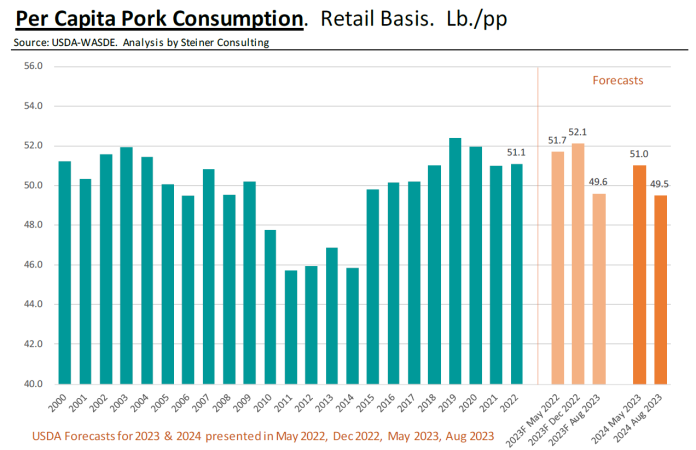

USDA recently forecasts according to capita home provide of red meat to be had down 2.9% from a 12 months in the past and at nearly the similar stage in 2024. Those are the bottom in a decade.

USDA lately diminished its forecasts for red meat manufacturing for 2023 by way of 107 million kilos or 0.4%. Present forecast continues to be for red meat manufacturing this 12 months to be up 268 million kilos or 1% vs. 2022. Upper slaughter has been offset by way of decrease hog carcass weights thus far. However whilst total red meat manufacturing is up, provide in home channels on a according to capita foundation is forecast down 2.9% for 2023 and at identical ranges in 2024 (see chart). USDA is recently forecasting red meat exports for 2023 at 6.926 billion kilos, 581 million kilos (+9.2%) upper than a 12 months in the past. Decrease imports have additional decreased home availability, with red meat imports in 2023 forecast at 1.080 billion kilos, 264 million kilos decrease. The swing in business has intended 845 million fewer kilos to be had within the home marketplace, excess of the rise in manufacturing. USDA recently expects marginal manufacturing positive factors for 2024. Manufacturing for 2024 is forecast to extend simply 71 million kilos (+0.2% y/y). Sure the breeding herd would possibly decline however USDA appears to be arguing that this will probably be offset by way of extra pigs according to clutter and expectancies for heavier weights for hogs coming to marketplace. Consistent with capita availability for 2023 and 2024 is recently anticipated to be on the lowest level in a decade.

International Beef Provides, Sow Inventories And Manufacturing Potentialities

As we famous within the first segment, the shift in international business patterns, with exports up and imports down, have had an important affect at the U.S. home marketplace. The red meat marketplace is international in nature, with 1 / 4 of all of the red meat produced within the U.S. going to customers out of doors U.S. borders. Along with taking a look at what home providers are doing, it is very important believe what different primary red meat exporting nations are doing as neatly. We attempted to determine a solution to illustrate the exchange within the sow stock for the highest 4 international red meat providers and adjustments in provide (see charts).

Within the Eu Union

By way of a long way the largest decline within the sow stock has taken position within the EU. The block comprises one of the crucial greatest international red meat manufacturers: Germany, Denmark, Spain, France, Poland. The mixed sow stock within the EU firstly of 2023 was once estimated at 10.4 million head, 3.6 million head (-26%) not up to the stock stage greater than a decade in the past (2010). On the other hand, red meat manufacturing within the EU all through this era declined from round 22.6 million MT to an estimated 21.6 million MT for 2023, a 4% aid. Moreover, as a result of shifts in home intake and international call for, EU in 2022 exported 4.1 million MT of red meat vs. 1.6 million MT in 2010. Exports for 2023 are anticipated to drop to three.7 million MT, however this is nonetheless over 2 million MT (+124%) upper than in 2010.

In Latin The usa

Productiveness positive factors were much more pronounced in nations like Brazil. The sow stock in Brazil on January 1 , 2023 was once estimated at a bit over 3 million head, a 4% acquire in comparison to 2010 ranges. Beef manufacturing all through this era higher by way of 1.27 million MT, a 40% building up, implying a productiveness acquire of about 36% up to now decade. Final 12 months Brazil exported about 1.3 million MT of red meat, in comparison to 600k MT in 2010. Present forecasts are for exports in 2023 to hit 1.5 million MT. Brazil has been effectively competing with U.S. red meat manufacturers in South The usa, Caribbean or even Mexico. That pageant will simplest warmth up as Brazilian feed manufacturing expands.

Having a look to the Finish of the Yr

The U.S. sow stock is predicted to be decrease by way of the tip of the 12 months, possibly up to 150k head. For the reason that first week of Would possibly, sow slaughter has been about 67k head upper than the similar duration remaining 12 months (+9%). A few of this building up is because of introduced sow farm closures. But if we take a look at regional numbers, sow slaughter will increase were extensively disbursed. And as we’ve got famous prior to now, the sow herd will decline each because of extra culling as neatly decrease gilt retention. On the other hand, take into accout the consequences of productiveness positive factors. In 2019 and 2020 U.S., Canada, Brazil or even EU ramped up manufacturing to fill the provision hollow created by way of ASF in China. Now that Chinese language provide has recovered, primary exporters wish to stability the decline in Chinse call for with the rise in productiveness. This implies fewer sows wanted, with expanding force on inefficient manufacturers.

Worth Chart

Forecasts

Steiner Consulting Crew produces the Nationwide Beef Board e-newsletter in keeping with data we consider is correct and dependable. On the other hand neither NPB nor Steiner and Corporate warrants or promises the accuracy of or accepts any legal responsibility for the knowledge, evaluations or suggestions expressed.