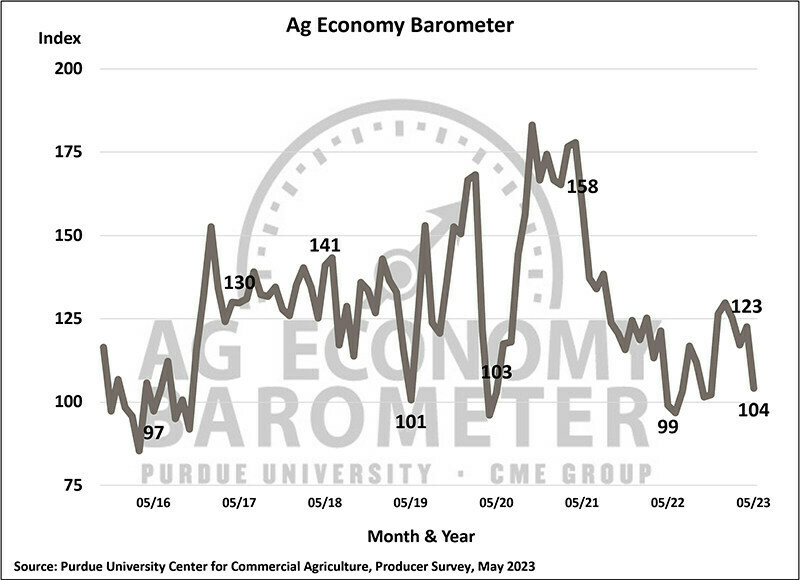

The barometer declined 19 issues to 104 in Would possibly

Manufacturer sentiment fell to its weakest studying since July 2022, because the Purdue College/CME Staff Ag Financial system Barometer declined 19 issues to a studying of 104 in Would possibly, in line with a Chicago Mercantile Trade (CME) press free up.

The Index of Long term Expectancies was once down 22 issues to a studying of 98 in Would possibly, whilst the Index of Present Stipulations was once down 13 issues to a studying of 116. This month’s decrease sentiment was once fueled through drops in either one of the barometer’s sub-indices and most probably induced through weakened crop costs.

In mid-Would possibly, Japanese Corn Belt fall supply bids for corn fell over $0.50/bushel (10%) and soybean bids declined over $1.00/bushel (8%), whilst new crop June/July supply wheat bids declined just about $0.50/bushel (8%), all in comparison to bids to be had in mid-April when remaining month’s barometer survey was once performed. The Ag Financial system Barometer is calculated every month from 400 US agricultural manufacturers’ responses to a phone survey. This month’s survey was once performed between Would possibly 15-19.

“Manufacturers are feeling the squeeze from weakened crop costs which has lowered their expectancies for sturdy monetary efficiency within the coming yr,” mentioned James Mintert, the barometer’s fundamental investigator and director of Purdue College’s Heart for Business Agriculture.

The Farm Monetary Efficiency Index was once impacted through decrease sentiment losing 17 issues to a studying of 76 in Would possibly. Crop worth weak spot, uncertainty associated with US financial institution disasters, and emerging rates of interest have been most probably key components in the back of the decline. This month, 38% of respondents mentioned they be expecting weaker monetary efficiency for his or her farm this yr, in comparison to simply 23% who felt that manner in April. Upper enter price stays the highest worry amongst manufacturers within the yr forward; on the other hand, worry over the chance of decrease crop and/or farm animals costs is rising. This month 26% of respondents selected decrease output costs as their best worry when put next with simply 8% of respondents who felt that manner in September. In the meantime, just about three-fifths (59%) of manufacturers mentioned they be expecting rates of interest to upward thrust all over the impending yr and 22% of respondents selected it as a best worry for his or her farm within the subsequent one year. Moreover, 40% of farmers on this month’s ballot mentioned they be expecting this spring’s US financial institution disasters to steer to a few adjustments in farm mortgage phrases within the upcoming yr, in all probability striking extra monetary drive on their operations.

Unsurprisingly, the Farm Capital Funding Index was once additionally decrease, down six issues to a studying of 37 in Would possibly. Greater than three-fourths (76%) of respondents proceed to really feel now’s a nasty time for enormous investments. Amongst those that really feel now’s a nasty time, two-thirds (67%) cited emerging rates of interest and greater costs for equipment and new development as key causes.

Manufacturers’ expectancies for temporary farmland values fell 13 issues to 110 in Would possibly and marked the weakest temporary index studying since August 2020. On this month’s survey, simply 29% of respondents mentioned they be expecting farmland values to upward thrust over the following one year in comparison to 54% who felt that manner a yr previous. By contrast, manufacturers stay extra positive concerning the longer-term outlook for farmland values because the Lengthy-Time period Farmland Worth Expectancies Index rose 3 issues in Would possibly to a studying of 145.

With farm invoice discussions on going, this month’s survey requested respondents what identify within the upcoming law will probably be maximum essential to their farming operation. Just about part (48%) of manufacturers mentioned the Crop Insurance coverage Identify will probably be crucial side of a brand new farm invoice to their farms, adopted through the Commodity Identify, selected through 25% of respondents. In a follow-up query, corn and soybean growers have been requested what alternate, if any, they be expecting to peer to the Worth Loss Protection (PLC) reference costs in a brand new farm invoice. Just about part (45%) of corn and soybean growers mentioned they be expecting Congress to determine upper reference costs for each vegetation, with only a few (10% and 13%) anticipating decrease reference costs for soybeans and corn, respectively.