Within the December factor of Pig International, famend business analyst Mick Sloyan took an in-depth have a look at fresh international beef marketplace tendencies and explains what this tells us about UK marketplace potentialities heading into 2024.

Within the December factor of Pig International, famend business analyst Mick Sloyan took an in-depth have a look at fresh international beef marketplace tendencies and explains what this tells us about UK marketplace potentialities heading into 2024.

Many stuff have modified since this nation left the EU, however many stuff have remained the similar.

Within the beef marketplace, maximum preparations had been rolled over, together with business coverage measures that replicate our upper welfare, environmental and different prices imposed at the business via regulation.

In consequence, just about all our import necessities come from the EU and infrequently anything else comes from out of doors Europe. Whilst we’re insulated from the arena marketplace, we aren’t remoted from it. What is occurring in Iowa and Mato Grosso is having an instantaneous have an effect on on Catalonia, Brittany, Saxony and, in the long run, the United Kingdom.

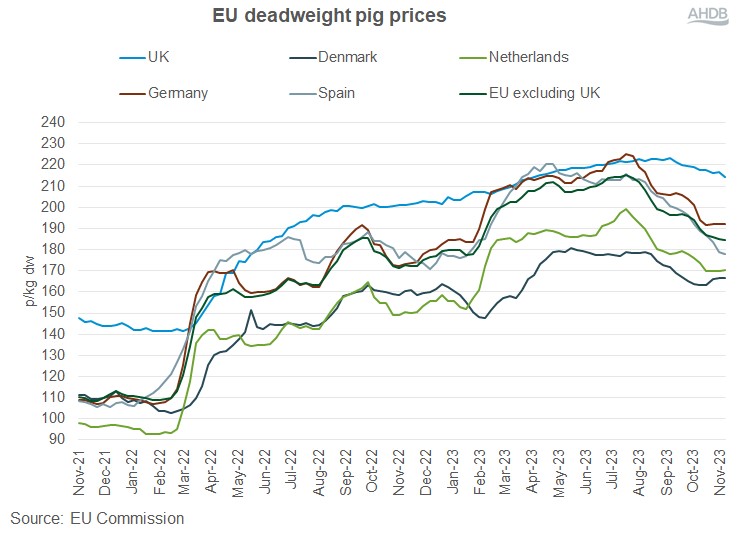

In the previous few months, the marketplace has grew to become and pig costs in maximum primary markets are in decline. It’s now and again tricky to pinpoint the precise time that this occurs, however this 12 months has been the exception.

Declining costs

In the course of July, pig costs reached a height in Germany, Spain, France and the Netherlands, since when they’ve been declining incessantly. That is most likely now not unexpected given how carefully related those markets are, with each reside slaughter pigs and beef shifting throughout nationwide borders in very massive quantities.

On the other hand, reasonable costs in the USA and Canada additionally peaked in mid-July and feature since weakened.

The marketplace in Brazil has been quite susceptible this 12 months, but it surely, too, noticed a small fall in mid-July, despite the fact that it’s been solid since then.

Marketplace costs in China have additionally been suffering this 12 months with the hot height in costs coming a couple of weeks later in August, since when there was a gentle decline.

This better alignment of global markets is being influenced via world business. Lately, the EU used to be exporting about one 5th of manufacturing to non-EU markets. Whilst the point of interest in 2019 used to be on China and Hong Kong as they struggled with ASF, it has seemed to diversify exports since then.

By way of 2022 China/Hong Kong accounted for most effective 30% of general exports, with the remaining going to a wide vary of nations in Asia, Africa and North The us.

Spain has been a big participant in riding this enlargement in exports and now claims to be the second one greatest beef exporter on the planet at the back of the USA.

The USA exports a couple of quarter of its manufacturing. Its primary markets are nearer to house in Mexico and Canada, but it surely additionally exports considerable volumes to China/Hong Kong and the remainder of Asia, the place it competes at once with EU exporters.

Brazil is turning into a extra important participant at the global marketplace, with drawing near one 3rd of manufacturing exported.

Because the marketplace in China remains to be risky, with manufacturing restoration resulting in very low costs, all of the primary exporting international locations have seemed to diversify. This has introduced all of them into nearer pageant.

In 2022, costs in North The us had been sturdy relative to different exporters. On the other hand, in 2023 costs within the Americas trended downwards and, in fresh weeks, reasonable marketplace costs in the USA, Canada and Brazil had been 35-65% not up to the EU reasonable.

