A paper at the efficiency of South Africa’s brand new fruit exports has been launched through Henley Industry College Africa in collaboration with the Gordon Institute of Industry Science and Stellenbosch College. It emphasises that keeping up robust exporter-importer relationships may well be important to stay the trade on most sensible.

Photograph: Wikimedia Commons

A singular three-way analysis collaboration between Henley Industry College Africa, the College of Pretoria’s Gordon Institute of Industry Science (GIBS) and Stellenbosch College just lately printed new analysis that cautioned South Africa’s brand new fruit farming trade is going through a super hurricane of demanding situations that can require a extra strategic relationship-driven option to safe its financial viability.

The trade, which is the largest contributor to the agriculture export sector through worth, has completed outstanding good fortune.

The biggest exporter of unpolluted fruit within the Southern Hemisphere, the trade generates greater than US$3 billion (about R55 billion) in foreign currencies yearly and has created over 400 000 employment alternatives all over the price chain. However emerging pageant and logistical demanding situations may just threaten the trade’s sustainability, the paper argues.

Decaying infrastructure, bottlenecks at ports, emerging transport prices, electrical energy and water crises, and the lingering results of the COVID-19 pandemic lockdowns are a number of the key demanding situations defined within the white paper.

Consistent with the lead creator of the analysis, Prof Daniel Petzer, head of analysis at Henley Industry College, those stumbling blocks now not handiest impede logistical efficiencies but additionally jeopardise South Africa’s international competitiveness.

“Whilst South Africa has a large export achieve (Russia and the EU are our greatest patrons of unpolluted fruit) and our costs are aggressive, force from fellow Southern Hemisphere manufacturers, particularly Chile and Peru, which percentage the similar wintry weather window, are threatening to grasp marketplace percentage. Will have to our manufacturing slip, or {our relationships} with key patrons fray, those competition will likely be able to step into the distance,” he says.

The white paper stresses that on this terrain, setting up and nurturing long-standing relationships with overseas patrons, in addition to diversifying buying and selling partnerships, are crucial methods for expansion.

“Our analysis highlights the significance of making an investment in robust relationships with each current and new markets,” says Prof Marianne Matthee from GIBS. “We got down to perceive extra about what drives a success exporter-importer relationships and export efficiency and sustainability. Unusually, empirical analysis on this important space is sparse and we got down to plug this hole.”

A snapshot of SA’s fresh-fruit exporters

The researchers surveyed 65 direct exporters of unpolluted fruit in South Africa, on the lookout for the behind-the-scenes inter-firm courting behaviours that had been essentially the most important predictors of export efficiency and sustainable exporter-importer relationships.

On moderate, respondents have been exporting their brand new fruit for 15 years, and exporting to their biggest overseas customer for 12 years.

Simply over 81% in their brand new produce gross sales had been derived from without delay exporting to 35 patrons and exporting just about 27% in their merchandise to their biggest overseas customer.

Whilst maximum exporters surveyed perceived their export efficiency as ample and sustainable, the white paper highlights the will for higher funding of time and effort within the biggest overseas patrons, who play a a very powerful position in long-term export sustainability.

On moderate, exporters faithful round 14 hours a week to trade affairs and verbal exchange with their biggest overseas patrons.

5 suggestions for good fortune

The analysis recommends 5 techniques during which brand new fruit exporters in South Africa can give a boost to their export efficiency and maintain their relationships with importers, even in tricky instances.

First, it recommends that exporters prioritise the industrial viability in their exporter-buyer relationships and use gross sales and profitability measures to measure this objectively.

This will require a willingness and talent to have interaction with patrons to talk about minimal order amounts and frequency of orders in a frank means.

2nd, it urges exporters to take a long-term view of relationships with overseas patrons and now not be swayed through non permanent good points that might compromise long-term sustainability and profitability.

3rd, it means that exporters retain open verbal exchange with overseas patrons; common and candid information-sharing and session is a very powerful, and exporters can paintings to make certain that traces of formal and casual verbal exchange stay open to have interaction steadily in listening, sharing, making plans and problem-solving.

Fourth, exporters can display and/or teach personnel to verify top ranges of courting proneness, which is recognized as a key driving force of each export efficiency and sustainable exporter-importer relationships.

For instance, ‘cushy talents’ and emotional intelligence workshops may just spice up workers’ want and talent to forge mutually advisable relationships with overseas patrons.

5th, on a control stage, leaders additionally want to ‘stroll the debate’, the researchers counsel. Exporters can foster a relationship-centred trade tradition this is upheld through control.

“Construction a relationship-centred trade calls for long-term making plans and funding each in monetary belongings and in human capital,” says Dr Stefanie Kühn of Stellenbosch College, including that it’s transparent that South African exporters themselves perceive the price of this way.

“It’s noteworthy that non-economic delight, dedication, verbal exchange, and co-operation emerged as key drivers of sustainable exporter-importer relationships on this learn about. It is a testimony that the exporters we surveyed worth running carefully and successfully with their overseas patrons within the pursuits of each events.”

