Pig costs in Europe pick out up following six months of decline

Ecu pig costs have noticed some vital actions within the first 11 weeks of the yr, in step with AHDB marketplace analyst Freya Shuttleworth.

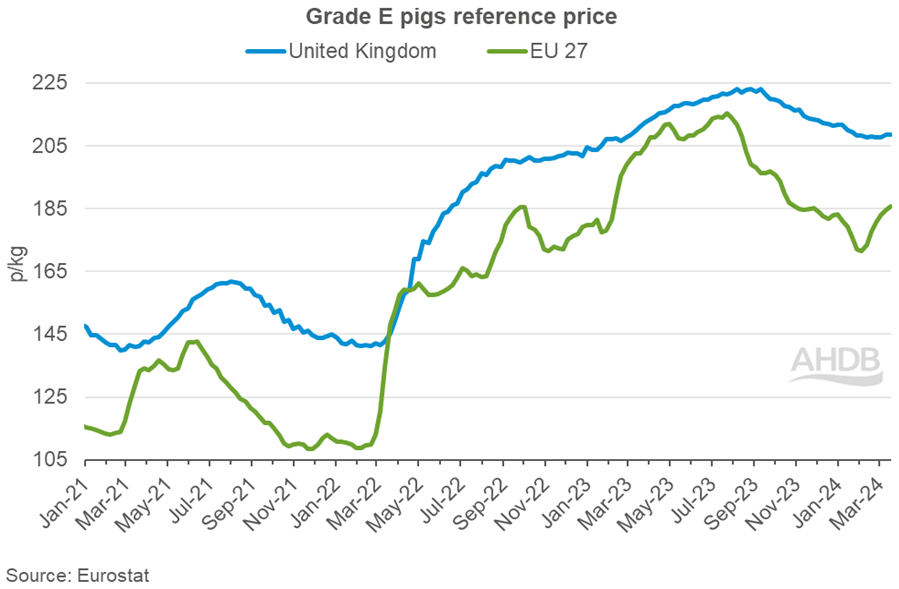

Within the first 5 weeks (length finishing 4 Feb), costs dropped off sharply, shedding on moderate 12p/kg, at the again of seasonally susceptible call for. On the other hand, in the most recent six weeks (length finishing 17 Mar), costs have recovered, gaining 14p to moderate 185.63p/kg. All key generating countries have recorded robust expansion in contemporary weeks at the again of tightening provides.

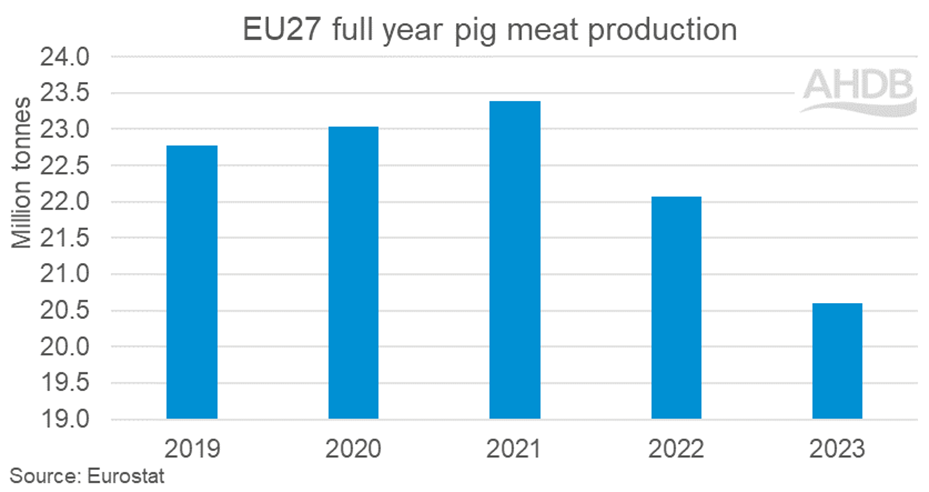

The motive force at the back of those worth will increase has been reported as an uplift in call for along the continuing tightening of provide. Manufacturing of pig meat within the EU was once the bottom quantity recorded in over a decade in 2023, at 20.6 million tonnes. It is a 7% decline year-on-year and follows a 6% fall in volumes in 2022. Those declines had been pushed through lowered slaughter numbers, that are additionally again 7% year-on-year.

Forecasts for 2024 expect additional decline in pig meat manufacturing, with the contraction in herd measurement noticed during the last couple of years now not anticipated to get well. In December 2023 the entire pig inhabitants within the EU 27 stood at 133.6 million head, the smallest-recorded inhabitants since information began in 2001. Pair this along incoming environmental laws and the long-term manufacturing outlook for the EU seems restricted, with the EU fee forecasting an annual decline of round 1% between now and 2035.

