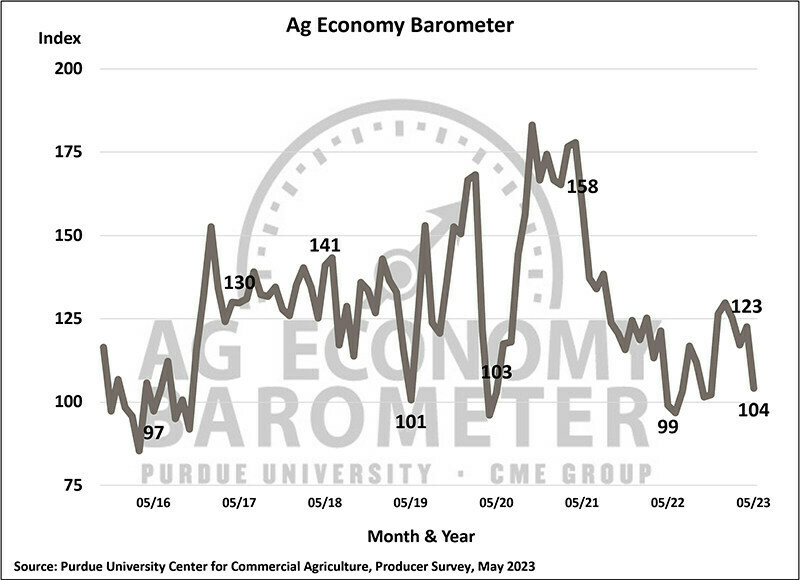

The barometer declined 19 issues to 104 in Would possibly

Manufacturer sentiment fell to its weakest studying since July 2022, because the Purdue College/CME Staff Ag Financial system Barometer declined 19 issues to a studying of 104 in Would possibly, in keeping with a Chicago Mercantile Alternate (CME) press unlock.

The Index of Long term Expectancies used to be down 22 issues to a studying of 98 in Would possibly, whilst the Index of Present Stipulations used to be down 13 issues to a studying of 116. This month’s decrease sentiment used to be fueled through drops in either one of the barometer’s sub-indices and most likely caused through weakened crop costs.

In mid-Would possibly, Japanese Corn Belt fall supply bids for corn fell over $0.50/bushel (10%) and soybean bids declined over $1.00/bushel (8%), whilst new crop June/July supply wheat bids declined just about $0.50/bushel (8%), all in comparison to bids to be had in mid-April when final month’s barometer survey used to be performed. The Ag Financial system Barometer is calculated each and every month from 400 US agricultural manufacturers’ responses to a phone survey. This month’s survey used to be performed between Would possibly 15-19.

“Manufacturers are feeling the squeeze from weakened crop costs which has diminished their expectancies for sturdy monetary efficiency within the coming 12 months,” mentioned James Mintert, the barometer’s major investigator and director of Purdue College’s Heart for Industrial Agriculture.

The Farm Monetary Efficiency Index used to be impacted through decrease sentiment shedding 17 issues to a studying of 76 in Would possibly. Crop worth weak spot, uncertainty associated with US financial institution disasters, and emerging rates of interest had been most likely key elements in the back of the decline. This month, 38% of respondents mentioned they be expecting weaker monetary efficiency for his or her farm this 12 months, in comparison to simply 23% who felt that manner in April. Upper enter price stays the highest worry amongst manufacturers within the 12 months forward; on the other hand, worry over the danger of decrease crop and/or farm animals costs is rising. This month 26% of respondents selected decrease output costs as their best worry when compared with simply 8% of respondents who felt that manner in September. In the meantime, just about three-fifths (59%) of manufacturers mentioned they be expecting rates of interest to upward thrust right through the impending 12 months and 22% of respondents selected it as a best worry for his or her farm within the subsequent twelve months. Moreover, 40% of farmers on this month’s ballot mentioned they be expecting this spring’s US financial institution disasters to guide to a few adjustments in farm mortgage phrases within the upcoming 12 months, in all probability hanging extra monetary force on their operations.

Unsurprisingly, the Farm Capital Funding Index used to be additionally decrease, down six issues to a studying of 37 in Would possibly. Greater than three-fourths (76%) of respondents proceed to really feel now’s a nasty time for massive investments. Amongst those that really feel now’s a nasty time, two-thirds (67%) cited emerging rates of interest and greater costs for equipment and new building as key causes.

Manufacturers’ expectancies for non permanent farmland values fell 13 issues to 110 in Would possibly and marked the weakest non permanent index studying since August 2020. On this month’s survey, simply 29% of respondents mentioned they be expecting farmland values to upward thrust over the following twelve months in comparison to 54% who felt that manner a 12 months previous. By contrast, manufacturers stay extra constructive in regards to the longer-term outlook for farmland values because the Lengthy-Time period Farmland Price Expectancies Index rose 3 issues in Would possibly to a studying of 145.

With farm invoice discussions on going, this month’s survey requested respondents what name within the upcoming regulation will likely be maximum necessary to their farming operation. Just about part (48%) of manufacturers mentioned the Crop Insurance coverage Name will likely be an important facet of a brand new farm invoice to their farms, adopted through the Commodity Name, selected through 25% of respondents. In a follow-up query, corn and soybean growers had been requested what trade, if any, they be expecting to look to the Worth Loss Protection (PLC) reference costs in a brand new farm invoice. With regards to part (45%) of corn and soybean growers mentioned they be expecting Congress to ascertain upper reference costs for each plants, with only a few (10% and 13%) anticipating decrease reference costs for soybeans and corn, respectively.