Citrus

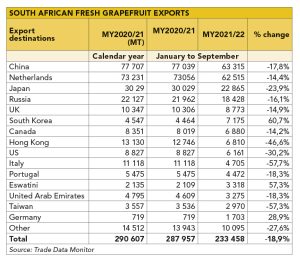

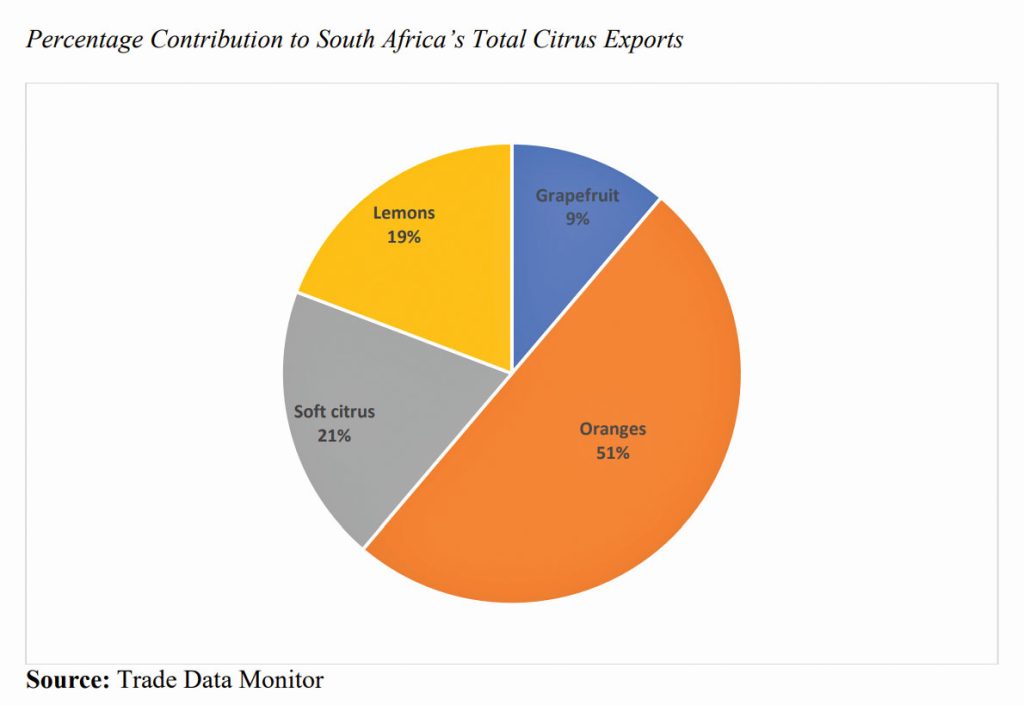

Citrus is a significant contributor to South Africa’s exports, producing round US$1,93 billion (about R35 billion) in income, in keeping with a 2021 OEC record. In spite of this, the citrus trade has skilled important demanding situations over the last 12 months, in particular because it relates to exports.

The advent of the EU’s false coddling moth (FCM) rules mid-season 2022, for instance, has had a significant have an effect on on exports. Manufacturing declines, because of load-shedding, drought and skyrocketing enter prices, among others, have additionally been skilled.

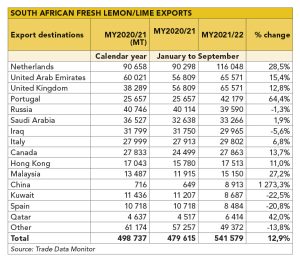

In spite of this, the trade stays the most important exporter on an international scale. Consistent with a March 2023 record printed through The Fruit Portal, lemon exports had been anticipated at 37,3 million 15kg-equivalent cartons, up 2,6 million cartons from 2022.

The rise was once attributed in large part to more youthful bushes getting into manufacturing. Nearly all of lemons exported within the 2022/23 season was once to the Heart East (49% of overall quantity), Asia (22%) and Russia (18%).

Navels will see a drop in exports through 2,5 million 15kg-equivalent cartons, with 25,3 million cartons predicted to be exported. Valencia exports had been anticipated to be marginally up through 700 000 15kg-equivalent cartons, with 54,5 million cartons anticipated to be exported.

In the case of grapefruit, 12,7 million 17kg-equivalent cartons are anticipated to be exported, down 2,1 million cartons from the 2022 quantity.

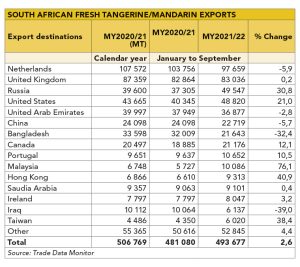

Tangerine and mandarin exports had been projected to develop 8% to achieve 560 000t. Alternatively, the EU is traditionally South Africa’s greatest marketplace for this product, and new FCM rules may just come into play all over the season.

On the very least, exporters will see a decline in benefit margins as they try to adhere to the rules.

Learn the overall analysis paper right here.