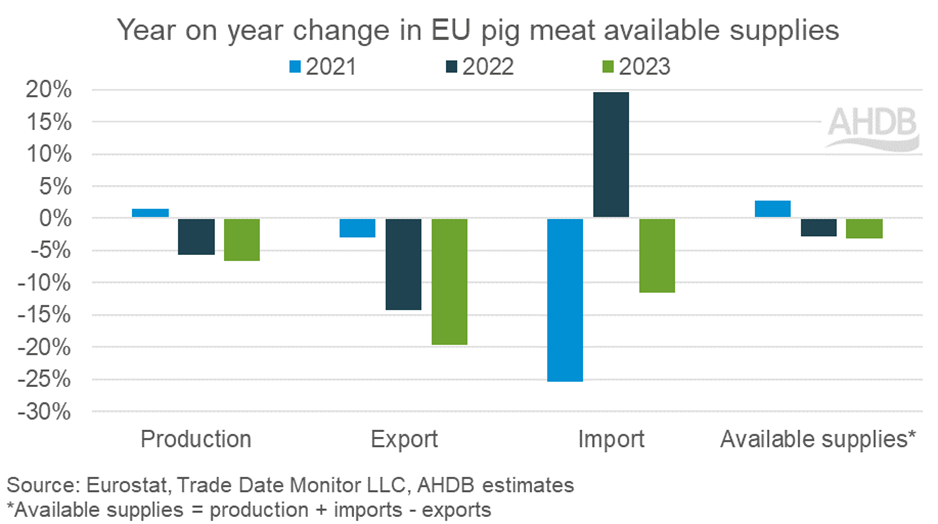

A difficult business dynamic thru 2023 might also have had some section to play in tightening pig meat provides. EU exports of pig meat (together with offal) noticed vital year-on-year decline, status at their lowest-recorded quantity since 2014, at 3.90 million tonnes. A lot of this decline will also be attributed to manufacturing losses, even if some product could have misplaced out on key locations because of greater world festival. On the other hand, this do not have been sufficient quantity to outweigh the adjustments in manufacturing and imports.

EU pig meat imports (together with offal) totalled 146,800 tonnes in 2023, the bottom quantity recorded in over a decade (aside from 2021 because of preliminary Brexit business friction). In spite of the EU fee forecasting in line with capita intake to fall 5% in 2023 because the greater value of residing impacted shopper spending, this quantity drop in provides to be had could have brought about disruption to the marketplace, elevating costs paid.

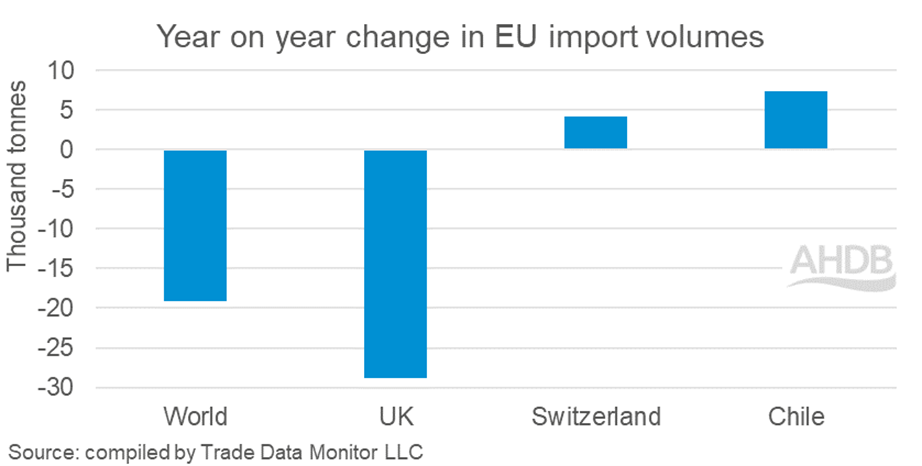

An affect to the United Kingdom of those converting marketplace dynamics has been a discounted marketplace proportion in EU import volumes. Traditionally, between 80 and 85% of EU pigmeat imports have been sourced from the United Kingdom; on the other hand, in 2023 it was once sitting at 71%. Even though the lowered shipments from the United Kingdom are principally right down to falling home provide, top pricing has now not aided festival at the world marketplace. In the meantime import volumes from Switzerland and Chile to the EU grew year-on-year, expanding their marketplace proportion from 7% and a pair of%, respectively, in 2022 to 11% and eight% in 2023, respectively.