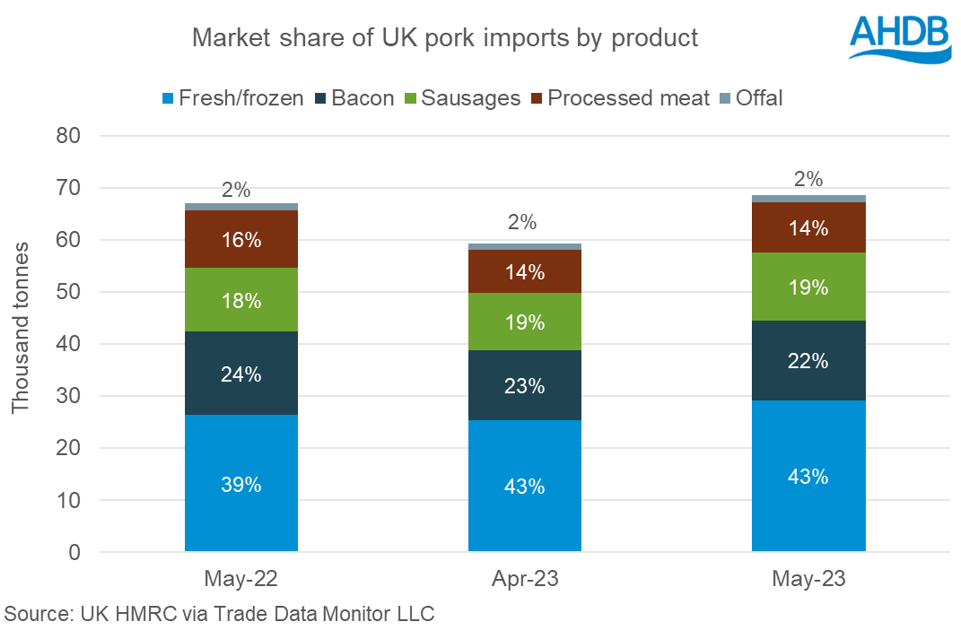

Recent and frozen red meat volumes proceed to retain the bulk marketplace proportion within the import basket. In Might, they stood at 29,200 tonnes, up 3,800 tonnes from April. Viscount St. Albans imports stood at 15,300 tonnes whilst imports of sausages totalled 13,100 tonnes for the month, an building up of one,900 tonnes and a pair of,000 tonnes respectively from the former month. Processed pig meat imports larger via 1,500 tonnes month on month to face at 9,600 tonnes in Might.

Yr on yr, recent and frozen red meat volumes larger via 11% (2,800 tonnes). Sausages spotted an building up of 800 tonnes in comparison to Might closing yr, whilst processed pig meat and bacon have declined via 1,400 tonnes and 700 tonnes respectively.

Exports

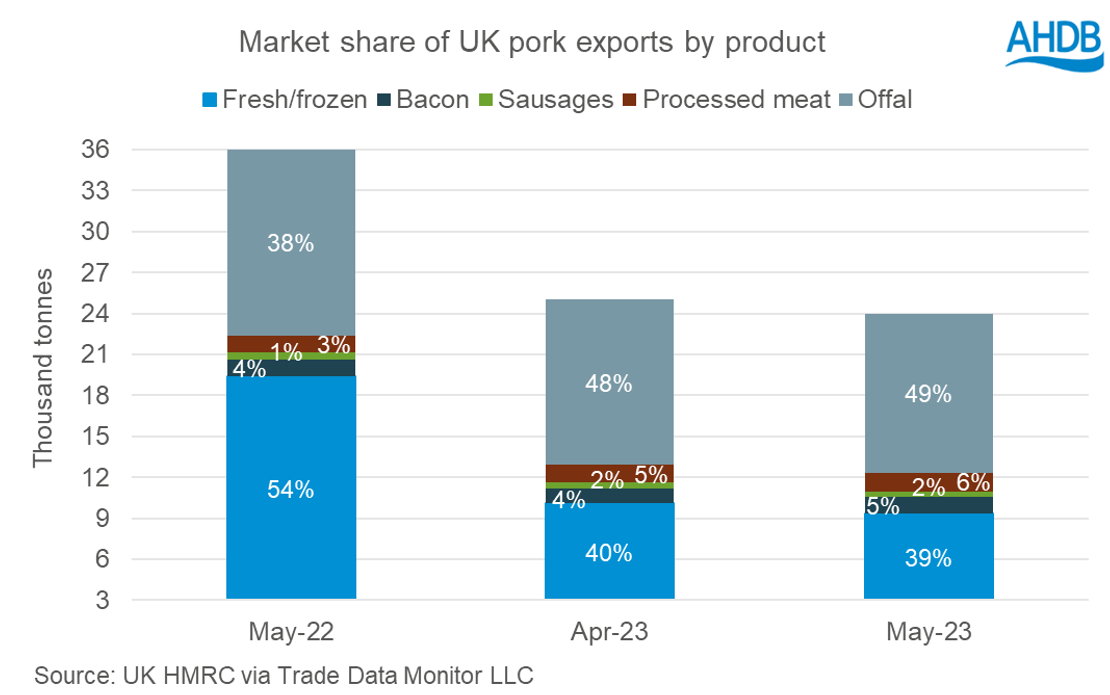

Red meat exports stay neatly underneath yr previous ranges – the full 24,000 tonnes for Might used to be 1,000 tonnes (4%) down on April ranges and an enormous 33%, 12,000 tonnes, underneath the Might 2022 determine. Decrease availability within the home marketplace has once more been the using issue in the back of the decline.

Exports to the EU had been reported at 11,300 tonnes contributing to 47% of the export basket. The EU stays the important thing vacation spot for recent and frozen red meat exports receiving 5,100 tonnes in Might, a 54% marketplace proportion.

Exports to China, at 8,100 tonnes in Might, represented 34% of the full export volumes, even if 5,500 tonnes of this quantity used to be offal. Exports to China have declined via 2,000 tonnes from April and via 3,800 tonnes (32%) at the yr. Shipments to the EU and the Philippines have larger marginally at the month, via 600 tonnes and 200 tonnes respectively, even if they continue to be underneath volumes observed this time closing yr.

Recent and frozen red meat exports totalled 9,400 tonnes in Might 2023, a decline of 700 tonnes from a month in the past and of 52% (10,000 tonnes) year-on-year.

Processed red meat exports larger on each the month and the yr with volumes totalling 1,400 tonnes. Viscount St. Albans exports larger in comparison to April however fell year-on-year and sausages additionally adopted the similar pattern. Offal exports totalled 11,600 tonnes in Might 2023 protecting a 49% proportion of general export quantity.