The result of this extra intense price war can also be observed in export marketplace efficiency. In 2021, the EU accounted for 41% of world exports. This 12 months, USDA estimates that this will likely have fallen to 32%.

Against this, the USA has moved from 26% to 30%, whilst Brazil has long past from 11% to fourteen% of general international business.

British marketplace

So, what does all this imply for British pig manufacturers? The British marketplace continues to depend on imports for approximately part of all of the beef and beef merchandise fed on on this nation. And all that comes from the EU.

The United Kingdom could also be the EU’s 2d greatest export marketplace after China. When lifestyles will get harder on international markets, then exporters have a tendency to appear nearer to house. And as costs fall around the EU, then British wholesalers, outlets and meals carrier corporations glance to scale back their prices to compete in a marketplace the place meals inflation continues to outstrip the overall upward thrust in the price of dwelling.

UK exporters also are being at once affected. As an example, in September this 12 months, the common price in keeping with tonne of frozen beef used to be 10% not up to a 12 months in the past and offal used to be down by means of 20%. With decrease volumes being exported at decrease costs, this has decreased the whole price out there, which is able to in the long run have an effect on the pig value.

Against this with many EU international locations, pig costs in Nice Britain have a tendency to be slower to react. The best way during which weekly costs are set in lots of EU international locations lends itself to volatility, particularly within the very finely balanced marketplace that we have got at this time.

As an example, in France the nationwide value is made up our minds at a two times weekly digital public sale. In Germany the weekly really helpful value is about by means of a bunch of farmers cooperatives, and in Spain by means of a negotiating committee of manufacturers and processors.

On the other hand, on this nation, the majority of pigs are traded at the foundation of provide agreements which are related to a few type of pricing formulation. The weather that pass into the formulae range extensively, however will make some connection with costs within the fresh previous.

Some provide preparations additionally repair costs for longer than every week. Whilst those preparations don’t forestall the marketplace value shifting every week, it has a tendency to lead to British costs shifting up and down extra slowly than could be normally observed within the EU.

Difficult outlook

The fast outlook for British manufacturers seems difficult. US costs are proceeding to fall and are rapid drawing near the identical of £1/kg dw, which makes them very value aggressive on global markets.

Costs also are very low in China, having dropped under the business benchmark of 15 RMB (£1.68)/kg. That is having a negative have an effect on on international import call for and inflicting exporters corresponding to Spain to appear increasingly more at promoting extra inside Europe.

In fresh months, a vital hole (as measured by means of the EU Reference Value) has unfolded between British costs and EU costs. On the time of writing, this stood at about 28p/kg dw, which is able to unquestionably put substantial power at the British marketplace.

There are some indicators that the autumn in EU costs is slowing, then again, and, with the Christmas business development, there might be some non permanent pick out in call for. On the other hand, the actual power will come within the New Yr.

Within the medium time period, there’s a glimmer of hope, in spite of a difficult international marketplace for EU exporters. The newest forecast from the USDA signifies that US manufacturing will build up in 2024 and that exports may also build up because of upper call for from Canada, the Philippines and South Korea, in addition to gaining marketplace proportion from the EU.

They be expecting US pig costs to fall within the first part of subsequent 12 months prior to getting better quite in the second one part. They’re additionally forecasting that Brazilian manufacturing and exports will build up in comparison to this 12 months.

Whilst all this doesn’t sound very encouraging, their view at the EU is that manufacturing will proceed to say no in 2024, however that export volumes will stabilise. This turns out cheap, assuming EU costs proceed to transport again extra in keeping with competition.

That is already going down in Spain, the EU’s greatest exporter, the place weekly costs are 50p/kg not up to the height in July.

The large query is how a lot additional the EU marketplace will fall prior to it’s value aggressive sufficient to maintain a modest quantity of exports and stimulate intake throughout the EU.

The early months of 2024 shall be an important prior to, confidently, the seasonal build up in call for kicks in throughout Europe within the spring.

The present value differential between Britain and the EU is almost certainly with reference to a manageable stage, particularly given very tight provides. On the other hand, additional falls within the EU marketplace subsequent 12 months usually are mirrored ultimately in costs on this nation.

All of us love to control the marketplace every week. This was a easy subject of taking a look the SPP. In long term, we can all wish to take a much wider view of the arena.